Last updated on September 3rd, 2025 at 04:10 am

Cardano is currently ranked 18th among blockchain ecosystems in terms of total value locked (TVL) in DeFi. While this position might not be the most eye-catching, it’s important to note that Cardano boasts a substantial on-chain activity within its ecosystem, with a TVL of $144 million.

Since its introduction in 2017, Cardano has emerged as one of the most dynamic and lively blockchains available today. Given its impressive growth, this blockchain undoubtedly warrants more than just a cursory glance – it deserves a closer examination and deeper consideration.

In this article, we present a comprehensive overview of the Cardano blockchain, shedding light on its operational mechanisms and the various components that form its ecosystem.

Unravelling the Origins of Cardano

Cardano is a Layer 1 (L1) blockchain developed to address the limitations of public blockchains such as Bitcoin and Ethereum. Its primary purpose is to improve upon the weaknesses of these existing blockchains and provide enhanced features and capabilities. As such, it’s regarded as a third-generation blockchain.

The development of Cardano commenced in 2015 under the leadership of Charles Hoskinson, one of the co-founders of Ethereum. During the early stages of building, Charles Hoskinson collaborated with Jeremy Wood, another former Ethereum co-founder.

Hoskinson’s decision to work on Cardano stemmed from having a distinct vision for the blockchain that differed from the direction pursued by other Ethereum founders, such as Vitalik Buterin.

The name “Cardano” pays homage to Gerolamo Cardano, an influential polymath from 16th-century Italy. The blockchain frequently references mathematical history because its development and operation rely significantly on mathematical formulas and computations.

Despite starting its development in 2015, the Cardano blockchain wasn’t operational until September 2017.

The Cardano Foundation, a non-profit organization based in Switzerland, is responsible for overseeing the development of the Cardano blockchain. However, the actual development work is mainly outsourced to two for-profit blockchain development companies: Input Output Hong Kong (IOHK), led by Charles Hoskinson, and EMURGO. Together, these organizations form the Cardano blockchain team, working collaboratively to advance the growth and progress of the blockchain.

Like the Ethereum blockchain, Cardano was designed to support smart contracts and create decentralized applications (dApps). However, the implementation of this functionality and support for smart contracts on the Cardano blockchain did not happen until 2021.

This upgrade marked a significant milestone for Cardano; it allowed developers to build and deploy smart contracts and thus brought the network closer to its objective of being a platform for dApps.

How Does Cardano Work?

In contrast to many other blockchain projects, the Cardano team chose not to release a traditional whitepaper outlining their plans. Instead, they opted to establish a set of design principles that would guide their approach to addressing the challenges identified in existing platforms.

Let’s explore what makes up the Cardano blockchain and contributes to its unique functionality.

Cardano Ouroboros Consensus

Cardano stands out for its focus on sustainability, speed, and energy efficiency compared to older blockchains like Bitcoin and Ethereum. Cardano is approximately 47,000 times more energy-efficient than public blockchains such as Bitcoin.

Cardano uses a process called “staking” to add new blocks to its network. It uses a specialized consensus method called Ouroboros, which reduces computational power consumption.

Consequently, Cardano has stake pools as part of its architecture. The stake pools allow users to support the network without energy-intensive mining processes. This addresses concerns about energy consumption in other protocols like Ethereum and Bitcoin.

To add new blocks, Cardano’s Ouroboros divides time into epochs, each lasting five days, with smaller units called slots, each corresponding to 20 seconds. These periods can be modified if the community reaches a consensus.

Slots are like fixed shift patterns in factories; they represent specific intervals in which a “slot leader” is chosen to perform certain responsibilities during the assigned intervals. Slot leaders have key responsibilities, including validating transactions, creating transaction blocks, and adding new blocks to the blockchain.

Occasionally, a slot leader may fail to create a block, resulting in an “empty slot.” These empty slots are a normal part of the Cardano protocol and do not disrupt the overall blockchain operation. The consensus algorithm is designed to handle empty slots without disrupting the overall blockchain operation, ensuring system integrity and continuity.

Slot leaders are randomly selected similarly to how validators are chosen in other blockchains that use the Proof-of-Stake (PoS) consensus mechanism. Thus, participants with higher stakes have a greater chance of becoming slot leaders.

Cardano Blockchain Layers

Cardano’s blockchain comprises two distinct layers: the Cardano Settlement Layer (CSL) and the Cardano Computational Layer (CCL).

The CSL layer enables seamless peer-to-peer transactions like the transfer of tokens between different users within the Cardano ecosystem. It serves as the ledger for maintaining balances and transaction records.

On the other hand, the CCL layer is where Cardano truly shines. It caters to the computational requirements of the blockchain and allows smart contracts to operate efficiently.

This separation of the two layers gives the CCL layer the flexibility to function more effectively. It uses an off-chain protocol that allows users to customize rules when verifying transactions.

Cardano’s two-layer architecture sets it apart from other smart contracts platforms like Ethereum, which typically adopt a single-layer architecture. Ethereum’s single-layer structure often leads to challenges related to network connectivity, high transaction fees, and slow transaction times.

However, Cardano effectively addresses these issues without sacrificing its overall performance. The two-layer design allows for smoother future upgrades.

Cardano’s ADA

ADA is the native cryptocurrency of the Cardano blockchain. You need ADA to complete transactions on Cardano. Similarly, developers who are building decentralized applications (dApps) on the Cardano blockchain use ADA tokens to interact with and build on the network.

You can use ADA as a form of digital currency and a store of value in the same way that popular cryptocurrencies like Ethereum and Bitcoin are used.

Staking ADA allows you to contribute to Cardano’s security and validate transactions on the network. In return, you earn additional ADA tokens as rewards. Running your own validator node may require some technical knowledge; however, delegating ADA into staking pools requires no technical expertise. ADA earned in a staking pool are shared in proportion to the contribution of the pool’s participants.

The native Cardano wallet, Daedalus, is used to stake ADA on the Cardano blockchain.

Additionally, ADA grants holders governance power within the Cardano ecosystem. They can participate in the decision-making process by voting on Cardano Improvement Proposals (CIPs) and Funding Proposals (FP) that aim to enhance and develop the Cardano platform.

Understanding ADA Tokenomics

Upon launch, 57.60% of ADA’s total supply was offered to the public through an Initial Coin Offering (ICO). The Cardano team reserved 11.50% for project development. The remaining 30.90% was allocated as rewards for investors who stake their ADA on the Cardano blockchain.

The maximum supply of ADA is capped at 45 billion. At the time of writing, more than 34 billion ADA tokens are already in circulation, accounting for approximately 77% of the total supply. With only a limited number of tokens left to enter circulation, there is minimal risk of dilution, and the price can be expected to remain relatively stable.

The finite supply of ADA creates a sense of scarcity, and demand may increase as Cardano gets closer to having all ADA tokens in circulation. This increased demand could drive up the price as buyers are willing to pay higher to acquire the token.

ADA currently trades at $0.36, with a market capitalization of well over $12 billion at the time of writing. This current price represents a significant 88% decline from its all-time high (ATH), according to data from CoinMarketCap.

How to Buy ADA

You can buy ADA on both centralized and decentralized exchanges. Buying on centralized platforms like Binance involves entrusting your ADA tokens to the exchange.

On the other hand, purchasing ADA on decentralized exchanges requires self-custody wallets, like Yoroi or Daedalus, to securely store your tokens. These Cardano wallets provide a unique address and enable you to hold other tokens and NFTs on the Cardano network.

You can keep track of your on-chain transactions on the Cardano network using Cardanoscan, the Cardano blockchain explorer. With Cardanoscan, you can monitor stake pools, view your transaction history, and maintain a record of all your Cardano network activities.

Is ADA a Good Investment?

Like other cryptocurrencies in the market, ADA carries inherent uncertainty and risks. Historical data from CoinMarketCap indicates that if you had purchased ADA when it launched in October 2017, you would be sitting on a 2000% profit. It’s important to note that ADA is currently down approximately 88% from its all-time high.

More than 70% of the ADA tokens that will ever be issued are already in circulation, reducing the risk of dilution. Factors such as more developers working on the network and greater adoption within the blockchain space may contribute to an upward price movement. However, market sentiment will play a more significant role in influencing the token’s price.

Given the prevailing perception of a future bull run in the crypto market, ADA could be considered a longer-term investment option, especially considering its position as the 7th largest cryptocurrency by market capitalization at the time of writing.

Remember to always conduct your own research (DYOR), assess risks carefully, and base your purchasing decisions on your financial objectives and risk tolerance.

Cardano’s Development Phases

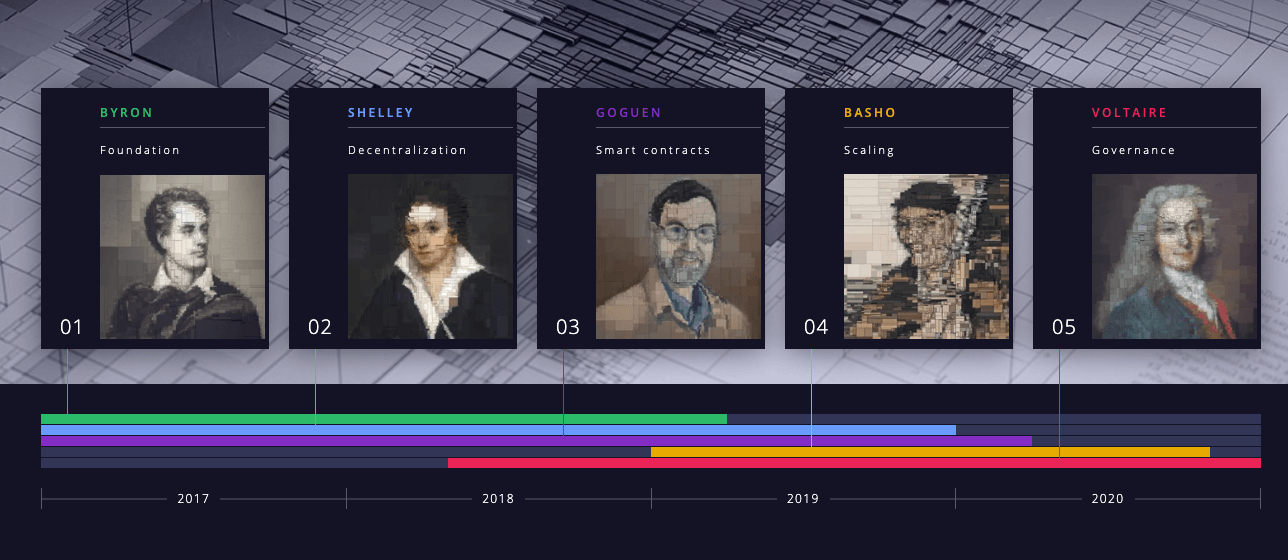

Cardano’s roadmap outlines the project’s execution in five distinct stages, each named after a prominent historical figure. These stages are crucial milestones in achieving the goals of the Cardano blockchain. The roadmap ensures a systematic approach to the development and implementation of the project’s features and functionalities.

While Cardano’s development phase is sequential, the various eras in its roadmap, including Byron, Shelley, Goguen, Basho, and Voltaire, occur simultaneously and in parallel.

The illustration below depicts the events that follow the various phases of Cardano’s development:

Challenges Facing Cardano

Cardano, like any other project, faces its fair share of challenges and external factors that could slow down its journey towards widespread use and success. Let’s take a look at some of the key issues it needs to address.

Delayed Development Timeline

Cardano takes a careful approach by involving peer-reviewed academic research in its development process. While this ensures a robust outcome, it can also lead to delays and deviations from the original timeline. For example, the Voltaire phase, which was initially set for September 2021, is still pending as of now. Such delays can create uncertainty about the project’s progress and future plans.

Regulatory Considerations

Like any other blockchain project available today, Cardano may face regulatory and legal hurdles in different jurisdictions. Adapting to evolving regulations can be complex and may impact the project’s growth and adoption.

Regulatory modifications can have significant implications not only for Cardano but also for the broader cryptocurrency industry.

Competitor Landscape

Cardano is up against stiff competition from established networks like Ethereum and Bitcoin. To stay ahead of the game, Cardano must continuously innovate and find ways to outperform its rivals. Cardano’s Total Value Locked (TVL) is currently lower than other platforms such as Ethereum, Tron, and emerging DeFi chains like Arbitrum. This clearly indicates that Cardano faces a firm challenge to demonstrate its relevance and usefulness in this fiercely competitive market.

Cardano: Looking Beyond the Horizon

Cardano is a promising prospect within the blockchain space. It takes a thoughtful approach, focusing on thorough research and peer-reviewed protocols to catch and fix potential problems before they even arise. This way, Cardano is well-prepared to handle challenges by offering well-considered solutions.

However, this strong emphasis on academic research can make Cardano’s progress a bit slower compared to other solutions like Ethereum, which prioritizes rapid expansion.

While this might make it harder for Cardano to compete and gain widespread adoption, it also shows that Cardano is committed to creating practical and user-friendly products.

As Cardano continues its journey towards full decentralization and a community-driven approach, we can expect even more innovative ideas to emerge from this collaborative project.

Although Cardano might not be as widely adopted as other blockchains like Solana and Ethereum right now, the shift towards a community-led ecosystem opens up endless possibilities for future development on the platform.

Disclaimer: This article is intended solely for informational purposes and should not be considered trading or investment advice. Nothing herein should be construed as financial, legal, or tax advice. Trading or investing in cryptocurrencies carries a considerable risk of financial loss. Always conduct due diligence.

If you would like to read more articles like this, visit DeFi Planet and follow us on Twitter, LinkedIn, Facebook, Instagram, and CoinMarketCap Community.

“Take control of your crypto portfolio with MARKETS PRO, DeFi Planet’s suite of analytics tools.”