Last updated on July 28th, 2025 at 04:23 pm

What if you could earn passive income not through staking, lending, or farming—but by putting market volatility to work for you? That’s exactly what DeFi Options Vaults (DOVs) offer, and they’re rapidly gaining traction as one of the most innovative yield-generating strategies in DeFi.

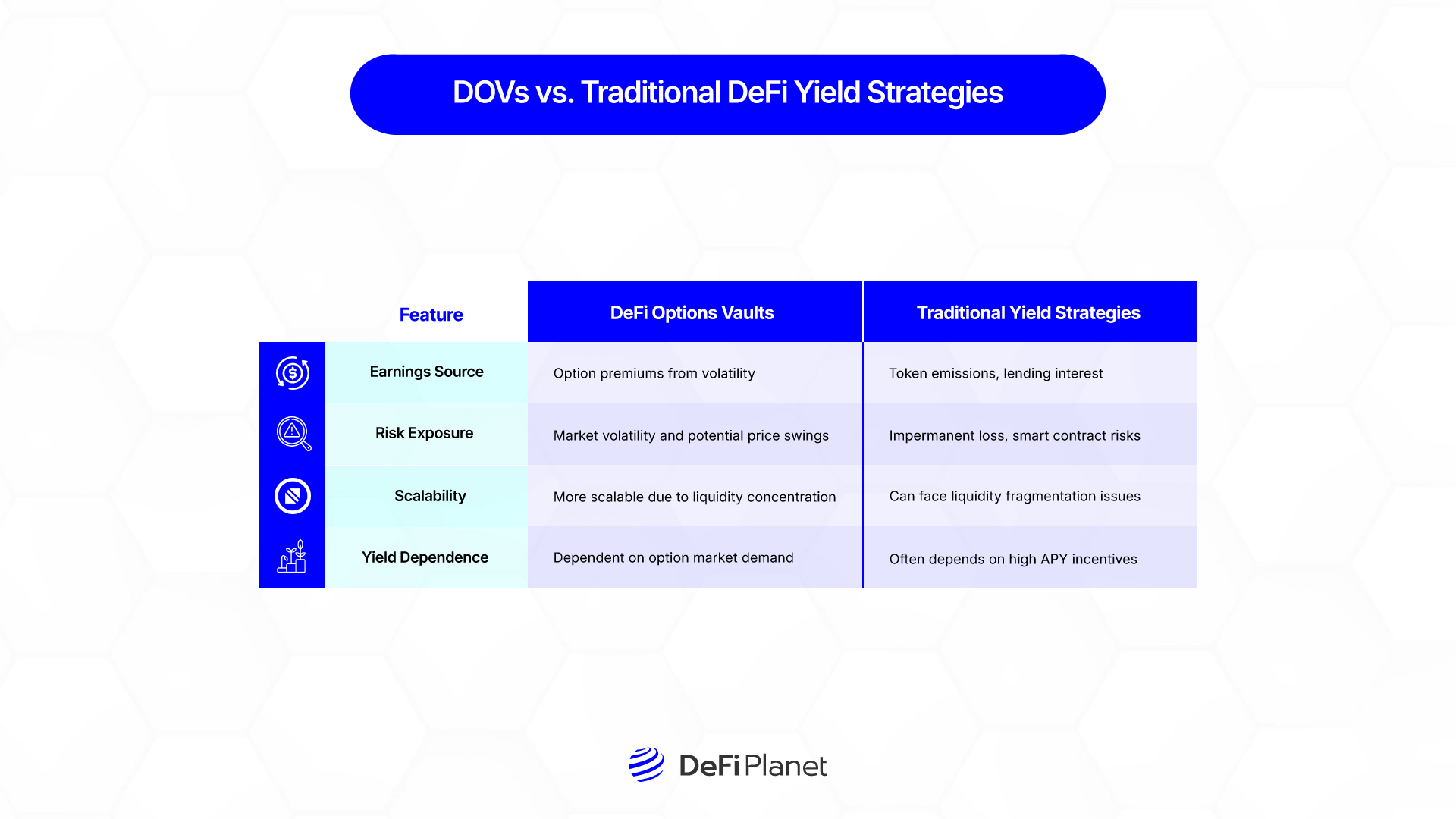

For years, earning yield in crypto often meant navigating liquidity pools, hunting down token incentives, or juggling complex yield farming strategies. These approaches required time, effort, and often carried risks tied to token inflation or impermanent loss.

DOVs change that. They provide a hands-off, automated way to generate income—without needing deep expertise in options trading or relying on unsustainable token rewards.

So, what exactly are DeFi Options Vaults?

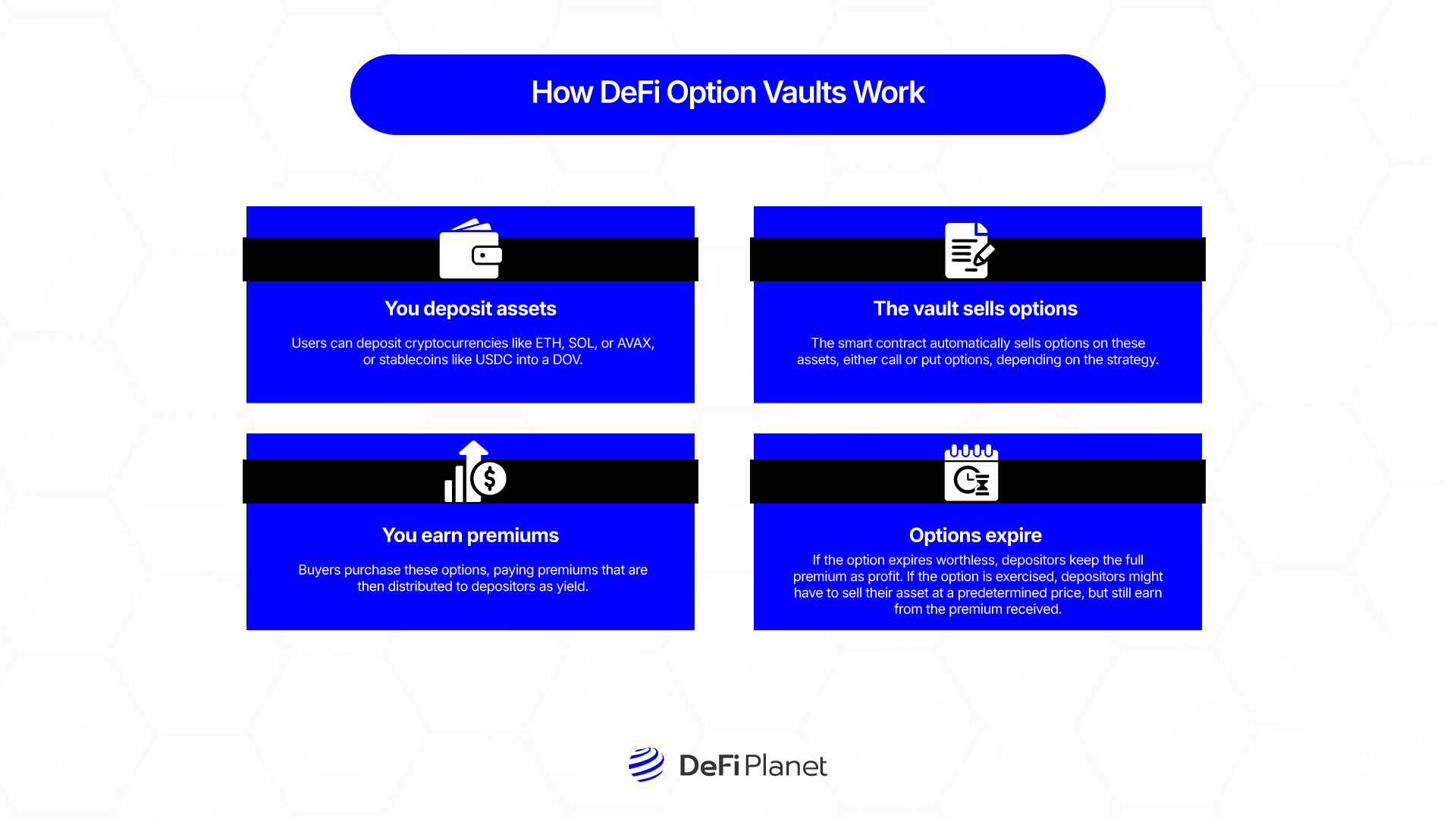

DOVs are smart contract-based protocols that automate options trading. Instead of actively managing trades yourself, you deposit crypto into a vault. That vault then sells options on your behalf, collecting premiums from buyers. It’s a passive way to capture returns from crypto’s price swings.

Most vaults follow one of two common option trading strategies: covered calls or cash-secured puts.

Covered Calls are usually used in vaults holding volatile assets like ETH, SOL, or AVAX. The vault sells out-of-the-money (OTM) call options, earning a premium while retaining the asset. If the option isn’t exercised, the depositor keeps both the asset and the premium. If the asset’s price exceeds the strike price, the underlying may be sold—but always at a predetermined rate.

Cash-Secured Puts are used in vaults holding stablecoins. Here, the vault sells OTM put options using the deposited stablecoins. If the option expires without being exercised, the depositor keeps the premium. If the asset’s price drops below the strike price, the depositor may need to buy it—potentially at a discount, depending on the strategy.

What makes DOVs stand out among other DeFi yield generation strategies is their focus on sustainable, volatility-based income. Unlike yield farming or liquidity mining, which often depend on inflationary token emissions and unpredictable APYs, DOVs rely on structured options strategies with more predictable outcomes.

These vaults are gaining attention for offering a reliable alternative in a market hungry for real yield. They appeal to both experienced traders looking to automate strategies and passive investors who want exposure to options trading without manual execution.

Leading projects in this space include Ribbon Finance, StakeDAO, Solana’s Friktion, Thetanuts Finance, and Opyn. Each provides slightly different interfaces and risk profiles, but the core mechanics remain the same: monetizing crypto volatility through automated, user-friendly vaults.

Risks & Challenges of Using DeFi Options Vaults

While DeFi Options Vaults (DOVs) provide an opportunity to earn passive income, they come with inherent risks that investors must consider:

1. Market Volatility Risk

Crypto markets are highly volatile, and when options expire in-the-money (ITM)—meaning the asset price moves beyond the option’s strike price—depositors may face losses instead of earning premiums. For example, in a covered call strategy, if the asset’s price surges past the strike price, users may be forced to sell their holdings at a lower value than the market price, missing out on potential gains. Similarly, in a cash-secured put, a sudden drop in asset value could result in an unintended purchase at a higher-than-market price, leading to losses.

2. Capital Inefficiency

Many DOVs require full collateralization, meaning users must lock up the full value of the asset being used in the options strategy. This can lead to capital inefficiency, as those funds remain idle when they could be utilized in other yield-generating opportunities like liquidity pools, staking, or lending. Unlike traditional finance, where margin-based options trading allows for greater capital efficiency, DeFi’s collateralized nature often results in lower capital productivity.

3. Front-Running & Auction Manipulation

DOVs typically use on-chain auctions to sell options, making them susceptible to front-running. Sophisticated traders and bots can monitor blockchain activity and place trades ahead of the auction, adjusting their strategies to exploit price movements. This can lower the implied volatility (IV) of the options being sold, ultimately reducing the premiums that depositors earn. Additionally, large investors or market makers participating in these auctions may use their size and influence to manipulate pricing, further impacting returns for retail users.

4. Overcrowding & Yield Compression

As more investors deposit funds into DOVs, the demand for options selling increases, which can lead to premium compression. If too many vaults sell similar options, competition among sellers drives down the price of premiums, leading to lower yields for depositors. This overcrowding effect can make previously lucrative strategies less profitable over time, especially during prolonged periods of low volatility when option premiums are naturally lower.

5. Smart Contract & Security Risks

DOVs rely on smart contracts to automate their strategies, and any bugs, exploits, or security vulnerabilities can put user funds at risk. Even well-audited protocols have faced unexpected hacks or contract failures, leading to significant losses. Additionally, DeFi projects may integrate with third-party protocols, and an exploit in one linked platform can create a contagion effect, impacting the security of the entire ecosystem. Users should always assess the security audits, team reputation, and risk mitigation measures of a protocol before depositing funds.

How to Maximize Returns with DeFi Options Vaults

Earning the highest possible yield from DeFi Options Vaults (DOVs) requires more than just depositing assets and waiting for returns. A well-planned strategy can significantly improve profitability while managing risks. Here’s how users can optimize their returns:

1. Diversify Across Different Vaults

Instead of committing all funds to a single vault or platform, spread investments across multiple DOVs. This approach reduces risk exposure in case one vault underperforms due to lower option premiums, smart contract failures, or market downturns. Diversification can also balance returns, as different vaults may employ varying strategies and operate on different assets, increasing the likelihood of steady profits.

2. Monitor Implied Volatility (IV) for Optimal Entry

Implied Volatility (IV) plays a crucial role in determining option premiums—the higher the IV, the more lucrative the premiums earned from selling options. Users should monitor market conditions and time their deposits when IV is elevated, such as during major economic events, market uncertainty, or significant price swings in crypto assets. Tracking IV through on-chain analytics tools or options platforms can help maximize earnings.

3. Utilize Liquid Staking for Additional Yield

Some DOVs integrate with liquid staking platforms like Lido or Rocket Pool, enabling users to earn staking rewards alongside option premiums. For example, Ribbon Finance allows users to deposit stETH (staked ETH) instead of regular ETH, ensuring that they benefit from both staking APY and option strategy yields. Leveraging such integrations can significantly boost overall returns without requiring additional capital.

4. Avoid Overcrowded Vaults for Higher APY

When too many users deposit into a single vault, the yield generated is split among more participants, leading to lower Annual Percentage Yield (APY). Overcrowding also drives down premiums, as the increased supply of options for sale results in reduced demand from buyers. To maximize earnings, users should seek newer, less saturated vaults that still offer competitive premiums but with fewer participants.

5. Stay Updated on Market Trends & Adjust Strategies

Crypto markets are dynamic, and different option strategies perform better under varying conditions. For example, covered calls work best in sideways or slightly bullish markets, while cash-secured puts are more profitable during mild downtrends. Staying informed about macro trends, regulatory updates, and protocol developments can help users anticipate which vaults are likely to generate higher returns at any given time. Following DeFi analytics platforms and project updates ensures users are always in a strong position to adjust their strategies accordingly.

Disclaimer: This article is intended solely for informational purposes and should not be considered trading or investment advice. Nothing herein should be construed as financial, legal, or tax advice. Trading or investing in cryptocurrencies carries a considerable risk of financial loss. Always conduct due diligence.

If you want to read more market analyses like this one, visit DeFi Planet and follow us on Twitter, LinkedIn, Facebook, Instagram, and CoinMarketCap Community.

Take control of your crypto portfolio with MARKETS PRO, DeFi Planet’s suite of analytics tools.”