The United States has earned itself the reputation of being “the land of opportunity”, and that was very true in the early days of cryptocurrency. The country was home to startups and investments that fueled innovation and growth in the space. However, the environment has shifted dramatically in recent years due to lawsuits and a lack of clear regulations.

The country’s regulators, particularly the U.S. Securities and Exchange Commission (SEC), rightfully began a campaign to protect investors, especially in the aftermath of the fallouts of some crypto projects. Even well-established crypto companies like Consensys, Binance, and OpenSea have not been spared, as they currently face lawsuits from one or more regulators on the mechanics of how they operate. However, the problem is that these regulators often rely on outdated laws that do not align with the unique nature of cryptocurrencies. As a result, even newer companies are hesitant to start operations in the country.

While these actions paint a picture of how the current regulatory environment in the U.S. may be stifling the growth and innovation that once characterized the country’s crypto sector, there is a growing trend of crypto adoption among Americans.

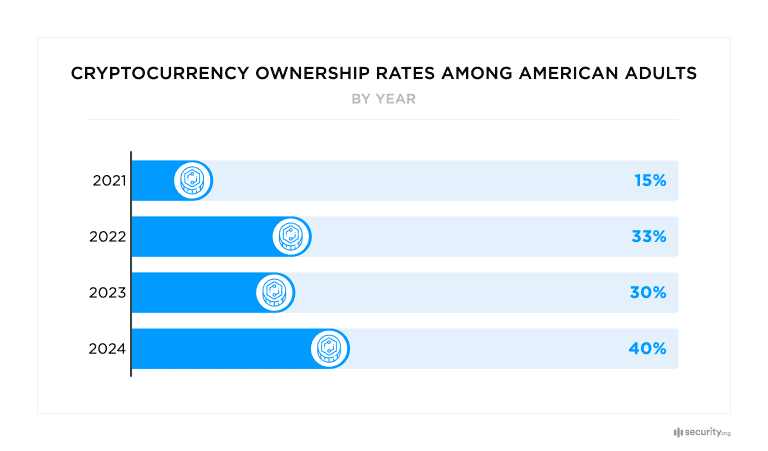

40% of American Adults Now Own Digital Assets

A report on cryptocurrency adoption and sentiment in 2024 reveals that approximately 40% of American adults now own digital assets, equating to about 93 million people in the crypto market.

Among current owners, an impressive 63% expressed a desire to acquire more digital assets in the coming year. Additionally, 21% of those who do not currently own cryptocurrencies shared the same intention.

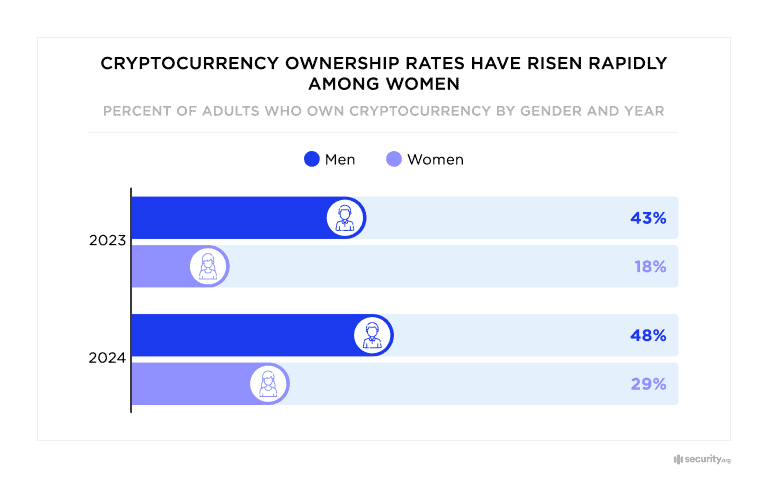

Notably, there has been a significant increase in women’s participation, with their ownership rising from 18% last year to 29% at the beginning of 2024.

These statistics highlight a remarkable shift in the U.S. cryptocurrency landscape, particularly considering that the country ranked very low in crypto adoption just a few years ago. In 2023, the crypto ownership rate in the U.S. was 13%, which was lower than the global ownership rate of 15%, according to BuyBitcoinWorldwide.

So, is the U.S. Still Behind in Crypto?

Yes. Though the rise in cryptocurrency ownership among American adults is notable, it doesn’t make the U.S. a leader in the crypto market. Clear and comprehensive regulations are essential, and the U.S. is still falling behind other countries in this area.

The country’s regulators can’t seem to agree on a working definition of how crypto assets should be treated. It is the same story with the legislators too. This poorly defined regulatory environment makes running a crypto business in the country a very daring adventure. Business owners would go to places like the European Union, Singapore, and the United Arab Emirates, where there are clear dos and don’ts in how they offer their services.

It is not a coincidence that this growth in crypto adoption rate was recorded after the SEC approved spot Bitcoin and Ether ETFs for public trading.

Until the U.S. establishes a more robust regulatory framework, it will keep losing ground to countries that have embraced digital assets and offered clearer pathways for innovation and growth.

There is hope for the U.S. to Consolidate its Crypto Gains

The approval of Bitcoin and Ether exchange-traded funds (ETFs) and the intensified discussions about crypto regulations in the House of Representatives show that this uncertainty and inconsistent regulations won’t be the case forever.

The proposed Financial Innovation and Technology for the 21st Century (FIT 21) Act offers a potential path forward by clarifying the regulatory responsibilities between the SEC and the CFTC. This kind of legislative clarity could help determine which digital assets are securities and which are commodities, offering businesses and investors the legal certainty they need to thrive.

However, it’s important to recognize that even with this new framework, the U.S. may not maintain its current dominance in the industry indefinitely. The global nature of cryptocurrencies means that the rest of the world is also innovating and shaping the future of digital finance. And it is already clear that other countries are already ahead in embracing digital assets and creating supportive ecosystems.

This global competition means that the U.S. will need to act swiftly and decisively if it hopes to keep its edge. With blockchain adoption growing worldwide, countries like Singapore, Switzerland, and the European Union are already offering more attractive environments to drive innovation in the sector.

Although proposed regulations like FIT 21 offer optimism, the country will need to not only pass these laws but also ensure they are effectively implemented. The U.S. must move beyond just regulatory clarity and create a comprehensive, forward-thinking strategy for crypto that fosters innovation while protecting investors. If it can do so, the U.S. may yet reclaim its leadership role in the evolving world of digital finance. But if it fails to act quickly, the country risks being fully overtaken by those willing to provide a more flexible and progressive regulatory environment.

As we discussed in our article “Does Crypto Need the U.S.“, the future of crypto does not rest entirely on the country. Still, the choices its government and power brokers make today could determine how much influence the country retains in shaping the industry moving forward.

Disclaimer: This article is intended solely for informational purposes and should not be considered trading or investment advice. Nothing herein should be construed as financial, legal, or tax advice. Trading or investing in cryptocurrencies carries a considerable risk of financial loss. Always conduct due diligence.

If you would like to read more market analyses like this, visit DeFi Planet and follow us on Twitter, LinkedIn, Facebook, Instagram, and CoinMarketCap Community.

Take control of your crypto portfolio with MARKETS PRO, DeFi Planet’s suite of analytics tools.”