Decentralized finance (DeFi) has unlocked new financial possibilities, but it also comes with serious risks, making DeFi risk management a top priority for developers and institutions alike. Smart contract bugs, flash loan attacks, and logic flaws have cost users billions of dollars over the past few years. Once deployed, these contracts often run without much oversight, making them an easy target for attackers.

To stay ahead of these threats, real-time monitoring tools are becoming critical. Unlike traditional audits that happen once, these tools keep an eye on smart contracts as they operate, detecting suspicious activity the moment it starts.

Sayfer, a real-time smart contract monitoring platform, was developed to alert developers and users to potential threats before major damage occurs. In this review, we’ll explore how Sayfer works and whether it’s truly helping make DeFi safer in 2025.

Why DeFi Needs Real-Time Monitoring

DeFi has come a long way, but it’s also been hit hard by high-profile exploits. Flash loan attacks, reentrancy bugs, and flawed logic in smart contracts have led to losses exceeding $5.7 billion since 2020.

Notable incidents like the bZx attacks, Cream Finance hacks, and the Ronin Bridge exploit show how fast things can go wrong, often within minutes or seconds.

While many DeFi projects undergo pre-deployment audits, those checks are not foolproof. Code can behave differently in the real world, and attackers often find edge cases that auditors miss. Once a contract is deployed, it’s usually immutable, meaning any vulnerabilities left behind can’t be patched easily.

That’s why continuous, real-time monitoring is becoming essential. It adds a second layer of protection by spotting suspicious behaviour as it happens. With traditional finance institutions showing growing interest in DeFi, tools that offer stronger, ongoing security assurances are no longer a luxury; they’re a necessity.

What Is Sayfer and How Does It Work?

Sayfer is a blockchain cybersecurity platform offering real-time smart contract monitoring and alerting to help DeFi projects stay one step ahead of threats. It’s designed not just to find vulnerabilities before launch, but to actively watch live contracts for dangerous activity as soon as they go live.

Here are the key features:

Real-Time Event Tracking and Anomaly Detection

Sayfer provides continuous, automated surveillance of smart contracts to spot irregularities in real time. It tracks on-chain events like token transfers, function executions, and balance changes, comparing them against known patterns of normal activity.

When anomalies like unusually large withdrawals or unauthorized access attempts occur, Sayfer immediately flags them, allowing developers or security teams to act before any damage is done.

Alerts for Suspicious Behaviours

Sayfer’s system is equipped to detect specific indicators of malicious intent, such as sudden spikes in gas fees (a sign of high-frequency bot activity), reentrancy attempts, or calls to self-destruct functions. These alerts are sent instantly via dashboards, email, or integrated messaging tools, giving security teams time to respond before funds are compromised.

Transaction Pattern Analysis and Custom Rule Setting

Users can tailor Sayfer to their specific risk tolerance by setting up custom alert rules based on transaction behaviour. For example, a protocol might want alerts for a sequence of rapid wallet creations followed by small token transfers, behaviour that often precedes an airdrop farming attack. This flexibility allows platforms to focus on threats that matter most to them and adapt their defence strategies as new attack vectors emerge.

User Interface: Dashboard with Real-Time Visualization and Logs

Sayfer presents suspicious behaviour via a clean dashboard that shows live data, event timelines, and transaction logs. This visual, real‑time interface helps both developers and security teams quickly interpret alerts, trace incidents, and take timely action.

Compliance Readiness: Helps Institutional Users Meet Audit and Security Benchmarks

For institutional clients, like asset managers or fund operators, Sayfer adds value by providing documented alerts and logs. These features support compliance efforts by offering a traceable audit trail, evidence of monitoring, and rapid incident response procedures.

Integration With Dev Environments and Existing Security Stacks

Sayfer integrates with developer toolsets and bug bounty platforms, blending into a project’s existing security workflow. Teams can receive alerts through their usual reporting tools and use Sayfer’s watchlist alongside audits and manual tests.

Sayfer supports integrations with popular Web3 tooling stacks. It can connect to block explorers to enrich alert data with transaction metadata, or plug into Gnosis Safe to trigger automated responses like multisig approvals for contract pausing.

It also works with existing security dashboards, enabling teams to view smart contract health alongside other risk signals. Because Sayfer combines continuous monitoring with compliance- and risk-based features, it’s suitable for both DeFi builders and larger players like institutional funds.

Smart Contract Monitoring for Developers and Institutions

Sayfer is designed to support developers throughout the lifecycle of a smart contract. During the development phase, it can be integrated into testnets or dev environments to monitor contract behaviour under simulated conditions.

Developers can set up custom rules to flag anomalies like unauthorized access attempts, unexpected changes in gas consumption, or edge-case behaviour during function calls.

After deploying the contract, Sayfer continues to run in real-time, tracking on-chain activity and alerting the team to any suspicious patterns that may signal an exploit in progress.

Institutional users, including DeFi asset managers and protocol treasuries, can use Sayfer to safeguard on-chain assets by receiving immediate alerts when monitored smart contracts behave abnormally.

For instance, a yield aggregator managing user funds across various vaults can monitor for reentrancy attacks or flash loan exploits across its strategies. Alerts from Sayfer can enable rapid response, such as pausing a contract or halting deposits, before major damage occurs.

This real-time visibility provides the level of DeFi risk management institutions increasingly require to operate confidently.

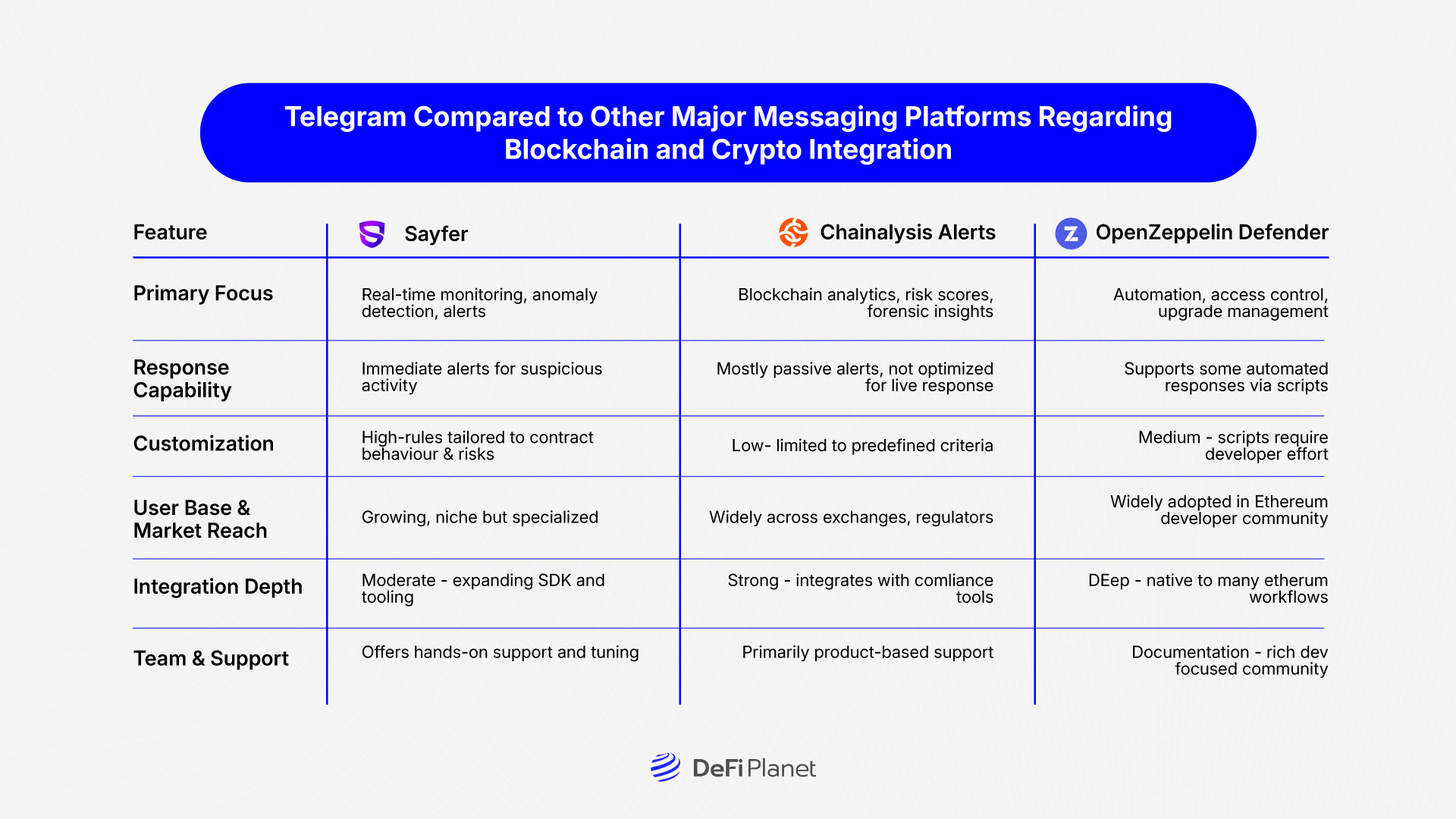

How Sayfer Compares to Other Security Tools

Sayfer stands out by emphasizing real-time threat detection and customizable alerts, while many other tools focus more on audits or post-incident forensics.

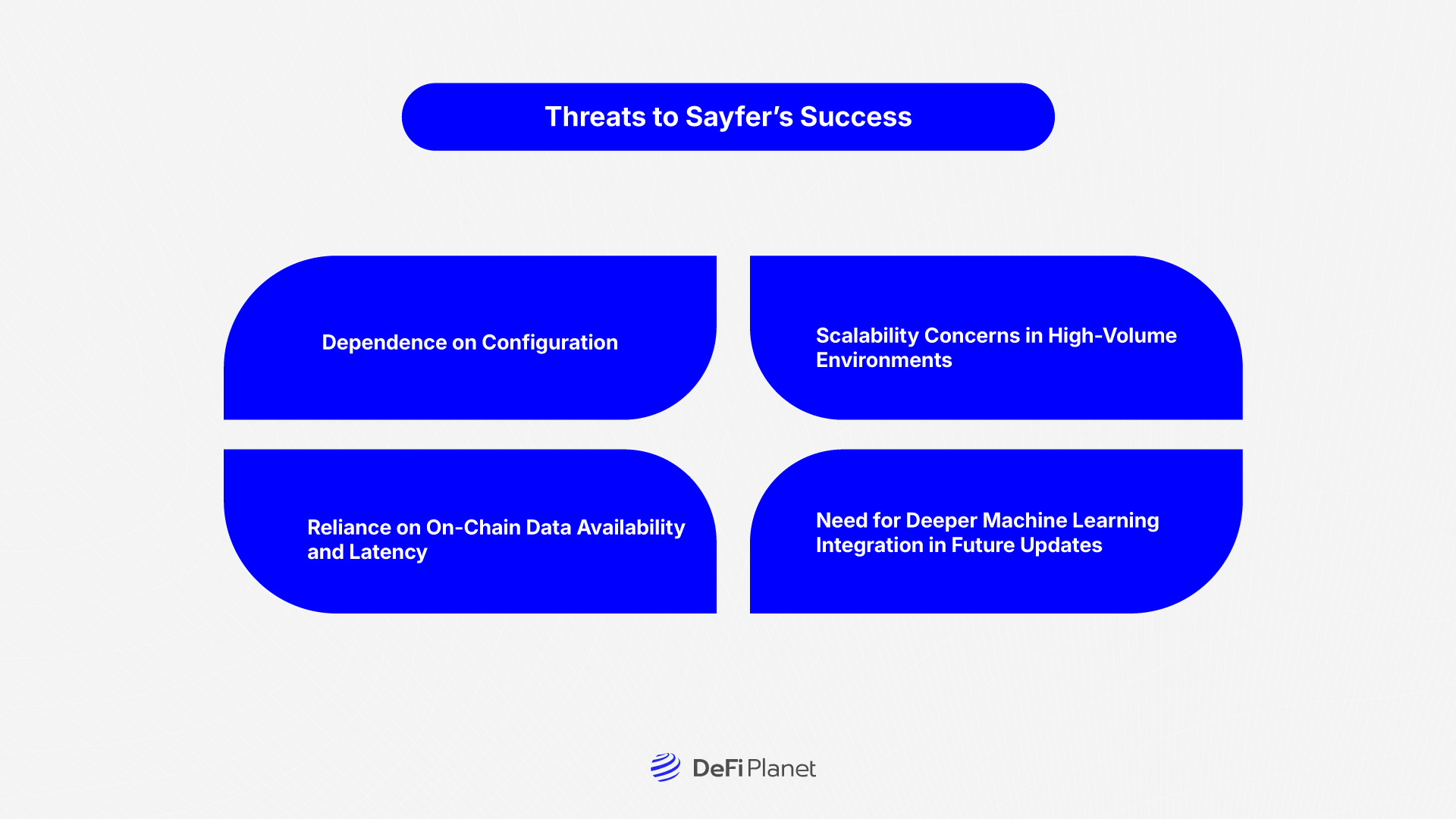

Threats to Sayfer’s Success

While Sayfer offers real-time smart contract monitoring to strengthen DeFi security, it still faces some challenges that could limit its broader effectiveness and adoption.

Dependence on Configuration

Sayfer relies on user-defined rules and thresholds to detect anomalies, which introduces a margin for error depending on how accurately the rules are set. If the parameters are too broad, they can generate excessive false positives, causing alert fatigue and potentially leading teams to ignore real threats.

On the other hand, overly narrow configurations can miss critical events, creating false negatives that allow exploits to slip through undetected. Striking the right balance requires security expertise, which not every development team may have.

Scalability Concerns in High-Volume Environments

DeFi applications with high-frequency transactions and complex multi-contract operations present scalability challenges. Monitoring thousands of live interactions across multiple blockchains in real time requires substantial computing power and backend optimization.

If Sayfer’s system cannot scale efficiently, delays in processing or dropped alerts could compromise its ability to protect high-volume protocols, particularly during peak network congestion or volatile market periods.

Reliance on On-Chain Data Availability and Latency

Sayfer’s alert system is only as fast and accurate as the blockchain data it receives. Network latency, delayed block finality, or poor data indexing can impact its ability to deliver timely alerts.

This is especially problematic during rapid, coordinated attacks like flash loan exploits, where seconds can determine whether a protocol suffers minor or catastrophic losses. Without a fallback mechanism or redundancy layer, Sayfer’s performance may be vulnerable to network instability.

Need for Deeper Machine Learning Integration in Future Updates

At present, Sayfer’s detection engine is rule-based, relying on patterns and thresholds defined by users or preconfigured templates. While this is effective for known attack types, it lacks adaptability against novel threats or evolving attack vectors that don’t fit existing models.

Integrating machine learning could help the system recognize subtle or unexpected behaviours across different contracts, improving detection accuracy and reducing the need for manual tuning over time. However, this requires major R&D investment and careful handling to avoid new risks from automated learning.

Final Words: Is Sayfer a Game-Changer for DeFi Security?

Sayfer delivers real-time smart contract monitoring that benefits both developers and institutions, offering customizable alerts, multi-chain support, and transaction-level insights. It’s a practical tool for builders looking to catch threats early and for larger protocols aiming to strengthen operational security.

While not a silver bullet, Sayfer adds a vital defence layer. Its rule-based system requires careful setup and lacks machine learning adaptability for now. Still, it helps reduce response time and alert fatigue, both critical in today’s fast-moving DeFi space.

As part of a layered DeFi risk management strategy, Sayfer fills a crucial gap between audit-time discovery and live exploit mitigation. As billion-dollar exploits grow more common, tools like Sayfer may soon become standard in secure DeFi protocol design, shifting from “nice to have” to essential.

Disclaimer: This article is intended solely for informational purposes and should not be considered trading or investment advice. Nothing herein should be construed as financial, legal, or tax advice. Trading or investing in cryptocurrencies carries a considerable risk of financial loss. Always conduct due diligence.

If you would like to read more articles like this, visit DeFi Planet and follow us on Twitter, LinkedIn, Facebook, Instagram, and CoinMarketCap Community.

Take control of your crypto portfolio with MARKETS PRO, DeFi Planet’s suite of analytics tools.”