Many analysts and enthusiasts have predicted that Bitcoin will soon go on a bullish run, even though its price appears to be experiencing a setback. On May 16, Bitcoin’s price stabilized around $66,000, a 7.5% increase from the previous day, igniting hopes among investors that the cryptocurrency could continue its upward trajectory.

Market sentiment remains mixed, with experts voicing both optimism and caution. However, market analytics and investment advisory firm QCP Capital has projected today that Bitcoin’s price could climb back to the high of $74,000.

But can Bitcoin possibly hit its current all-time high again, or $74,000, within the next seven days?

Let’s examine the market state to understand Bitcoin’s current position and its potential to reach the price mark.

Current Market Dynamics: Bitcoin’s Recent Positive Momentum

The recent boost in Bitcoin’s price can be attributed to favourable macroeconomic indicators. The Consumer Price Index (CPI) for April slightly exceeded expectations, suggesting that inflationary pressures might ease in the near future. This development has created an optimistic outlook for risk assets, including cryptocurrencies, as investors anticipate a more accommodating financial environment.

The bullish sentiment is evident from the recent Bitcoin price movements. According to TradingView, bulls were actively trying to consolidate the gains made from the previous day.

“We expect bullish momentum here that could take us back to the highs of 74k,”

the institutional-focused firm wrote in the Telegram channel QCP Broadcast, citing buy-side demand.

“The stars seem to be aligning on this breakout, with significant sovereign and institutional adoption, abating inflation, and upcoming US elections,” QCP Capital summarized.

Market observers, however, remain cautious, citing rapidly increasing open-interest (OI) metric as a potential sign that Bitcoin’s recent gains may not be sustainable. The cryptocurrency experienced a breakout after a period of low volatility, with the market previously fluctuating between $60,000 and $70,000.

Prominent traders like Credible Crypto noted the critical support levels that Bitcoin needs to maintain to continue its upward trend.

Credible Crypto, a well-known trader, characterized the post-CPI conditions as something “we don’t want to see on a rise” in Bitcoin’s price.

Credible Crypto highlighted the importance of the $62,000-$63,000 range as a key support level. Holding this range would prevent a drop back to the $59,000-$60,000 levels.

“The 62-63k regions is key- if we are going to avoid 59-60k we should hold there. Lose that and we go straight back to 59-60k. Not sure which of the two scenarios we will get atm so preparing for both,”

the trader wrote in a social media post on May 16.

Key Support and Resistance Levels

Understanding Bitcoin’s support and resistance levels is crucial for predicting its price movements.

Currently, the $66,000 to $67,000 range acts as a significant resistance level, with over $400 million in sell orders placed within this band, as observed by Daan Crypto Trades.

Daan Crypto Trades, highlighted significant ask liquidity above the spot price, with over $400 million in orders placed between $66,000 and $67,000.

He suggested that if the price starts eating into these orders, it could lead to a quick fill of most of them.

“If price starts eating into these, it often ends up with a quick fill of most of orders”,

he noted.

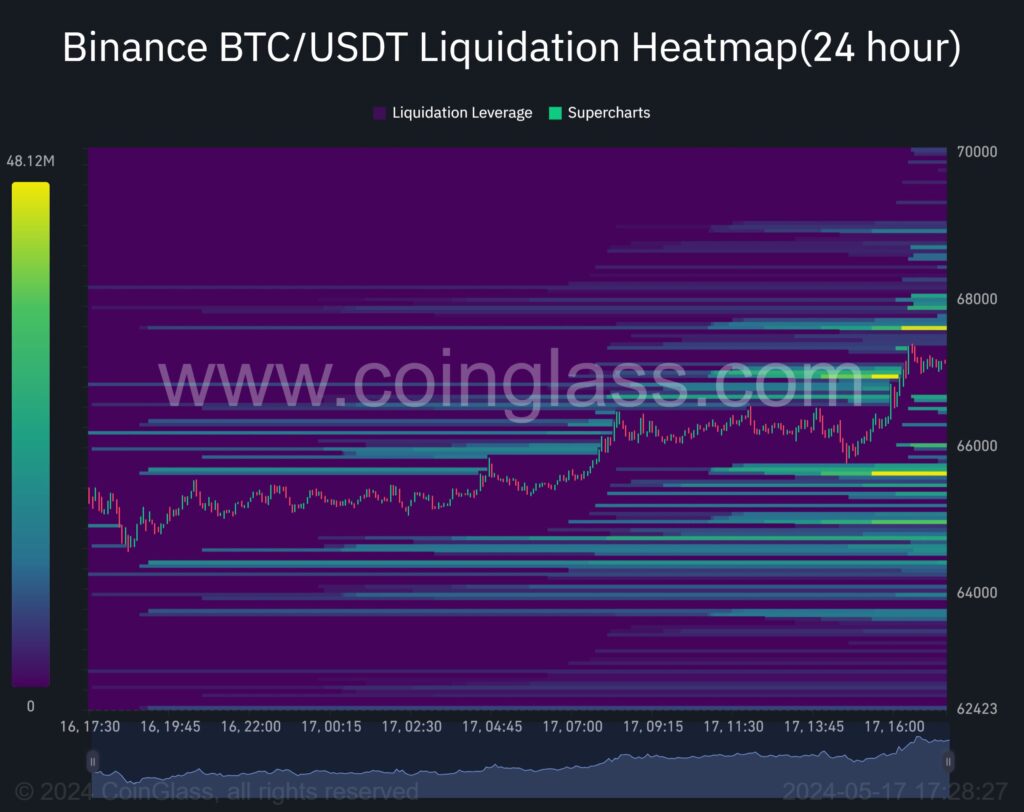

If Bitcoin can break through this resistance, it could trigger a rapid price increase due to the liquidation of short positions concentrated around $67,000, as reported by CoinGlass.

Betting On the Long-Term Outlook

Veteran trader Peter Brandt remains optimistic about Bitcoin’s long-term prospects, referencing historical price patterns that suggest a continued upward trend.

According to him;

“I have shown this chart many times in the past in slightly different iterations and it remains my preferred interpretation.”

Similarly, Michaël van de Poppe, founder and CEO of trading firm MNTrading, predicted a “calm upwards period” for Bitcoin, with altcoins potentially outperforming.

“Clearly, Bitcoin has held range low strongly at $60.5K. The breakout upwards took place, through which a calm, upwards period seems inevitable,”

he said, expressing confidence in the market’s recovery.

Bitcoin’s Price Movement: Factors to Watch Out For

1. Macroeconomic Indicators

The performance of macroeconomic indicators, such as the CPI, interest rates, and economic growth data, significantly influences Bitcoin’s price. Positive indicators can boost investor confidence and drive up the price, while negative data can have the opposite effect. Thus, upcoming economic reports and central bank announcements, especially the speeches of the members of the Federal Open Market Committee in the coming week, are ones to watch out for.

Also, Bitcoin’s price is often influenced by broader market volatility and geopolitical events. Economic instability, political tensions, and major global events can drive investors towards or away from cryptocurrencies as a safe-haven asset.

2. Spot Bitcoin ETFs and Institutional Investors.

There are theories that the spot Bitcoin ETF market might be correlated with the general Bitcoin market. And if that continues to be true, there is a possibility the $74,000 price forecast for Bitcoin. The U.S. spot Bitcoin market, in particular, seems to have recovered from its recent slump. It has posted four days of cumulative net inflows, netting over $303 million on Wednesday, May 15.

In addition, institutional demand for Bitcoin is on the rise, with large asset managers like Millennium Management and Schonfeld investing about 3% and 2% of their assets under management into Bitcoin spot ETFs, respectively. These massive investments can surely influence the market in little ways that can aid the cryptocurrency’s current price trajectory.

Conclusion

Bitcoin’s potential to reach $74,000 within the next seven days hinges on favourable conditions across various factors, including market sentiment and macroeconomic conditions. While the recent surge in price and optimistic predictions from influential traders provide a bullish outlook, significant resistance levels and the concentration of short liquidations around $67,000 present hurdles. A careful and informed approach will be essential for investors looking to capitalize on Bitcoin’s potential price movements in the coming days.

Disclaimer: This report is intended solely for informational purposes and should not be considered trading or investment advice. Nothing herein should be construed as financial, legal, or tax advice. Trading or investing in cryptocurrencies carries a considerable risk of financial loss. Always conduct due diligence.

If you want to read more news articles like this, visit DeFi Planet and follow us on Twitter, LinkedIn, Facebook, Instagram, and CoinMarketCap Community.

“Take control of your crypto portfolio with MARKETS PRO, DeFi Planet’s suite of analytics tools.”