Last updated on June 21st, 2023 at 04:39 pm

With Algorand (ALGO) ‘s price more than doubling to over $2 in a month, many people have started paying attention to the Algorand protocol. While the price action of Algorand has been impressive, the technology behind the protocol is second to none.

This article will talk about the Algorand protocol and the team behind the popular cryptocurrency project. We will also talk about the uses of Algorand and learn more about its native token, ALGO.

Let’s dive in!

What Is Algorand Protocol?

Officially launched in 2019, Algorand is a Pure Proof-of-Stake blockchain that attempts to solve the blockchain trilemma using algorithmic randomness. The name of the project is also derived from Algorithmic Randomness (Algo + Rand).

The project aims to expand the use cases for cryptocurrency by increasing the speed of transactions and reducing the time taken to finalize transactions on the blockchain network. It is a public blockchain that enables developers to build decentralized applications on top of it by using its infrastructure as the base layer.

At the heart of every blockchain project in crypto, there lies ledger inefficiencies, including scalability, wastage of energy, and high transaction costs. However, by utilizing the pros of both centralized and decentralized blockchains, Algorand can provide an efficient and effective platform like a centralized platform and follow a governance model proposed by Decentralized Autonomous Organizations (DAOs) to ensure accountability.

The Algorand blockchain ecosystem uses a new Byzantine Agreement (BA) protocol for its consensus mechanism. BA is based on the pure Proof-of-Stake (PPoS) and enables the protocol to reach consensus among users on the next set of transactions. The protocol uses a unique combination of the Proof-of-Stake consensus mechanism instead of the widely used Proof of Work algorithm, requiring minimal computation. It is seen by many as a revolutionary project that has many use cases.

Use Cases Of Algorand

Hundreds of organizations, including fintech, startups, financial institutions, service providers, and decentralized financial services, are leveraging Algorand’s blockchain technology to build applications.

Algorand’s technology enables the creation of financial products, protocols, exchange of value in DeFi, financial Institutions, and DeFi applications or DApps.

Some of the well-known companies using Algorand’s technology are:

- Archax – It is currently collaborating with Alogrand to develop financial protocols that one can sell on exchanges regulated by the Financial Conduct Authority (FCA).

- Tether – Tether, the company behind USDT, which converts cash into digital currency, uses Algorand to process over 1000 transactions per second.

- VeriTX – VeriTX teamed with Algorand to deliver a leading digital marketplace for aerospace manufacturing. By working with Algorand, they aim to remove the middlemen and streamline purchasing directly from the platform, thereby removing any additional costs.

- Circle – Circle is the company behind the stablecoin USDC. Circle has partnered with Algorand to enable users to easily move funds between traditional banks and card networks to digital banks using the Algorand blockchain.

- Republic – Republic is a private investing platform and technology services provider using Algorand’s platform to power its profit-sharing token, the Republic Note, by leveraging the technology to enable its low-cost structure and high throughput volumes.

There are many more companies that are building on Algorand. You can find their highlighted use cases here. You can also find the list of additional Algorand ecosystem members here.

Problems Solved By Algorand

Algorand aims to solve the problem of inefficiencies of ledgers, a problem that currently plagues existing blockchains, even the likes of Bitcoin and Ethereum. While both Bitcoin and Ethereum are two of the most widely used blockchains in the crypto space, they face scalability issues as their distributed ledgers that are used to store transactions, contracts, and more, are inefficient in their current form.

Most blockchain projects have failed to solve the very popular problem in the crypto space, known as the blockchain trilemma: security, scalability, and decentralization. Through its innovative solutions, Algorand solves the Blockchain Trilemma.

Let’s briefly look at how Algorand does so:

- Security – The Algorand network uses Pure Proof of Stake (PPoS) based on the Byzantine Agreement for its consensus. This offers the network more security than a Proof of Work (PoW) or Proof of Stake (PoS) consensus mechanism.

- Scalability – Scalability is perhaps the most critical problem of the Ethereum network. With an increasing number of transactions on the Ethereum network resulting in network congestion and abnormally high transaction costs, a solution to its scalability problem was the need of the hour. With its Pure Proof of Stake mechanism, Algorand solves the scalability problem too. This is because Algorand uses algorithmic randomness to choose block proposers and verifiers. Thus, only a few messages are required for consensus, making Algorand a highly scalable network.

- Decentralization – At the core of every blockchain lies the concept of decentralization. By ensuring that the community is involved in every aspect of the network decisions, including technical, policy, or monetary aspects of the ecosystem, Algorand ensures that decision-making is completely decentralized. Moreover, Algorand’s algorithmic randomness in its operations enables it to become a truly decentralized blockchain.

The Team Behind Algorand

Algorand was founded in 2017 by Silvio Micali, a computer scientist, and Massachusetts Institute of Technology (MIT) professor. Micali is also the recipient of a 2012 Turing Award, which is a notable achievement in Computer Science. The fact that it was started by an established academic who already had a successful career makes Algorand different from other crypto projects.

Silvio Micali, the founder of Algorand, is in charge of all the theoretical, security, and crypto-financial studies research at Algorand. While Micali leads from the front, the Algorand team boasts of globally known researchers, mathematicians, cryptographers, economics, business executives who all boast technical expertise of the crypto and financial space combined with professional experience.

The core team of Algorand comprises:

- Silvio Micali, Founder – Computer scientist and MIT professor.

- Steven Kokinos, CEO – Entrepreneur, and co-founder of Fuze, BladeLogic, and Web Yes.

- W. Sean Ford, COO – Co-founder of Upromise and an experienced consultant.

You can learn more about Algorand’s team and project through their community pages linked below:

Basics Of ALGO – The Native Token Of Algorand

ALGO is the transactional token of the Algorand ecosystem. Therefore, one can use cryptocurrencies like ALGO within the Algorand network just like fiat currency can be used in the real world.

The ALGO crypto boasts of the following features:

- Speed – Users can send ALGOs to anyone’s wallet within 4.5 seconds.

- Scale – The Algorand blockchain can support a large number of ALGO transactions.

- Trustworthy – The Algorand blockchain is secure and decentralized, making it a trustworthy platform for sending and receiving ALGO.

- Transparent – The total number of ALGOs in use can be checked by anyone using the public Algorand blockchain.

- Secure – The Algorand blockchain uses the most advanced cryptography to secure the blockchain network. This ensures that all private information in ALGO transactions remains secure.

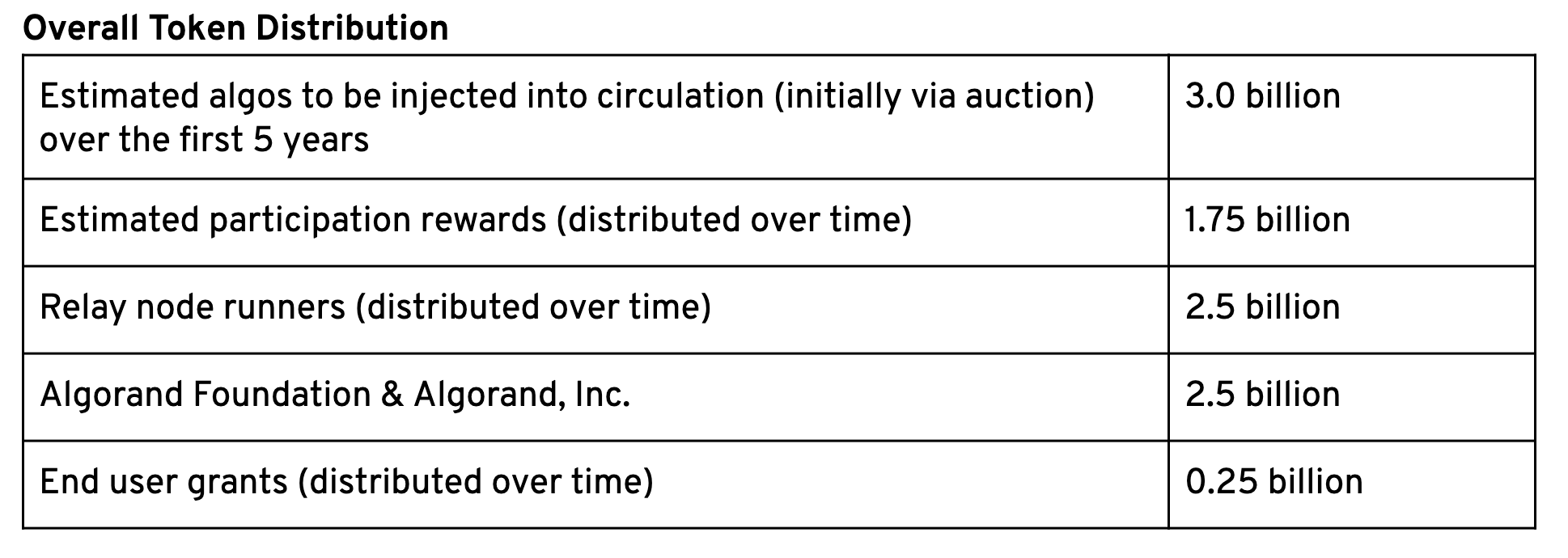

Here’s what the ALGO token distribution looks like:

In Conclusion…

- Algorand provides a stable and secure infrastructure, on top of which many projects are already building applications to power the future of finance and technology. Moreover, it provides a way to solve a technical problem that has been faced by most existing blockchains, i.e., the blockchain trilemma. Finally, doing so offers a solution to the scalability issues associated with blockchain, which have been one of the most critical virtues of blockchain and have undermined common blockchain adoption.

So, what do you think about the Algorand protocol? Do you think it can become a force to be reckoned with in the future?

Comment below and let us know what you think!

If you would like to read more articles like this, follow DeFi Planet on Twitter and LinkedIn.