Last updated on November 17th, 2022 at 02:21 pm

DeFi wallets are used to manage digital assets and interact with the different DeFi protocols such as lending and borrowing protocols or decentralized exchanges. They allow investors to easily and safely access the protocols that are shaping the future of finance.

In recent years, the DeFi space has grown significantly and has attracted millions of users. With the surge in demand for DeFi, the demand for DeFi wallets also increased significantly. As a result, we’ve seen drastic improvement to DeFi wallets and users have many options to choose from.

In the nascent days of DeFi, the market was dominated by wallets such as MyEtherWallet that provided users with poor UI/UX. Thankfully, we’ve come a long way since then and the market is now full of amazing wallets that are making DeFi more inclusive and accessible.

DeFi Planet has researched the market to find the top DeFi wallets. So, as you gear up to embrace the future of finance, we are here to help you learn more about the Top DeFi wallets available in the market.

Characteristics Of DeFi Wallets

If you want to participate in DeFi and interact with the DeFi applications, you need a good crypto wallet. Many wallets in the market offer a lot of different features.

All wallets have certain characteristics in common. These characteristics have now become unanimous with DeFi wallets. Some of the core components of DeFi wallets include:

Non-custodial

Users have complete control and ownership over their assets in the wallet. They can transfer funds knowing that they are the only ones who have access to their funds. They are “non-custodial” because the users have not transferred custody of their assets to a third party; instead, they are self-custodying their assets, and, as such, are retaining their private keys.

Key-based

All DeFi wallets have a unique keypair and users are responsible for safekeeping their private keys. The private keys are often introduced as a 12-word seed phrase. It is a recovery phase consisting of a set of words that can be used to restore the wallet.

Anyone who decides to use a non-custodial wallet must ensure that their recovery phase is safe. This is in case you lose access to your DeFi wallet, in which case you can use your seed phrase to recover access to the wallet. But losing access to your wallet together with losing your recovery phase means that you will lose all your digital assets that were stored in the wallet.

The basic security measures that users must take for their recovery phase are as follows:

- Write down the recovery phrase offline and keep multiple copies in different locations.

- Avoid storing any copies of the recovery phase online.

- If ever you recover an existing wallet using your recovery phrase, you should move your funds to a new wallet.

Accessible

All non-custodial are built in a way that can manage a complete suite of assets. For example, An Ethereum based DeFi wallet allows users to deposit ETH alongside stable coins like Dai, ERC20 tokens like KNC (Kyber Network), and ERC721 tokens like Axies.

Compatible

All DeFi wallets can be accessible by connecting a web3 wallet. To make it more convenient for users, mobile apps have started integrating dApp browsers that allow users to connect with DeFi protocols without having to leave the app every time.

Types Of DeFi Wallets

So what are the different types of DeFi wallets? What features do they support and what are the pros and cons of using each type?

Let’s answer all these questions with the help of examples.

Browser Extension

Browser extensions are arguably one of the most used DeFi wallets and probably one that DeFi users are most familiar with. These are web browser extensions that serve as a DeFi wallet and allow users to interact with different DeFi protocols.

One of the most popular web browser extension DeFi wallets is Metamask.

For anyone interested in DeFi, Metamask is usually the go-to wallet. With the growth in the DeFi and NFT space, Metamask saw its user base grow to over 5 million active users monthly.

Metamask is a DeFi wallet that acts as a gateway to applications built on blockchain. It enables users to interact with all DeFi protocols like Uniswap, Sushiswap, Compound, Aave, Maker, Yearn Finance, Synthetix, and many others.

Initially, Metamask supported only ETH and Ethereum-based tokens such as ERC20 and ERC721 and acted as a bridge into Ethereum.

Now, Metamask allows its users to interact with other chains as well like the Binance Smart Chain. Moreover, it also allows users to interact with Ethereum Layer-2 solutions like Polygon through its Matic Mainnet.

Why Metamask?

- Metamask is arguably the most used DeFi wallet across the entire ecosystem

- It is an open-source and non-custodial wallet

- It allows users to create multiple accounts

- It enables users to keep their recovery phase in their browser

- It provides users with an easy to use bridge into different smart chains and DeFi apps

- It offers features like ‘speed up’ which allows users to facilitate quick transfer of their funds. This is particularly useful in times of congestion.

- While it is mostly used as a browser extension, Metamask offers its users the option of using their services through a mobile app.

While Metamask offers many benefits to its users, one limitation that it still faces is that Metamask is a hot wallet. This means that the private keys of users are stored on the device itself. The devices are connected to the internet and as a result, there is an increased risk.

Hardware Wallet

A hardware wallet allows users to store their private keys in a secure physical location. It enables users to store their assets offline, removing the risk of hacks and breaches. It is especially useful for users who find DeFi too technical to use.

A DeFi-friendly hardware device that is used by most cryptocurrency owners is Ledger.

Using Ledger, users can store their private keys offline on a secure hardware device. This isolates the private keys from online devices like smartphones and computers which can be vulnerable to hacks.

Ledger has also been adding DeFi friendly features to their wallet. For example, they recently added a feature that enables users to lend crypto directly on platforms like Compound via the LedgerLive management app. The team has identified DeFi as a key niche for their growth and is continuously working on adding more DeFi features in the future.

Why Ledger?

- Offers DeFi friendly features

- Supports a wide range of cryptocurrencies

- Offers the highest degree of security to its users

- Offers a range of different products – Ledger Nano S is the most popular model

For anyone who believes that security is paramount, investing in a hardware wallet is highly recommended to keep their digital assets safe. However, the security does come at the cost of the inconvenience of using a separate hardware device that has to be physically connected to transfer assets in and out.

Mobile App

These are DeFi friendly wallets that can be accessed through smartphones.

One of the widely used mobile-friendly DeFi wallets is Argent.

The creators of Argent have a mission to let everyone enjoy the benefits of decentralization in the Web 3.0 world. The wallet prides itself as “the most simple and secure smart wallet for crypto”.

Argent allows users to interact easily with DeFi as the wallet is integrated with different protocols such as Uniswap, Aave, Compound, and Set Protocol amongst others.

When a new wallet is created on Argent, a smart contract is created on Ethereum which is controlled by the owner of the wallet. This means that Argent never has any control over the smart contract and the user is always in control. Moreover, this also enables users to explore additional features that wouldn’t be available if a simple Ethereum address was being used.

The recovery model used by Argent for security is also unique. Instead of writing down a recovery phrase as in the case for other DeFi wallets, users can choose “Guardians” for their wallet. This is a method of setting up social recovery for their wallet. Guardians can be people that are trusted by the users or it can be any other DeFi wallet or third-party services.

For a user to recover a wallet, they must obtain approval from the majority of Guardians.

Furthermore, Argent offers features similar to the ones offered by credit card services. For example, users can temporarily free their wallets or even set a daily transfer limit.

Why Argent?

- Offers users a mobile-friendly approach

- Doesn’t require the use of a recovery phrase

- Users do not have to pay transaction fees owing to their meta transactions feature

- Users can directly leverage the services of the most popular DeFi protocols

- Offers features like daily limits and locking options

For users looking for a mobile-first approach to interacting with crypto and DeFi, Argent is a great option. However, it has to be said that it is not as secure as a hardware wallet. Moreover, users need to first develop a good understanding of the social recovery model to ensure the safety of their assets.

Web Wallet

The web wallet is a term used to refer to an online wallet. These wallets are similar to e-wallets like Paypal used for storing everyday fiat currency. Web wallets for cryptocurrencies are run on a software program that stores both the public and private keys on top of interacting with the blockchain.

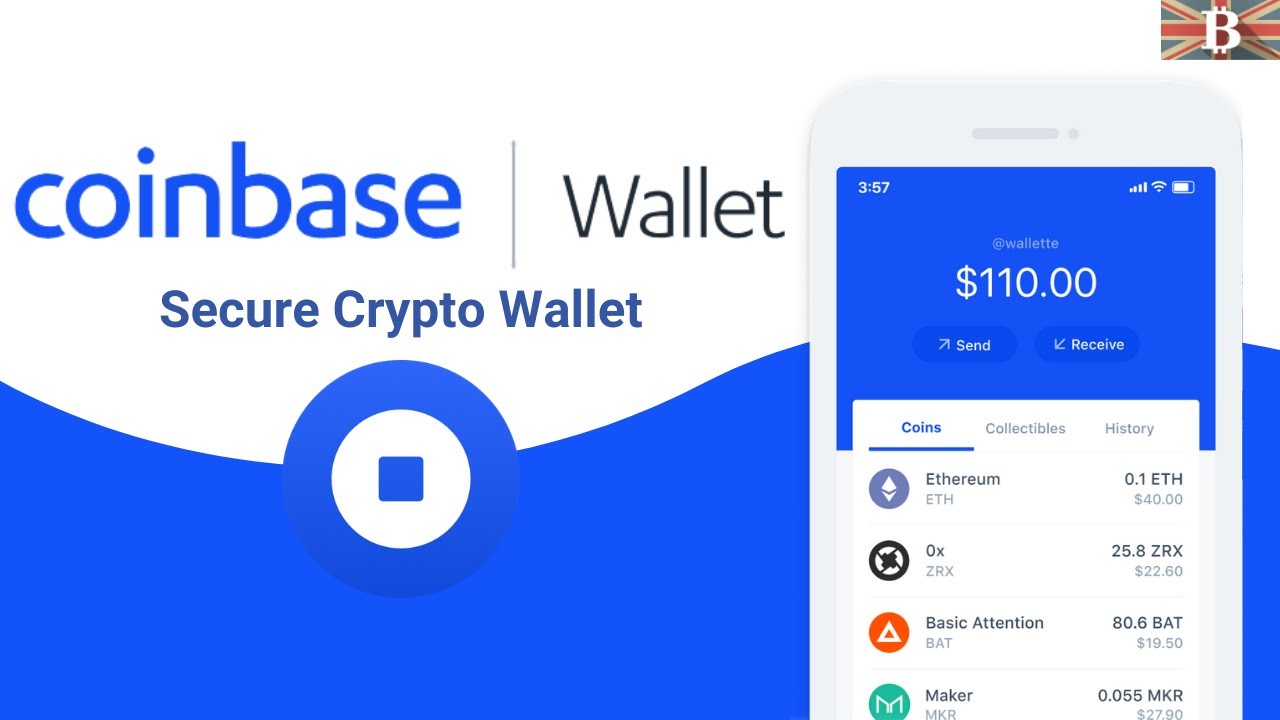

Coinbase wallet is one of the most widely used web wallets for DeFi. It is also available to be used as a mobile app. Furthermore, it also offers a Coinbase wallet extension.

Initially released as “Toshi”, the Coinbase wallet stores private keys directly on the user’s device. It offers a DApp browser that allows users to easily interact with the DeFi ecosystem. In terms of usability, it is identical to traditional web browsers and hence, it is easy to use for non-technical users.

Why Coinbase wallet?

- It enables easy transfer of funds

- It supports a broad spectrum of assets

- Users can send and receive digital assets with just a username instead of having to use a traditional public wallet address

- Offers six-digit pin or biometric security such as facial recognition

While the Coinbase wallet provides an easy pathway for non-experienced users to interact with DeFi, it is important to note that it does not allow users to trade digital assets directly from their platforms.

DeFi Dashboards

While DeFi Dashboards cannot be defined strictly as wallets, we believe that it is important to mention them in our list.

DeFi dashboards allow users to track their portfolios in one place. They enable users to manage their portfolios more efficiently. Moreover, they also provide users with data and analysis related to different DeFi protocols.

In DeFi dashboards, users have the option to either use the dashboard in a view-only mode or to use it for investing and transferring purposes.

To be able to invest or transfer assets, users need to connect their DeFi wallets such as Metamask or Ledger. If they want to use the view-only mode, they can just add their address or set of addresses to the dashboard and manage their portfolio.

Zapper is one of the best DeFi dashboards currently available to DeFi users.

Which DeFi Wallet Is Best For You?

There are many different wallets out there and all of them offer a lot of features. The decision of selecting a DeFi wallet in 2021 is tough.

Here are some key points to consider that will help you pick the best DeFi wallet for you:

- Have a plan – Make sure that you have a plan in place for your journey in the DeFi ecosystem.

- Check your requirements – Determine what your objectives are and then ascertain the resources you need. Based on your requirements, identify key characteristics that you need in your DeFi wallet.

- Check access points – Ensure that the wallets provide access to the DeFi protocols you wish to interact with.

- Supported Assets – It is vital to ensure that your wallet supports the assets you want to store. Most wallets support only specific assets. For example, Metamask does not allow you to store Bitcoin (BTC).

- Check social presence – Check out the social presence of a wallet on different platforms like Twitter, Discord, Reddit. Interact with other users and ask questions. Usually, it has been seen that wallets with a strong community-backing are very active on all these social media platforms.

- Check recovery process – Ensure that you’re aware of the recovery process you need to go through to gain access to your wallet in case you lose the seed phrase.

In conclusion…

- For DeFi to grow in the long term, DeFi wallets and other asset management tools are vital. They enable users to interact with the DeFi platform conveniently and securely.

- The DeFi ecosystem is still in its early stage of development and as the niche continues to grow, more DeFi friendly wallets with even better features will keep rolling out in the market.

- We believe that asset management tools will act as the foundation on which DeFi can continue to grow. They will act as a pillar of support as DeFi continues to bank the unbanked and create an open financial system.

At DeFi Planet, we’re excited to see how the DeFi ecosystem grows in the coming years.