In the battle for blockchain dominance, two titans are leading the charge: Ethereum and Bitcoin. These networks have defined the crypto industry’s evolution since its inception. But as we look ahead to the next decade, the key question emerges: Does Ethereum or Bitcoin have more potential? Will Ethereum’s innovation outpace Bitcoin’s stability, or will the original cryptocurrency maintain its reign as the most trusted blockchain?

This comprehensive comparison explores their philosophies, technologies, market dynamics, and visions to determine which is better, Ethereum or Bitcoin—and which strategy is more likely to shape the future of finance and decentralized infrastructure.

Ethereum’s Rapid Upgrades vs Bitcoin’s Conservative Development

Ethereum has earned a reputation as the experimental powerhouse of blockchain. From its transition to Proof of Stake, to the rollout of rollups, danksharding, and modular upgrades like the Pectra update, Ethereum’s pace is relentless. These upgrades aim to solve long-term problems—scalability, sustainability, and speed—making Ethereum more than just a cryptocurrency.

In contrast, Bitcoin prioritizes minimalism and immutability. Changes to the Bitcoin protocol are rare, thoroughly debated, and conservative by design. Its development ethos values stability, predictability, and resistance to change, aligning with its core role as a digital store of value.

This divergence raises a core debate in crypto: Which is better, Ethereum or Bitcoin? If you value innovation, Ethereum leads. If you prefer long-term reliability, Bitcoin remains the king.

Trade-offs Between Flexibility and Trust

So, does Ethereum have more potential than BTC? The answer lies in how you weigh adaptability against simplicity. Ethereum’s architecture is inherently flexible, it powers smart contracts, DeFi, NFTs, and Layer 2 ecosystems. It’s a vibrant, evolving digital economy. But this flexibility doesn’t come free. It introduces added complexity in protocol design, a heavier dependence on third-party infrastructure like Infura and Alchemy, and a broader surface area for bugs, vulnerabilities, or centralization risks.

Vitalik Buterin has openly recognized that both Ethereum and Bitcoin have their strengths and trade-offs. He believes Ethereum currently leads in areas like censorship resistance and network security. However, he also points out that Bitcoin has certain advantages—such as simpler code, fewer protocol changes, a higher number of full nodes, and less reliance on external RPC services.

> I believe Ethereum is leading in terms of CR and security.

There’s some aspects of this where bitcoin is ahead imo

(eg. less code complexity, lower rate of protocol change, higher full node count, less dependence on RPCs)

— vitalik.eth (@VitalikButerin) June 3, 2025

Bitcoin’s simplicity is its greatest strength, a lean, battle-tested network that prioritizes security, reliability, and decentralization above all else. It doesn’t try to do everything. It does one thing exceptionally well: store and transfer value securely.

If you’re asking, can Ethereum beat Bitcoin in the long run, the answer depends on your definition of “winning.” Ethereum might outpace in terms of innovation and application, but Bitcoin leads in terms of predictability, decentralization, and long-term confidence.

Decentralization in Practice: Nodes, Staking, and the Struggle for Trustlessness

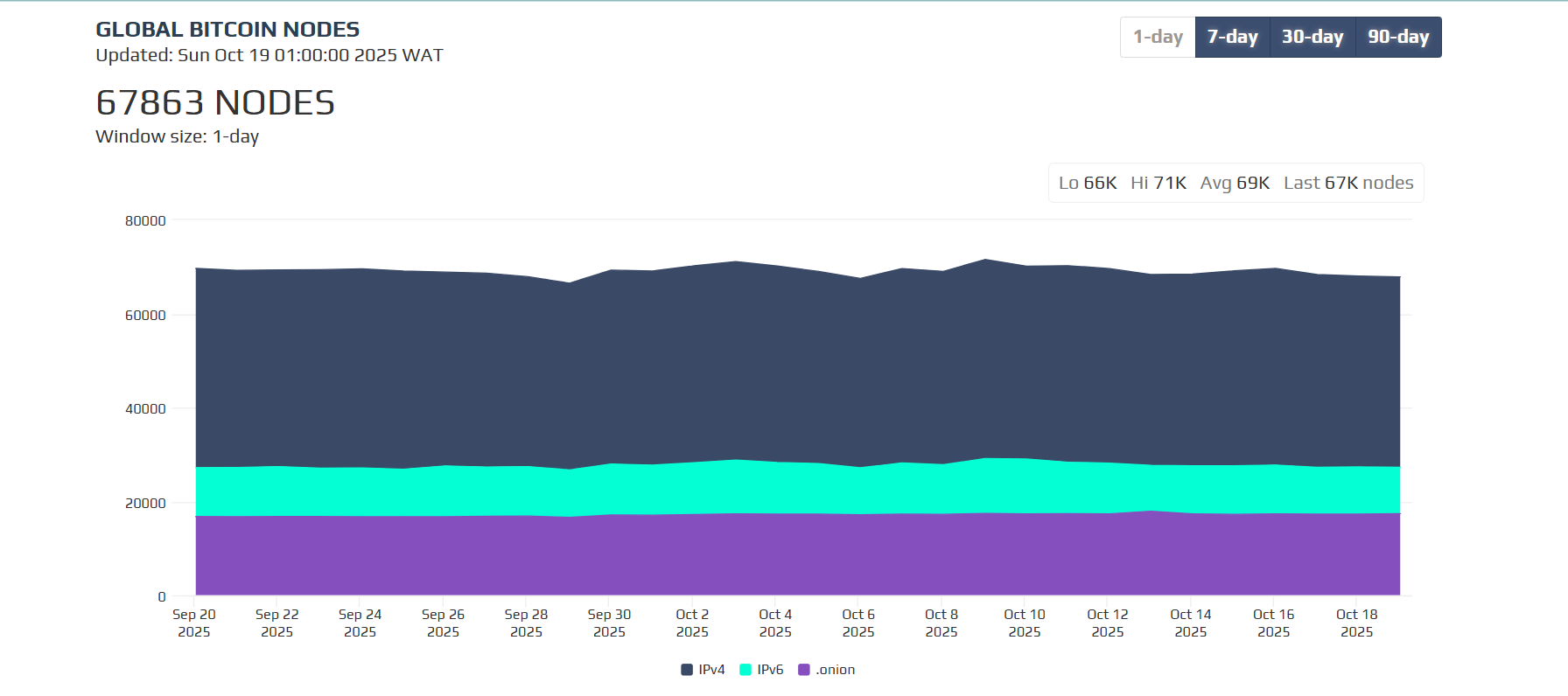

One of the most critical distinctions between Bitcoin and Ethereum lies in how each network approaches decentralization, not just as a principle, but as a lived reality in their architecture and participation models. At its core, Bitcoin remains the gold standard for network decentralization. With over 60,000 full nodes operating globally, Bitcoin’s infrastructure is deeply distributed.

Its Proof of Work (PoW) consensus allows anyone with adequate hardware and electricity to contribute to securing the network. This permissionless model promotes accessibility and ensures that no single party can easily exert control. Importantly, Bitcoin’s reliance on full nodes, not external services, reinforces its self-verification model, allowing users to independently validate transactions without third-party dependencies. It’s a system that values protocol purity and minimalism as the bedrock of trust.

Ethereum, meanwhile, has taken a different path. Its post-Merge shift to Proof of Stake (PoS) marked a foundational change in how the network operates. Rather than requiring computational effort, validators now secure Ethereum by locking up ETH. This model is significantly more energy-efficient and reduces the hardware barrier to entry, theoretically enabling broader participation. However, it also introduces a wealth-based dynamic: the more ETH one holds, the greater their influence on consensus.

Vitalik Buterin, Ethereum’s co-founder, has openly addressed one of the most nuanced challenges in this evolution: maintaining trustlessness and decentralization across Ethereum’s growing Layer 2 ecosystem. He cautions against declaring interoperability and decentralization “solved” simply because Layer 2 solutions exist. In his words,

“It’s not solved until cross-L2 actions can be as censorship-resistant, trustless, and intermediary-free as within-L2 actions.

Ultimately, the debate between Ethereum and Bitcoin often circles back to this philosophical divide. Bitcoin prioritizes simplicity, self-sovereignty, and the integrity of a slow-moving but highly resilient protocol. Ethereum embraces innovation and inclusion, building a more expansive but complex system that seeks to evolve with the needs of a growing digital economy.

Future Positioning: Global Payments vs Programmable Finance

Bitcoin and Ethereum are charting distinct paths toward the future, each optimizing for a different vision of what blockchain can become. For Bitcoin, the goal is clear: to serve as the world’s ultimate peer-to-peer currency and a secure store of value. It’s a digital alternative to cash and gold, built for simplicity, resilience, and long-term trust.

Ethereum, by contrast, is constructing a full-stack infrastructure for programmable finance and decentralized applications. Its vision goes far beyond payments. Through smart contracts, Ethereum enables DeFi protocols for lending, borrowing, and trading; it powers NFTs, decentralized identity systems, and DAOs; and it continues to scale through rollups and Layer 2 solutions that improve throughput without compromising on security.

What is the main purpose of Bitcoin? Simply put: to serve as a digital, censorship-resistant currency and a long-term store of value. Ethereum, meanwhile, is betting on programmability. It’s not just a cryptocurrency, it’s an entire financial ecosystem.

When it comes to evaluating which is “better,” the answer ultimately depends on the intended use case. Bitcoin may lead in sovereign finance, offering a censorship-resistant monetary base layer. Ethereum, on the other hand, is likely to dominate in the realm of decentralized utility, where complex financial logic and innovation thrive. Each blockchain plays a distinct, essential role in shaping the future of the digital world.

Supply, Scarcity, and Monetary Policy

Scarcity is another key battlefield in the Ethereum vs Bitcoin conversation. At the heart of Bitcoin’s value proposition is its absolute scarcity. With a fixed supply cap of 21 million coins and a halving event every four years, Bitcoin enforces a predictable, programmed monetary policy. Its deflationary nature is hardcoded, offering clarity and certainty to investors and institutions alike.

Ethereum, on the other hand, has embraced a more flexible and adaptive monetary model. The introduction of EIP-1559 brought a burn mechanism that permanently removed a portion of transaction fees from circulation, counteracting new issuance. The shift to Proof of Stake (PoS) further reduced Ethereum’s inflation rate, and during periods of high network activity, ETH supply can actually become deflationary. This means Ethereum’s scarcity is tied not to a fixed cap but to the network’s utility and usage.

This divergence has sparked an ongoing debate: Which asset has the stronger claim to digital scarcity? Bitcoin’s hard limit provides unmatched predictability and trust in its monetary policy. Yet Ethereum’s evolving model—driven by network demand and real economic activity—offers a unique form of scarcity that’s dynamic, utility-based, and increasingly deflationary.

In the end, Bitcoin embodies absolute scarcity; Ethereum represents adaptive scarcity. Both models carry value—but in different ways for different kinds of users.

Market Metrics and Real-World Adoption

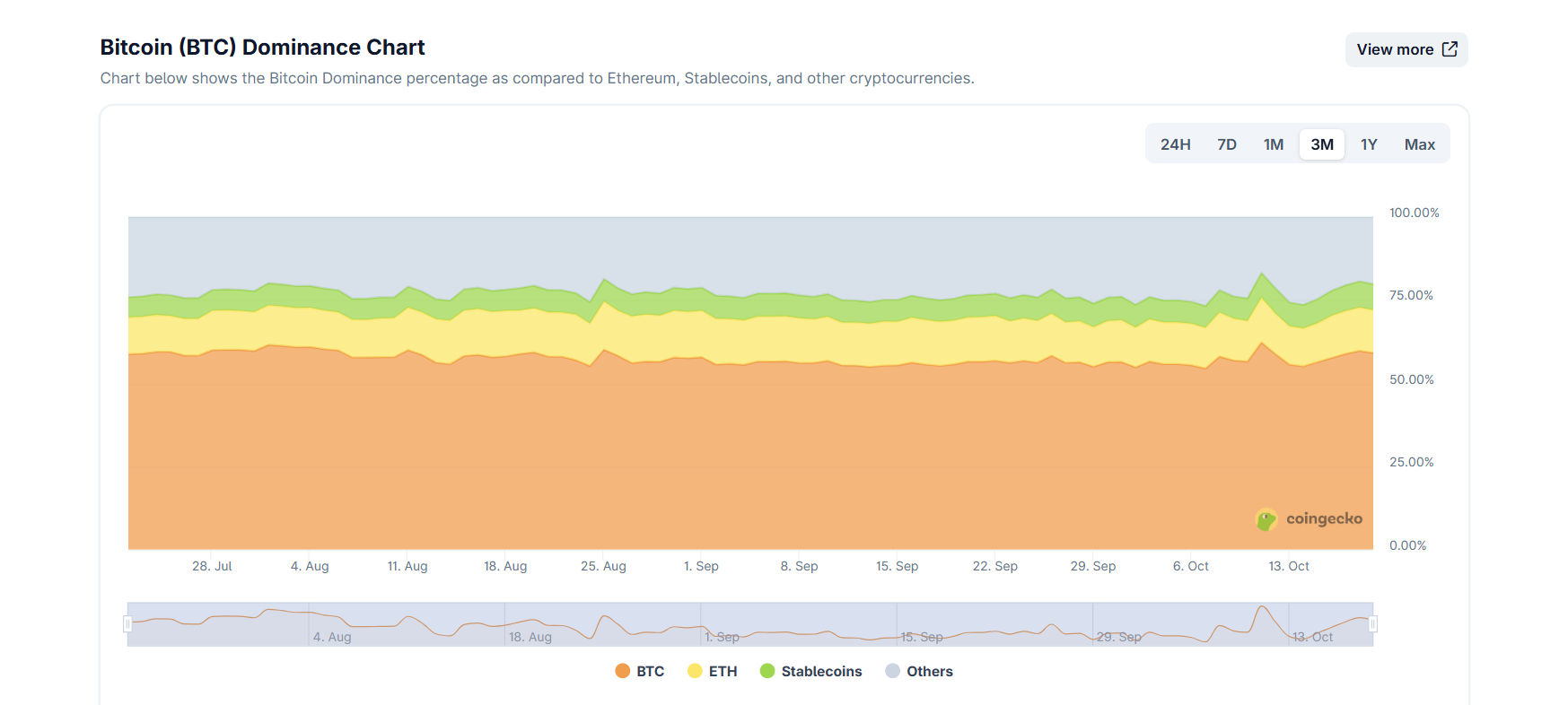

As of mid-2025, the landscape of crypto market metrics and real-world adoption continues to highlight the distinct roles of Bitcoin and Ethereum. Bitcoin maintains a dominant position, commanding over 60% of the total cryptocurrency market capitalization.

This reflects not only its first-mover advantage but also its strong brand recognition and perceived status as a digital store of value.

Meanwhile, Ethereum processes significantly more daily transactions and supports a broader range of real-world applications. From decentralized finance (DeFi) and non-fungible tokens (NFTs) to enterprise integrations and gaming platforms, Ethereum’s flexible architecture has made it the go-to blockchain for developers and innovators building next-generation digital tools.

Institutional adoption leans in favor of Bitcoin, particularly among traditional financial institutions and corporate treasuries seeking a hedge against inflation or a non-sovereign asset class. However, Ethereum is steadily gaining ground, especially in sectors like finance, gaming, and enterprise tech, thanks to its programmability and ongoing infrastructure upgrades.

So, does Ethereum or Bitcoin have more potential to shape the next phase of digital finance? Ethereum leads in developer activity, dApp integrations, and ecosystem expansion, while Bitcoin holds unmatched trust, simplicity, and regulatory clarity. The future of both assets will depend on how these strengths continue to evolve in parallel and in response to global demand.

Final Verdict: Which Strategy Will Win the Next Decade?

The real question might not be which one wins, but how both can thrive together. Bitcoin remains solid, secure, and singular in purpose—a digital monetary base layer built for long-term value storage and sovereign financial independence. Its strength lies in its stability, simplicity, and unmatched trust as a decentralized store of value.

Ethereum, on the other hand, is agile, adaptable, and unapologetically ambitious. It positions itself as the foundational layer of a decentralized, programmable internet—powering everything from DeFi and NFTs to DAOs and decentralized identity systems. Its bold, tech-forward approach is designed to evolve with the needs of a rapidly changing digital world.

Ultimately, the debate between Ethereum and Bitcoin is not just about code—it’s about competing philosophies. Innovation versus resilience. Flexibility versus stability. The next decade may not yield a clear victor, but rather a coexistence where both networks serve distinct, vital roles: Bitcoin as the bedrock of digital value, and Ethereum as the engine of decentralized infrastructure. Together, they could shape the future of finance in complementary, rather than competitive, ways.

Disclaimer: This article is intended solely for informational purposes and should not be considered trading or investment advice. Nothing herein should be construed as financial, legal, or tax advice. Trading or investing in cryptocurrencies carries a considerable risk of financial loss. Always conduct due diligence.

If you want to read more market analyses like this, visit DeFi Planet and follow us on Twitter, LinkedIn, Facebook, Instagram, and CoinMarketCap Community.

“Take control of your crypto portfolio with Markets PRO, DeFi Planet’s suite of analytics tools.”