In recent years, Decentralized Exchanges (DEXs) have experienced significant growth due to their ability to provide users with a high level of security and freedom.

The collapse of FTX, one of the largest centralized cryptocurrency exchanges in the world, has further increased the demand for safe and sophisticated ways to trade digital assets.

Unlike centralized exchanges, DEXs do not have a central point of control or third-party involvement, allowing users to trade freely, securely, and without external interference.

Transactions on DEXs are executed using smart contracts on the platform, enabling individuals to buy and sell cryptocurrencies directly. This setup allows both parties to maintain full control over their private keys, ensuring the security of their wallets without disclosing any personal information.

Kine Protocol is a popular DEX that establishes general-purpose liquidity pools supported by customizable digital assets. By eliminating the entry barriers for existing peer-to-pool trading protocols, Kine Protocol allows third-party liquidation and expands the collateral space to include any Ethereum-based assets.

This article explores the Kine Protocol, its operational mechanics, and its unique advantages compared to other DEXs.

TL;DR:

- Kine Protocol is a multi-chain DEX that supports on-chain staking. It doesn’t charge gas fees and offers better trading conditions for derivatives.

- Kine Protocol creates versatile liquidity pools using a unique mix of digital assets. These pools allow traders to open or close derivative positions based on reliable price inputs, all without the need for a counterparty.

- Kine makes it easier for people to participate in peer-to-pool (also known as peer-to-contract) trading protocols. It does this by allowing third-party liquidation and expanding the range of Ethereum-based assets that can be used as collateral.

What is the Kine Protocol?

The Kine Protocol is a decentralized derivatives platform operating on the Ethereum blockchain. It enables users to swiftly, transparently, and conveniently execute derivative trades while establishing a derivatives market with unlimited liquidity.

The platform employs a peer-to-peer pool engine to enhance capital efficiency through optimal leverage, cross-margining, and cutting-edge technology.

Kine Protocol has developed a multi-chain infrastructure to accommodate diverse user needs. This integrated multi-chain trading ecosystem positions it as the most comprehensive decentralized derivatives trading platform available.

Kine Protocol’s objective is to serve as a decentralized derivatives trading platform for a wide range of assets. This starkly contrasts the current state of “monotonous” trading in crypto-asset derivatives.

Kine believes that assets like gold, US stocks, and other commodities are more likely to gain recognition from traditional financial market investors and participants compared to cryptocurrencies, which are still relatively new.

The platform’s goal of “trading everything” aligns with the achievements of other DeFi protocols, such as Mirror, Synthetix, and UMA, which have created financial assets with broad consensus in the blockchain sphere.

However, it adopts an approach that enables not only crypto investors but also traditional traders to participate in DeFi. The protocol seeks to dismantle entry barriers and provide a platform for trading synthetic assets, thereby unlocking numerous opportunities for participants.

Kine employs the “peer-to-pool” model to attain “infinite liquidity” for DeFi derivatives. This model addresses the issue of high collateral requirements and accelerates the utilization of funds, akin to what Synthetix and Mirror have accomplished in the past.

An Overview of kUSD

Kine Exchange is a peer-to-peer derivatives trading platform that exclusively uses kUSD as its currency. This digital currency, kUSD, is directly tied to the value of the US dollar and is backed by a substantial liquidity pool. Users can mint kUSD as long as they have available debt limits.

One crucial part of Kine’s ecosystem is the connection between kUSD and the KINE token. KINE tokens serve as governance and utility tokens in the Kine Protocol.

When Kine Exchange earns revenue from trading activities, these earnings are collected in kUSD. To align community interests and enhance the ecosystem, kUSD earnings are converted into KINE tokens using a third-party DEX like Uniswap.

This mechanism ensures that KINE token holders actively participate in the platform’s growth. KINE tokens also have other important functions in the Kine ecosystem. They can be staked to provide liquidity for Kine’s lending and borrowing markets, allowing users to earn rewards in the form of transaction (gas) fees.

Additionally, KINE tokens can serve as collateral within the Kine Protocol, enabling users to engage in advanced trading strategies and access financial services.

The synergy between kUSD and KINE tokens ensures the stability and growth of the Kine Protocol, offering users a versatile and powerful financial platform.

Key Features of the Kine Protocol

- Social and Fun Modules:

- Loyalty Points and Airdrop Events: Kine Protocol’s main website incorporates engaging modules like Loyalty Points and Airdrop Events to enhance user participation. These features provide more freedom and incentives to dedicated platform supporters.

- Educational Modules:

- Games and Special Rewards: Kine offers entertaining and educational modules, including games and special rewards, to help new users understand how the protocol operates. These interactive tools guide newcomers in building their portfolios and grasping complex trading concepts such as perpetual futures.

- Membership Tiers:

- Bronze, Silver, and Gold Levels: Kine’s website introduces “Kine Membership” with three distinct membership levels: Bronze, Silver, and Gold. Each tier offers a set of benefits, including discounts on trading fees, Loyalty Points (LP) airdrops, higher leverage degrees, beta-test priority, and more.

- Membership Upgrades:

- Earning Exp Points: To advance their membership status, users must accumulate Exp points, indicating their membership level. Exp points can be earned through daily check-ins, increasing trading capital, and fulfilling KYC requirements.

- Play-to-Earn Module:

- Game Center and Loyalty Points: Kine introduces a “Play-to-Earn” module called “Game Center and Loyalty Points.” This feature provides users with an enjoyable and interactive way to trade on Kine’s decentralized exchange (DEX).

- Loyalty Points (LP):

- Engagement Indicator: Kine’s Loyalty Points (LPs) are a valuable indicator of a user’s engagement within the Kine ecosystem. Users can accumulate LPs by participating in Kine’s Game Center and Loyalty Point platform, as well as by engaging in future community activities and airdrops.

- LP Redemption:

- Exclusive Benefits: Accumulated LP points can be exchanged for various items within the Kine ecosystem, including $KINE, the platform’s native token. It’s important to note that LP tokens cannot be bought or sold outside the Kine ecosystem; they are exclusively redeemable within the platform.

Benefits of Kine Protocol

Kine users have access to a range of benefits, some of which include:

Staking and Minting

Users can stake their digital assets within the Kine Finance dApp. This involves setting a “debt limit” and increasing “staking value” to mint kUSD, representing the actual system debt. For every dollar of debt limit, 0.8 kUSD can be minted.

This feature allows users to put their assets to work and earn interest by staking them. Kine’s unique debt-limit-based minting system offers a flexible way to leverage assets, setting it apart from other protocols.

Trading

Minted kUSD can be used as a trading margin on Kine Exchange. It’s a highly sought-after coin traded on various exchanges, including Gate.io and OKEx. All trading profits and losses are denominated in kUSD.

This trading feature streamlines access to the market, and all profits and losses are settled in kUSD, ensuring users have a stable reference point for their trading activities.

Token Burning and Unstaking

Users can withdraw staked assets by burning an equivalent amount of kUSD to settle their outstanding obligations. This process ensures a secure and transparent way to withdraw staked assets. It simplifies the unstaking process and ensures that users receive exactly what they are owed, distinguishing Kine Protocol from platforms with more complex unstaking mechanisms.

User Incentives

Kine rewards users with outstanding debts through periodic distributions.

This rewards system incentivizes users to participate actively in the protocol, providing additional value beyond traditional staking or lending platforms.

Affiliate Income

Users can earn 28% of the gas fees paid by individuals they refer to the Kine Protocol. The affiliate program offers users an opportunity to earn passive income by simply referring others, making the protocol more attractive and community-driven.

How to Use the Kine Protocol

Step 1: Sign Up on the Kine Exchange and Deposit

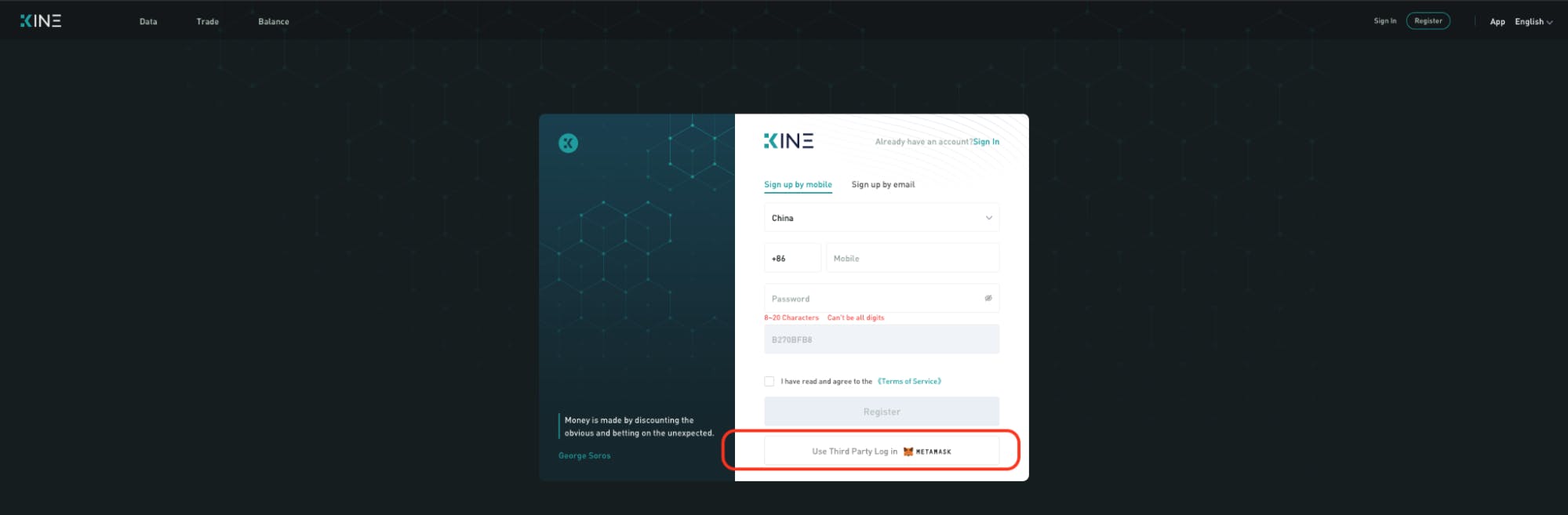

MetaMask users can connect directly to Kine Exchange without registering. After clicking “Connect with MetaMask,” you will be prompted to sign a message (without incurring any gas fees). After a few seconds, you will be successfully logged into Kine Exchange.

Your assets will be displayed in your account’s “Balance” tab. To get your deposit address, click on “Deposit.” You can then send your kUSD to the provided address, just like on most cryptocurrency exchanges. Your token balance will be updated after 12 blocks have been confirmed.

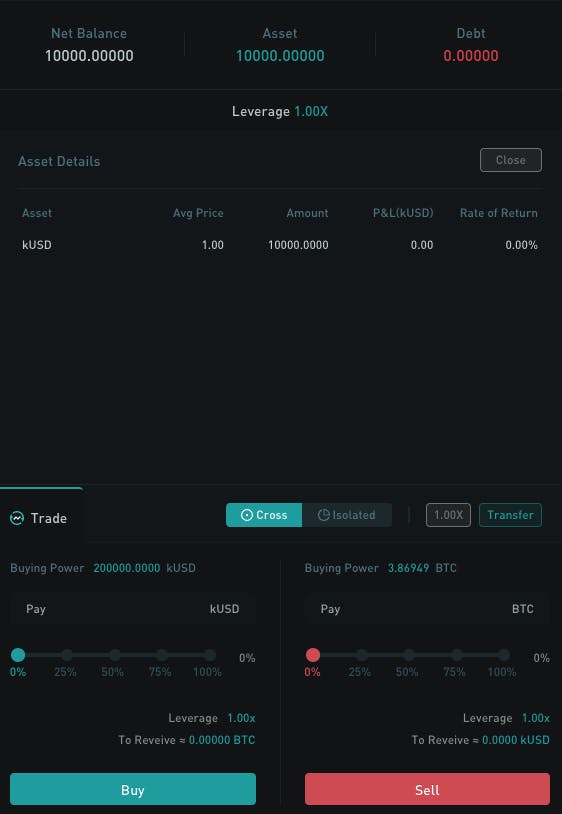

Step 2: Fund the Cross-Margin Account with kUSD to Start Trading

You can choose an asset from the top-left column to monitor its price movement and funding rates. Before placing an order, you should review your account’s equity, debt, assets, and the liquidation price for leverage.

Disclaimer: This article is intended solely for informational purposes only and should not be considered trading or investment advice. Nothing herein should be construed as financial, legal, or tax advice. Trading or investing in cryptocurrencies carries a considerable risk of financial loss. Always conduct due diligence.

If you would like to read more articles like this, visit DeFi Planet and follow us on Twitter, LinkedIn, Facebook, and Instagram, and CoinMarketCap Community.

“Take control of your crypto portfolio with MARKETS PRO, DeFi Planet’s suite of analytics tools.”