Stablecoins have evolved from a niche innovation to a critical pillar of the digital asset economy, bridging the gap between blockchain technology and traditional finance. Today, this sector boasts a total market capitalization of over $241 billion.

No longer just a side note in the crypto world, stablecoins now form a foundational layer for global financial infrastructure, supporting a wide range of use cases, from cross-border payments and decentralized finance (DeFi) to remittances and institutional treasury management. This growth underscores their rising importance, with some experts even predicting a “ChatGPT moment” for blockchain, potentially pushing the stablecoin market to a staggering $3.7 trillion by 2030, as forecasted by Citi.

Dominant Stablecoins and Their Real-World Applications

The stablecoin market cap is valued at approximately $241 billion, dominated by three major examples of stablecoins: Tether (USDT), USD Coin (USDC), and Dai (DAI)—which collectively account for over 90% of the sector’s total market capitalization.

Each of these stablecoins has carved out a distinct role within the broader digital asset ecosystem, reflecting diverse approaches to stability, transparency, and use cases.

Tether (USDT) remains the undisputed leader, commanding approximately 61.73% of the stablecoin market cap. Its widespread adoption can be attributed to its deep liquidity and broad acceptance in high-volume trading pairs on both centralized and decentralized exchanges. USDT is also a preferred medium for cross-border settlements and offshore markets where access to traditional banking is limited.

In 2024 alone, Tether reported a net profit of over $13 billion, largely driven by interest income from its reserves, a significant portion of which is held in U.S. Treasury bills.

USD Coin (USDC), with a market capitalization of approximately $61 billion, stands as the second-largest stablecoin. Co-issued by Circle and supported by Coinbase, USDC is known for its transparency, regulatory compliance, and strict reserve management.

DAI, governed by the MakerDAO protocol, takes a fundamentally different approach by offering a decentralized, over-collateralized stablecoin model. With a market capitalization of over $4 billion, DAI is backed by a diverse pool of crypto assets, including Ethereum and USDC, rather than a single fiat currency. This decentralized design aims to eliminate reliance on centralized custodians, aligning closely with the core principles of permissionless finance.

Together, these three stablecoins not only dominate the market today but also illustrate the dollar’s continued dominance within the stablecoin ecosystem. In fact, stablecoins are expected to remain heavily dollar-denominated well into the future, with recent projections suggesting that 90% of all stablecoins in circulation by 2030 will still be tied to the U.S. dollar, further cementing its role as the world’s reserve currency in digital form. This dominance is also reflected in the broader financial system, as Citibank estimates that stablecoin issuers could hold $1.2 trillion in U.S. government debt by the end of the decade, potentially surpassing all major foreign sovereign holders.

This growing connection between the stablecoin market and U.S. Treasury securities underscores the strategic importance of these digital assets within the global financial architecture.

Related: How U.S. Dollar-Backed Stablecoins Will Reinforce the Dollar’s Dominance in Global Commerce

Regulatory Environment and Global Divergence

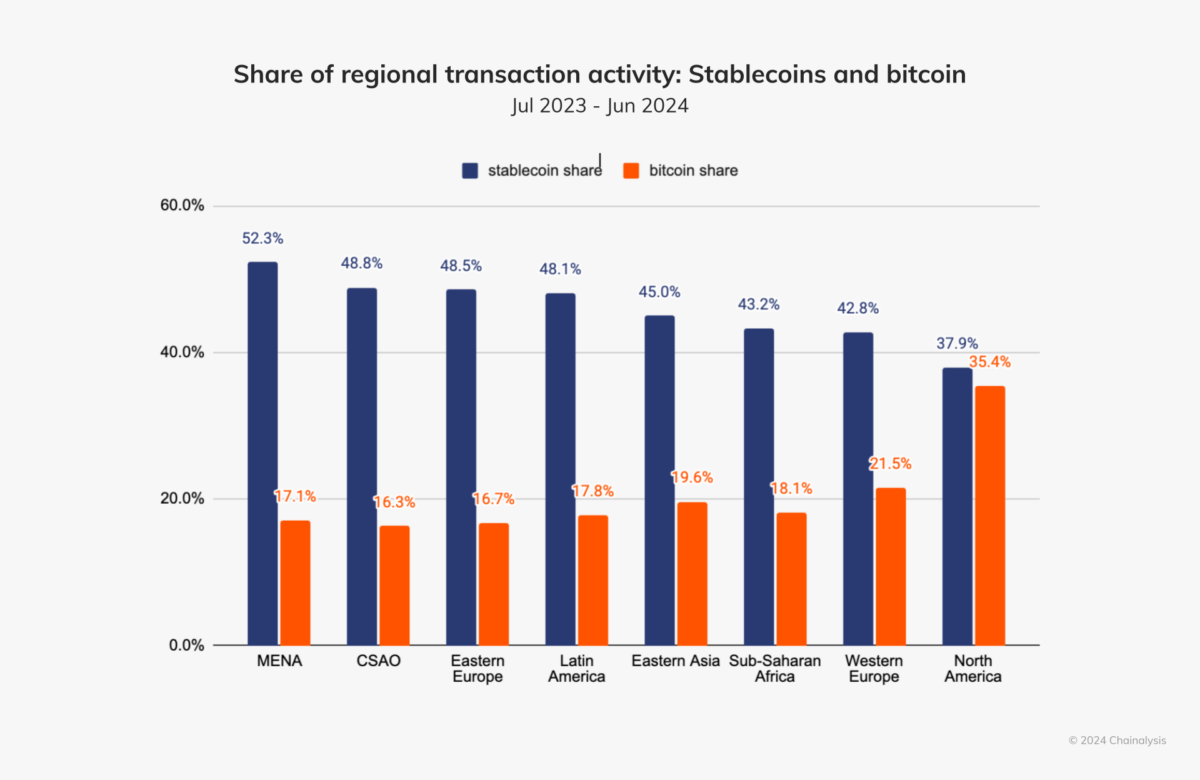

As the stablecoin market matures globally, it is increasingly viewed as a practical financial instrument, often surpassing Bitcoin as the preferred asset for everyday transactions in certain regions. In Latin America and Sub-Saharan Africa, stablecoins have emerged as essential tools for financial stability, offering a lifeline in economies plagued by high inflation, currency devaluation, and restricted access to traditional banking.

These digital assets provide a reliable store of value and a low-cost medium of exchange, supporting a wide range of use cases, from remittances and secure savings to decentralized finance (DeFi) activities like lending and staking. This grassroots stablecoin adoption trend underscores the critical role stablecoins play in promoting financial inclusion, enabling millions to preserve their wealth in volatile economic conditions.

In the United States, stablecoin legislation is becoming a significant point of discussion as regulators grapple with integrating these digital assets into the formal banking system. One notable legislative effort is the proposed GENIUS Act, which aims to establish a comprehensive legal framework for stablecoins, reinforcing the dollar’s dominance in the digital age.

However, progress has been slowed by political tensions, including recent controversies involving President Donald Trump’s reported involvement in cryptocurrency ventures, including the launch of a meme coin and rumoured ties to a new stablecoin. These political dynamics have complicated efforts to pass cohesive stablecoin regulations, highlighting the delicate intersection of financial policy and political manoeuvring in the U.S.

Across the European Union, the focus has shifted towards public-sector digital currencies, particularly the digital euro. EU regulators view privately issued stablecoins with caution, perceiving them as potential threats to monetary sovereignty. As a result, the EU’s regulatory framework emphasizes Central Bank Digital Currencies (CBDCs) that provide similar benefits without ceding control to private issuers. This cautious stance highlights the EU’s preference for tightly regulated financial innovation, aiming to protect the stability of the euro while enabling digital payments.

Together, these regional approaches underscore the broader challenges facing the global stablecoin industry.

Emerging Categories: Algorithmic, Decentralized, and CBDC-Backed Stablecoins

While fiat-backed stablecoins like USDT and USDC continue to dominate the market, new types of stablecoins are emerging, challenging the traditional paradigms of digital currency stability. These innovative models include algorithmic stablecoins, decentralized stablecoins, and central bank digital currencies (CBDCs), each presenting unique benefits and risks.

Algorithmic stablecoins represent a particularly experimental and often volatile sector within the stablecoin ecosystem. Unlike fiat-collateralized tokens, these stablecoins rely on on-chain supply adjustments to maintain their peg to a target value, typically a fiat currency like the U.S. dollar.

Despite their innovative approach, algorithmic stablecoins have faced some serious setbacks. One of the most prominent being TerraUSD (UST), which collapsed in May 2022, leading to widespread financial losses. Despite these high-profile failures, developers in the space have remained undeterred, continually exploring more robust mechanisms that blend programmability with stability.

On the other hand, decentralized stablecoins aim to eliminate the dependence on centralized custodians. Governed by smart contracts and backed by over-collateralized crypto assets (such as Ethereum and USDC), these stablecoins maintain price parity with fiat currencies through decentralized financial mechanisms. However, they are not immune to challenges, including crypto market volatility and governance inefficiencies, which can compromise their stability and decentralized nature..

Governments around the world are increasingly embracing central bank digital currencies (CBDCs) as they recognize the potential of digital money to modernize their financial systems. According to a recent study by the Atlantic Council, a record 134 countries are now actively exploring CBDCs, a significant rise from just 35 countries in May 2020. Countries like China, the European Union, and several emerging markets have moved quickly to develop pilot programs or even fully implement state-backed digital currencies.

The rise of algorithmic, decentralized, and CBDC-backed stablecoins reflects the evolving landscape of the digital economy. While each model presents distinct opportunities and challenges, their collective development underscores the diverse approaches being taken to achieve monetary stability in the crypto space.

Also Read: Can CBCDs Combat Financial Exclusion Better Than Stablecoins?

Offshore Issuers and the Role of Shadow Players

A persistent concern in the stablecoin ecosystem is the outsized role of offshore issuers and shadow financial entities. Many stablecoins operate in jurisdictions with lax regulatory oversight, enabling them to avoid stringent stablecoin compliance requirements. While this allows for greater operational flexibility and access to underserved markets, it also opens the door to opacity and potential misuse.

Stablecoin issuers not subject to rigorous audits or transparency standards can pose systemic risks, especially in times of market stress. There have been recurring concerns around the adequacy and composition of reserves backing certain stablecoins, and these concerns are amplified when issuers are based in loosely regulated territories. Furthermore, offshore stablecoins are more susceptible to being used in illicit finance, money laundering, and evasion of capital controls, issues regulators globally are increasingly eager to address.

As stablecoins become embedded in the financial system, the presence of these shadow actors will remain a significant point of contention and regulatory focus.

Key Risks and Systemic Vulnerabilities

Despite their usefulness, stablecoins are not without flaws. Several risks threaten the long-term stability and integrity of the ecosystem.

- Regulatory uncertainty: The lack of harmonized global standards creates legal ambiguities for users, developers, and institutions. In some regions, stablecoins exist in a regulatory grey zone; in others, they face outright bans or highly restrictive policies. This fragmentation could impede cross-border interoperability and stifle innovation.

- Operational risks: Smart contract bugs, oracle failures, and custody breaches can lead to de-pegging events or financial loss. For decentralized stablecoins, governance issues, such as attacks on voting mechanisms or poorly designed incentive structures, can further destabilize protocols.

- Market risks: Particularly for crypto-collateralized and algorithmic stablecoins, stem from the volatility of underlying assets. Sharp downturns in crypto markets can cause under-collateralization, triggering mass liquidations or loss of peg, as witnessed during past collapses. Also, the concentration of liquidity in a handful of stablecoins, particularly USDT and USDC, introduces concentration risk. If either of these stablecoins were to face legal or operational crises, the ripple effects could destabilize the broader crypto market and DeFi protocols that depend on them.

The Road Ahead: Stablecoins and the Future of Finance

Looking forward, stablecoins are expected to play an increasingly central role in mainstream finance. Depending on the pace of regulation and institutional adoption. This potential “ChatGPT moment” for stablecoins signals a tipping point where their benefits become widely embraced beyond the crypto-native world.

One key driver of this growth will be institutional integration. Traditional finance is already experimenting with tokenized money market funds, as seen in initiatives by BlackRock and Franklin Templeton, which aim to tokenize short-term securities and offer liquidity on-chain. These moves blur the lines between traditional finance and decentralized infrastructure, with stablecoins acting as the bridge.

Payment giants like Visa and Mastercard are building infrastructure to facilitate stablecoin transactions across wallets, point-of-sale systems, and e-commerce platforms, hinting at a future where stablecoins are used not only for trading and savings but also for everyday purchases and global payments.

Finally, as stablecoin issuers become major holders of U.S. Treasuries, their influence on macroeconomic stability and monetary policy may increase. Some analysts suggest that stablecoin reserves could one day rival those of major sovereign wealth funds or even foreign central banks. This trend would cement their importance in the financial hierarchy.

Disclaimer: This piece is intended solely for informational purposes and should not be considered trading or investment advice. Nothing herein should be construed as financial, legal, or tax advice. Trading or investing in cryptocurrencies carries a considerable risk of financial loss. Always conduct due diligence.

If you would like to read more articles like this, visit DeFi Planet and follow us on Twitter, LinkedIn, Facebook, Instagram, and CoinMarketCap Community.

Take control of your crypto portfolio with MARKETS PRO, DeFi Planet’s suite of analytics tools.”