As the crypto and DeFi spaces grow, new tokens with diverse use cases emerge, and the Ankr protocol represents the enormous potential of the decentralized finance (DeFi) space.

The project was launched as a blockchain-based DeFi infrastructure and Web3 platform with cross-chain staking capabilities.

Ankr’s primary goal is to improve the accessibility and efficiency of Web3 on blockchain infrastructures.

It is powered by the ANKR token, which is based on Ethereum and can be used for payments, staking, governance, and the development of decentralized apps. Over 40 blockchain protocols can be staked and developed on the Ankr protocol.

This guide will teach you all you need to know about the Ankr protocol and prepare you to dive into the most user-friendly trading experience possible.

What is Ankr?

Ankr Protocol was founded in 2017 by Ryan Fang and Chandler Song, and the mainnet went live in 2019. It provides a set of Web3 tools that allow developers, applications, and stakers to access the infrastructure of various blockchains from a single decentralized platform. Anyone can become a node on the Ankr Protocol and earn money by serving requests to blockchains all over the world.

On the other hand, developers and projects that do not wish to build up and run their nodes can pay to use the Ankr Protocol’s decentralized node infrastructure. Users who want to stake or become validators on multiple blockchains can use Ankr to expedite the process.

Ankr protocol currently supports staking on Polygon (MATIC), BNB Smart Chain (BNB), Ethereum (ETH), Avalanche (AVAX), Polkadot (DOT), and Kusama (KSM). By paying a monthly fee for validator experience, users can also use ANKR to run Ethereum 2.0 nodes.

How Does the Ankr Protocol Work?

Ankr protocol’s product offerings are divided into two categories:

Node Infrastructure

The Ankr protocol understands that not every user has the financial or technical resources to start a node from scratch or participate in the Proof of Stake blockchain validation process. Ankr makes it easier for people and developers to use dozens of blockchains, like Tron, Bifrost, and Kusama, whether they want to set up a full node that stores all of the chain’s information or a validator node that only stores the chain’s current status.

Ankr monitors node performance to ensure that user funds are protected and that the burden of setting up a new node is avoided. This is accomplished by ensuring that nodes are not penalized for downtime or dishonesty.

Ankr has also worked to promote Web3 usage by making it easier to deploy decentralized apps (dApps) via their application programming interface (API). Developers may use Ankr’s infrastructure to access dozens of popular blockchain systems, such as Ethereum, Polkadot, and Polygon, without having to go through voluminous documentation. Ankr’s API solutions should shorten implementation times while also providing more accurate and timely data to dApps.

Ankr has also worked to increase Web3 adoption by making it easier to deploy decentralized apps (dApps) through their application programming interface (API).

Developers can use Ankr’s infrastructure to access dozens of popular blockchain systems, such as Ethereum, Polkadot, and Polygon, without having to wade through extensive documentation. Ankr’s API solutions should reduce implementation times while also providing dApps with more accurate and timely data.

StakeFi

Individuals who want to stake tokens on multiple blockchains and help validate transactions can use Ankr to streamline the onboarding process. To become a validator for the Ethereum 2.0 blockchain, for example, you must stake 32 ETH in addition to having the technical skills to set up and operate a node.

Individuals can stake as little as 0.5 ETH using Ankr’s StakeFi, which is automatically directed to the pools with the highest yield. Because the platform is non-custodial, users can keep their assets in their wallets rather than transfer them to another platform.

Users receive aETH (a synthetic token on the Ankr platform that represents the value of ETH) and other benefits in exchange for their participation.

Factors To Consider When Choosing an ANKR Wallet

The ERC-20 ANKR token can be stored in any Ethereum wallet, and the wallet you choose will most likely be determined by what you intend to do with it and how much you need to store.

Hardware wallets also referred to as “cold wallets,” such as Trezor or Ledger, are the most secure way to store and back up cryptocurrency.

However, they require more technical knowledge and are a more expensive option. As a result, more experienced users may be able to store larger amounts of ANKR with them.

Another option is to use a free and easy-to-use software wallet like Atomic. This wallet (which can be custodial or non-custodial) is available as a desktop or smartphone app. If you use a custodial wallet, the service provider will assist you in managing and backing up your private keys.

Non-custodial wallets, on the other hand, store private keys on your device using security components. These wallets may be more suitable for users with less ANKR or experience. Although they are simple to use, they are not as secure as hardware wallets.

Online wallets are also free and simple to use and can be accessed via a web browser from various devices. They are, however, regarded as riskier and less secure than hardware or software alternatives. Because you will be entrusting the platform with your ANKR, choosing a reputable provider with a track record in security and custody is best.

Why Should You Buy ANKR?

Ankr is a game-changer

The cloud computing industry is well-defined, with only a few major businesses dominating the market. With such an oligopolistic setup, cloud computing companies control the majority of the pricing power. This is great for Amazon stockholders but not so much for businesses or individuals who require cloud infrastructure.

All of that is about to change, thanks to Ankr. This network leases previously unused hardware from cloud computing providers. Cloud computing organizations can maximize the usage of their processing capacity in exchange for ANKR tokens. Waste is a major issue in every business, and Ankr can help significantly reduce it.

The concept of repurposing unused assets is also a very environmentally beneficial undertaking. Of course, not all blockchains are environmentally progressive. For instance, the amount of energy Bitcoin consumes each year has received a lot of attention.

Ankr has discovered a means to provide value to its users. Instead of exacerbating the sector’s energy-consumption issues, this blockchain network intends to solve them by utilizing what is already available.

Ankr offers a decentralized service

Ankr aims to democratize segments of the economy by breaking down the consolidated market dominance of a few corporations in any given industry. On the surface, these goals appear unattainable. On the other hand, the implications of Ankr’s cloud computing capability are massive.

Most centralized cloud computing services have a single or a few points of failure when several central locations lose power. This risk is reduced for decentralized cloud computing players such as Ankr. Ankr, by utilizing a decentralized network of providers, can provide companies seeking decentralized options with network stability and low-cost cloud computing services.

Ankr’s network value may rise as demand for decentralized solutions grows. As a result, those who bet on the value of ANKR tokens as a proxy for the value created by its ecosystem may find ANKR to be an excellent way to grow their money.

Ankr is pushing the boundaries of staking

Besides the cloud computing aspect, Ankr provides investors with a novel way to stake tokens. Those who stake their tokens typically receive interest in the form of additional tokens. As a result, many crypto investors want to take advantage of this method of earning passive income. Ankr, on the other hand, provides an exciting opportunity for investors to stake tokens with significantly lower cash outlays. Ankr’s StakeFi allows investors to earn staking incentives with as little as 0.5 ETH. Staking on the Ethereum beacon chain currently costs 32 ETH. This would currently require more than $125,000 in cash.

This is accomplished through the use of synthetic derivatives, which effectively reduce the amount of initial capital required by investors.

Ankr, much like options on the stock market, is becoming a revolutionary force in this new area of decentralized finance.

How to Buy ANKR

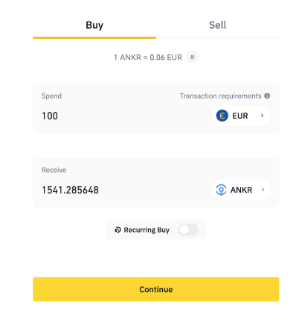

There are two simple ways to buy ANKR on Binance. The first method involves buying the token with a credit or debit card in one of several fiat currencies. Navigate to the “Buy Crypto with Debit/Credit Card” page, select your preferred fiat currency, and then enter ANKR in the “Receive” field. Click “Continue” to get more information and to confirm your purchase.

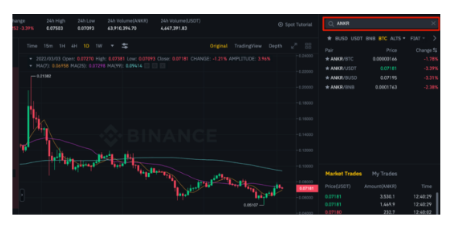

Also, you can trade Ankr with a variety of other cryptocurrencies. To find a list of available trading pairs, go to the Exchange view and type ANKR in the trading pair search form.

How to Stake Using Ankr

Step 1

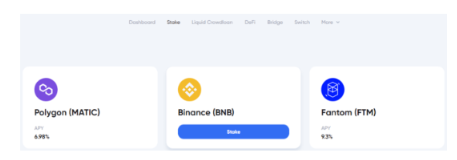

One of Ankr’s primary capabilities is staking over multiple chains by a single client. To do so, go to the Ankr Earn website and choose the cryptocurrency you want to stake. Since we’ve selected BNB, we’ll need to click “Stake.” It’s important to remember that you need the Binance Chain Wallet to stake BNB on the Binance Beacon Chain.

Step 2

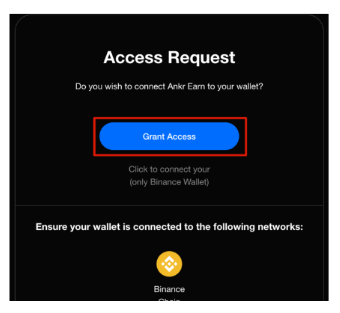

Click on the “Grant Access” button.

Step 3

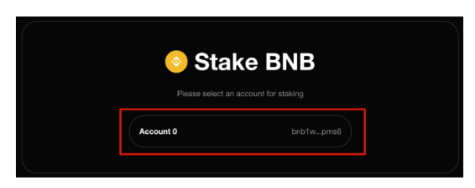

Choose your account.

Step 4

Choose the amount you want to stake. Make sure you have enough BNB to cover your transaction fees and don’t forget to return to Ankr to unstake your funds.

In Conclusion,

- Ankr is a noteworthy initiative in the DeFi and cloud storage sectors, which complements ETH 2.0 and ANKR token staking.

- ANKR (Ankr’s token) promotes effective developer APIs, enterprise solutions, and staking nodes to decentralize the internet and provide easy access to Web3 and all related functionalities

- Builders will have access to decentralized multi-chain development resources that will allow them to quickly expand to new networks. Enterprises can also acquire whatever custom solutions they require to incorporate staked goods, infrastructure, and other features into their platforms.

- Ankr has become one of the fastest-growing decentralized infrastructure providers, constantly adding new services for Web3 developers and users.

DISCLAIMER: This article is intended solely for informational purposes only and should not be considered trading or investment advice. Nothing herein should be construed as financial, legal, or tax advice. Trading or investing in cryptocurrencies carries a considerable risk of financial loss. Always conduct due diligence.

If you would like to read more articles like this, visit DeFi Planet and follow us on Twitter, LinkedIn, Facebook, and Instagram.

“Take control of your crypto portfolio with MARKETS PRO, DeFi Planet’s suite of analytics tools.”