Quick Breakdown

- A FinCEN report reveals $312B laundered through U.S. banks, exposing fiat’s role in financial crime.

- In contrast, illicit crypto use continues to decline.

- Politicians and regulators often scapegoat crypto while ignoring repeated banking scandals.

- Future regulation must be evidence-based, targeting both fiat and crypto, with a focus on where risks are real.

When the conversation around financial crime comes up, cryptocurrency is often the first scapegoat. Headlines warn of Bitcoin enabling cartels, and politicians repeatedly paint crypto as the underworld’s favourite tool. But the numbers tell a different story. A recent U.S. Treasury report shows that old-fashioned fiat, not crypto, is still the preferred highway for money laundering. The scale is staggering, and it challenges the very narrative driving today’s regulatory debates.

FinCEN Report on US Banks & Chinese Cartels

In August 2025, the U.S. Treasury’s Financial Crimes Enforcement Network (FinCEN) dropped a bombshell. Between January 2020 and December 2024, U.S. banks reported 137,153 suspicious activities tied to Chinese Money Laundering Networks (CMLNs). These networks, working hand-in-hand with Mexican cartels, funnelled $312 billion through U.S. financial institutions, averaging more than $62 billion per year.

And the problem isn’t limited to drugs. FinCEN flagged money laundering connected to human trafficking, healthcare fraud, elder abuse, and even real estate, where more than $53.7 billion in suspicious transactions were recorded. Shockingly, everyday individuals, students, retirees, and even housewives were pulled into the scheme, often unknowingly, as money mules to skirt China’s capital controls.

This is a systemic weakness in fiat and crypto comparisons: fiat finance relies on opaque, human-driven systems that make large-scale money laundering all too easy.

Fiat Laundering vs. Crypto Illicit Use

Now, let’s stack fiat and crypto side by side. The contrast couldn’t be sharper.

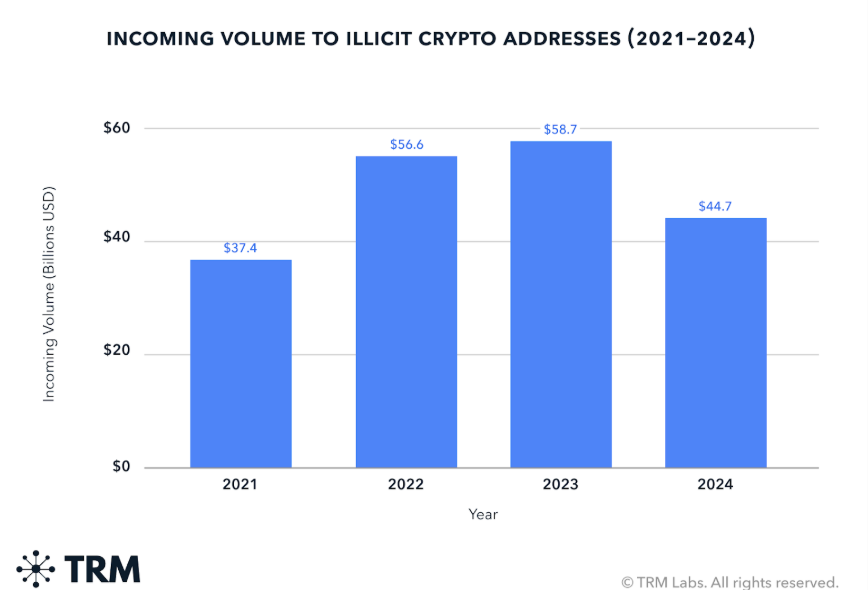

According to TRM Labs’ 2025 Crypto Crime Report, illicit crypto volume fell to $45 billion in 2024, representing just 0.4% of total crypto transactions. That’s nearly half of the 0.9% recorded in 2023.

Compare that to $312 billion via fiat and crypto laundering differences in just one country over four years, and suddenly, crypto’s role looks like a drop in the ocean. While crypto crime headlines dominate news cycles, the data shows that fewer than all crypto transactions involve illicit use. At the same time, fiat finance remains the actual engine room of global money laundering.

READ MORE: Are Scams Damaging Crypto’s Reputation?

Why Crypto Gets Scapegoated

So why does crypto keep getting cast as the villain of global finance? Much of it boils down to political theatre and public optics.

Take U.S. Treasury Secretary Janet Yellen, who has argued that crypto is mainly used for illicit financing or ECB President Christine Lagarde, who dismissed crypto as worthless and dangerous. These kinds of remarks strike a chord with the masses, but they miss the elephant in the room: the real laundering playground is still traditional banking.

History proves the point. HSBC paid a record $1.9 billion fine in 2012 after U.S. investigators revealed it helped Mexican drug cartels wash hundreds of millions of dollars through its accounts. Europe’s Danske Bank faced allegations of funnelling $230 billion in suspicious funds through its Estonian branch, one of the biggest money-laundering scandals in history.

And yet, crypto remains the convenient scapegoat. Why?- because blockchains are new, complex, and intimidating to the public, which makes them easier to demonize. Meanwhile, traditional banks, the very institutions repeatedly caught failing AML checks, benefit from keeping the spotlight on digital assets.

Implications for Future Regulation

If regulators are serious about curbing financial crime, the next wave of rules must be driven by evidence, not fear. That starts with shifting the focus back to where the real problem lies: traditional finance. The $312 billion laundered through U.S. banks dwarfs anything seen in crypto, yet regulatory energy continues to pour into policing digital assets. A proportional approach would mean focusing the spotlight on both fiat and crypto, with an emphasis on areas where money laundering remains rampant.

Banks, in particular, must be pushed to raise their standards. Enhanced AML and counter-terrorist financing checks are long overdue, especially around suspicious large cash deposits tied to daigou networks or real estate fronts that have long served as laundering vehicles. These weaknesses are not hypothetical; they’ve been exposed time and again in major money laundering scandals, yet oversight has barely kept pace.

At the same time, regulation should avoid falling into the trap of double standards. If anything, crypto is already showing how financial innovation can be part of the solution. Initiatives like the T3 Financial Crime Unit, a joint effort by TRON, Tether, and TRM Labs, highlight how blockchain technology can proactively detect and even prevent illicit flows before they spiral. Rather than painting the entire industry as a risk, policymakers should focus on how to harness these tools across both fiat and crypto channels.

Above all, legislation must be balanced and data-driven. Reactionary rhetoric might win headlines, but it risks stifling innovation while leaving systemic vulnerabilities in fiat finance unaddressed. Objective evidence, such as the FinCEN report’s $312 billion figure, should guide future frameworks, ensuring regulations actually match the scale of risk rather than political narratives.

Finally, winning the narrative battle will be just as important as writing the rules. Public perception still casts crypto as the primary vehicle for crime, but awareness campaigns can help reframe the discussion. By highlighting the transparency of blockchain and how often that visibility helps law enforcement crack cases, both the industry and regulators can shift the blame and the policy response toward where it truly belongs.

Looking Ahead: Shifting the Spotlight

The numbers don’t lie. If $312 billion can quietly slip through U.S. banks while crypto’s illicit flows are shrinking, then we have to ask: where should regulators really be pointing their spotlight?

Crypto may be louder in headlines, but fiat remains the silent, yet real, enabler. The coming years will test whether policymakers can move past political posturing to address the heart of the problem or whether they’ll keep hammering crypto. At the same time, criminals continue exploiting the blind spots in traditional finance.

And that leaves us with one pressing question: will future financial crime policy be built on fear or on facts?

Disclaimer: This article is intended solely for informational purposes and should not be considered trading or investment advice. Nothing herein should be construed as financial, legal, or tax advice. Trading or investing in cryptocurrencies carries a considerable risk of financial loss. Always conduct due diligence.

If you would like to read more articles like this, visit DeFi Planet and follow us on Twitter, LinkedIn, Facebook, Instagram, and CoinMarketCap Community.

Take control of your crypto portfolio with MARKETS PRO, DeFi Planet’s suite of analytics tools.”