Last updated on May 27th, 2025 at 07:24 am

Crypto arbitrage, much like in traditional finance, is one of the most popular trading strategies in the cryptocurrency market. It involves capitalizing on price differences for the same cryptocurrency across various exchanges.

These price discrepancies arise because exchanges often update their prices at different times, influenced by factors such as demand, supply, and how fast they respond to market changes.

What makes this strategy particularly appealing in the crypto space is the market’s global, 24/7 nature and its inherent price volatility. Unlike strategies that rely on predicting market trends, crypto arbitrage enables traders to profit from existing price gaps. It offers a compelling opportunity for those who can act quickly and navigate the risks.

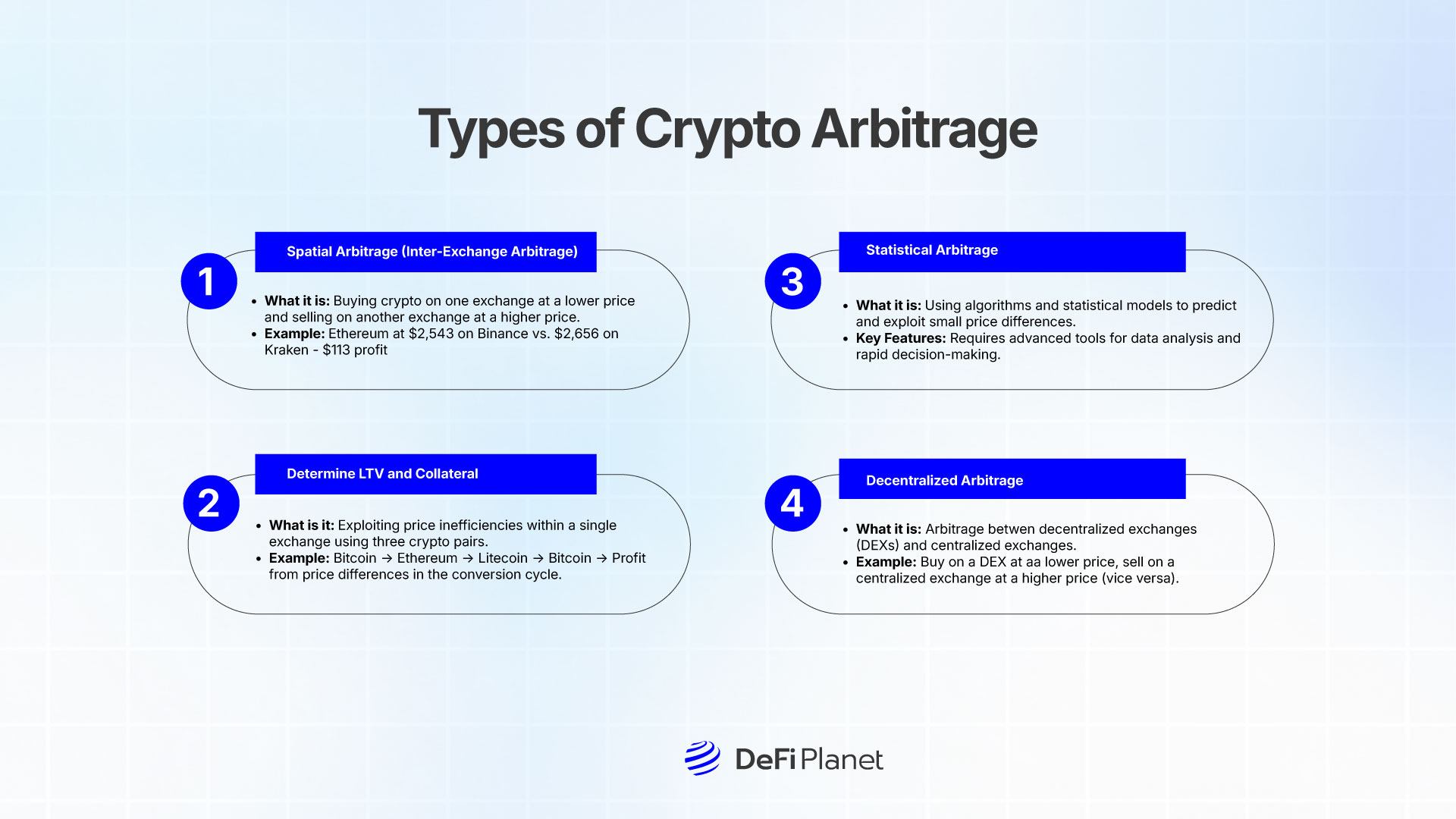

Types of Crypto Arbitrage

There are various approaches to crypto arbitrage, each with different levels of complexity and risk. They also require distinct skills and tools, and profits can fluctuate based on market conditions and transaction fees.

Spatial Arbitrage (Inter-Exchange Arbitrage)

This is the most common form of crypto arbitrage. It involves buying the same cryptocurrency on one exchange where the price is lower and selling it on another exchange where the price is higher.

The price difference between exchanges presents an opportunity to profit. For example, you might find Ethereum listed at $2,543 on Binance, but it is listed at $2,656 on Kraken. This $113 price difference presents an arbitrage opportunity.

Triangular Arbitrage

This strategy involves taking advantage of price inefficiencies within a single exchange, using three different cryptocurrency pairs. The process works by converting one cryptocurrency into another, then into a third, and finally back to the original.

For example, a trader might exchange Bitcoin for Ethereum, then Ethereum for Litecoin, and finally Litecoin back into Bitcoin. If there are price inefficiencies between the three pairs, the trader can profit from the conversion cycle.

Statistical Arbitrage

This approach uses sophisticated algorithms and statistical models to analyze market data and predict short-term price movements. By identifying patterns in the market, traders can exploit small price differences between crypto assets that are statistically likely to converge or diverge. It requires advanced tools and systems to manage large amounts of data and make rapid trading decisions based on predictions, making it suitable for more experienced traders.

Decentralized Arbitrage

Decentralized exchanges (DEXs) have become more popular in the crypto world, and they also present unique arbitrage opportunities. These platforms operate without a central authority and allow traders to buy and sell cryptocurrencies directly from one another.

However, price differences between DEXs and centralized exchanges can create arbitrage opportunities. Traders can take advantage of these inefficiencies by purchasing crypto on DEXs, where the price is lower, and selling on centralized exchanges, where the price is higher, or vice versa.

How to Perform Crypto Arbitrage

A typical crypto arbitrage strategy has the steps described below. Though our description is more applicable to spatial arbitrage (inter-exchange arbitrage), the principles outlined in each step also apply to other types of crypto arbitrage.

A typical crypto arbitrage strategy has the steps described below. Though our description is more applicable to spatial arbitrage (inter-exchange arbitrage), the principles outlined in each step also apply to other types of crypto arbitrage.

Step 1: Research and Select Exchanges

The first step is to identify exchanges that often have notable price differences for the same cryptocurrency. These differences can vary based on factors like liquidity, trading volume, and regional demand. So these factors should inform your search.

Also, consider transaction fees, withdrawal limits, and liquidity, as they can impact your ability to execute arbitrage efficiently. It’s important to choose exchanges with good reputations for reliability and low fees. Some popular exchanges check out include Binance, Kraken, Coinbase, and decentralized platforms like Uniswap.

Step 2: Analyze the Market for Arbitrage Opportunities

Once you’ve selected your exchanges, monitor the market for price discrepancies. Crypto prices are volatile and can change quickly, so using real-time price tracking tools or arbitrage bots can help you spot opportunities more easily.

Look for exchanges where the price of the same cryptocurrency differs significantly. Tools like CoinMarketCap or CoinGecko, or automated platforms like Bitsgap, coinrule, coinarbitrage, and pixelplex, can help track prices across multiple exchanges simultaneously.

Step 3: Buy on the Lower-Priced Exchange

When you find a price difference, act quickly by purchasing the cryptocurrency on the exchange where it’s priced lower. The key to arbitrage is speed, as the price difference may only last for a short time. Ensure that you are familiar with the buying process on the exchange and that there are no delays or restrictions that could prevent the transaction from going through smoothly.

Step 4: Transfer and Sell on the Higher-Priced Exchange

After buying the cryptocurrency, transfer it to the exchange with the higher price. This step is crucial, and the transfer time can vary depending on the blockchain network used. Once the transfer is complete, sell the cryptocurrency at a higher price. Ideally, you want to minimize transfer time to avoid the risk of the price difference narrowing during the process.

Step 5: Calculate Profits and Fees

After completing the trade, calculate your profits by subtracting any associated fees (such as trading fees, withdrawal fees, and transfer costs) from your earnings. It’s important to factor in all the costs to determine whether the arbitrage opportunity was truly profitable. Also, consider the time it took to complete the entire process, as longer transaction times can reduce the profitability of an arbitrage trade. Ensure that the price difference is large enough to cover these costs and still yield a profit.

Risks of Crypto Arbitrage

Crypto arbitrage can be an appealing way to make profits, but it’s important to be aware of the risks involved.

Market Volatility

Arbitrage strategies are all about capitalizing on the crypto market’s volatility. However, there is still a looming risk that it could backfire.

Prices can change rapidly, sometimes within seconds. For instance, if you purchase cryptocurrency at a lower price on one exchange and then transfer it to another, the price may move during the transfer. This shift can reduce or eliminate the price difference between the exchanges, diminishing your potential arbitrage profit or making it vanish entirely. The risk is particularly high during periods of high volatility, such as when significant news or events impact the market.

Exchange Liquidity

Liquidity is about how easily you can buy or sell an asset without affecting its price. If an exchange has low liquidity, there might not be enough buyers or sellers at your desired price. This sets you up to experience price slippage, meaning your trade might not happen at the expected price.

The best platforms for crypto arbitrage are the ones that have high liquidity and relatively low transaction fees.

Transaction Fees and Costs

Every transaction on an exchange comes with fees, and these can add up quickly. Some exchanges charge high fees for trading, withdrawing, or transferring cryptocurrencies.

When you’re doing arbitrage, especially with smaller price differences, these fees can take a big chunk out of your potential profits. Even if there’s a good price gap between exchanges, high fees can make the opportunity unprofitable, so it’s important to calculate these costs before you start trading.

Timing Issues

In crypto arbitrage, timing is everything. Price differences between exchanges can close quickly, and delays can occur during transfers or when your order is processed.

If there’s a delay in transferring funds or processing the trade, the price gap could disappear before you can act. This could mean missed profits or even a loss if the market moves in the wrong direction during the wait.

Regulatory Risks

Crypto regulations are still changing around the world. While arbitrage is usually not illegal, some countries have strict rules about cryptocurrency trading, exchanges, or cross-border transactions. These rules can include tax reporting requirements, trading limits, or restrictions on certain types of transactions.

If you’re arbitraging across exchanges in different countries, you might face regulatory scrutiny. It’s important to stay updated on the rules in your area and in the countries where you’re trading to avoid potential legal penalties.

Final Thoughts

Crypto arbitrage can be a great way to make money by taking advantage of differences in price for the same cryptocurrency on different exchanges. To be successful at arbitrage, you need to do your homework. This means constantly researching the market, tracking price trends, and understanding how fees, transfer times, and other factors can eat into your profits.

The best traders are the ones who plan ahead, stay alert, and have a solid strategy for managing risks. They’re able to spot and act on price differences quickly, but they also know when to step back and assess the situation to avoid unnecessary losses.

So, whether you’re just getting started or have been trading for a while, the message is that crypto arbitrage requires a good mix of preparation, fast decision-making, and careful risk management. If you can handle that, you’ll be in a better position to take advantage of opportunities and make steady profits.

Disclaimer: This article is intended solely for informational purposes and should not be considered trading or investment advice. Nothing herein should be construed as financial, legal, or tax advice. Trading or investing in cryptocurrencies carries a considerable risk of financial loss. Always conduct due diligence.

If you would like to read more articles like this, visit DeFi Planet and follow us on Twitter, LinkedIn, Facebook, Instagram, and CoinMarketCap Community.

Take control of your crypto portfolio with MARKETS PRO, DeFi Planet’s suite of analytics tools.”