A Matrixport analyst, Markus Thielen, has predicted that the Securities and Exchange Commission (SEC) will reject all bitcoin spot exchange-traded fund (ETF) proposals this month. Despite ongoing discussions and revised S-1 prospectuses, Thielen contends that the current applications do not meet a crucial requirement necessary for SEC approval.

Referring to Gensler’s recent remarks on CNBC, Thielen highlighted the SEC chair’s concerns about fraud, non-compliance with securities laws, anti-money laundering regulations, and protecting the public from bad actors within the cryptocurrency space.

Thielen’s analysis diverges from the prevailing market sentiment, as he underscored the lack of compliance and unresolved political dynamics in the ETF proposals. Notably, he emphasized that the SEC Chair, Gary Gensler, maintains a cautious stance toward the cryptocurrency industry, expressing reservations about compliance and regulatory adherence.

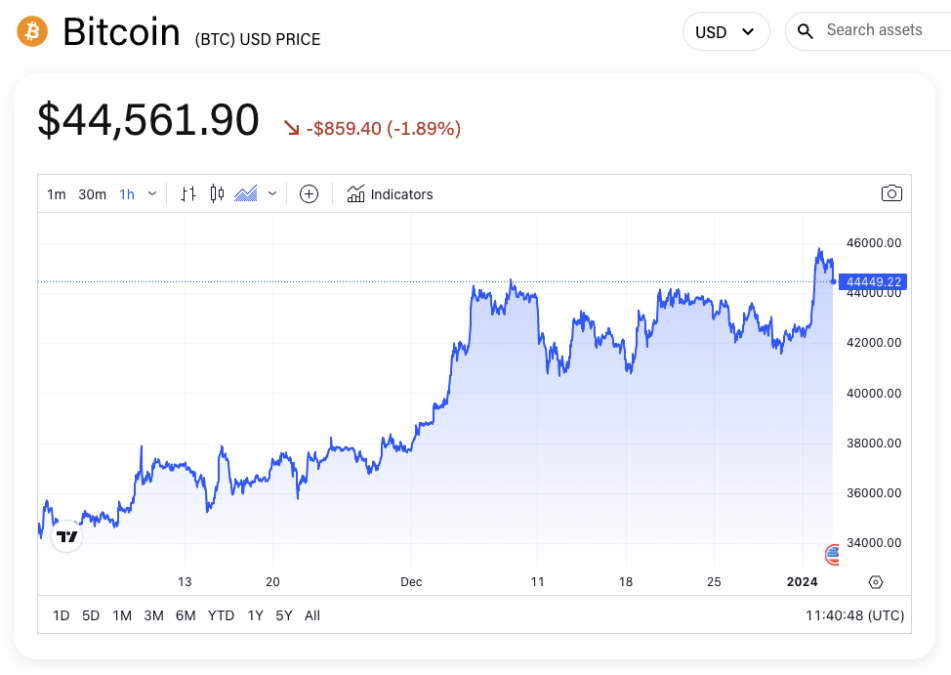

A potential rejection of the Bitcoin spot ETF applications could trigger widespread repercussions in the crypto industry. Thielen anticipates a cascade of liquidations, potentially leading to a substantial downturn in Bitcoin’s price, estimated to be around 20%, resulting in a retreat to the $36,000 to $38,000 range.

As of now, Bitcoin is trading at $44,562, reflecting a 5% increase since the beginning of the year and a 65% surge over the past three months, according to The Block’s price page.

Despite projecting short-term volatility following potential SEC rejections, Thielen remains bullish about Bitcoin’s outlook for 2024. Drawing on historical trends during U.S. election years and Bitcoin mining cycles, the Matrixport analyst forecasts that Bitcoin’s value will surpass its initial mark of $42,000 by year-end.

The global cryptocurrency community has been eagerly anticipating the approval of a bitcoin spot ETF for several years, with prominent asset managers such as BlackRock, Fidelity, Franklin Templeton, Valkyrie, and VanEck vying for SEC endorsement. However, if Thielen’s forecast materializes, the rejection of these proposals could steer the industry toward significant adjustments and strategic shifts.

If you want to read more news articles like this, visit DeFi Planet and follow us on Twitter, LinkedIn, Facebook, Instagram, and CoinMarketCap Community.

“Take control of your crypto portfolio with MARKETS PRO, DeFi Planet’s suite of analytics tools.”