Last updated on September 7th, 2025 at 10:14 pm

GCC countries such as the United Arab Emirates (UAE) and Bahrain have jumped out of the blocks with progressive crypto regulations, attracting global talent, investments, and cutting-edge blockchain projects. Meanwhile, Saudi Arabia, the region’s economic heavyweight, seems to be hesitating, potentially losing ground in this digital sprint.

This piece examines whether Saudi Arabia is falling behind due to the lack of unified GCC regulations, exploring the economic, technological, and strategic implications of its cautious approach.

Regulatory Fragmentation in the GCC – Understanding the Current Landscape

What is the main purpose of GCC? The Gulf Cooperation Council (GCC), comprising Saudi Arabia, the UAE, Bahrain, Kuwait, Oman, and Qatar, was established to foster economic, political, and security cooperation among its member states. However, when it comes to cryptocurrency regulation, the GCC lacks a unified framework, leading to fragmented policies across the region.

While the UAE has emerged as a global crypto hub, thanks to its clear legal framework and supportive regulatory environment, Saudi Arabia has taken a more conservative stance. This cautious approach contrasts sharply with the UAE’s proactive stance, which has resulted in significant economic benefits. For instance, between July 2023 and June 2024, the UAE received over $30 billion in crypto, making it the third-largest crypto economy in the Middle East and North Africa (MENA) region and placing it among the top 40 global crypto economies.

Prominent Saudi economist Ihsan Buhulaiga, a former member of the Shura Council, recently emphasized the need for unified GCC cryptocurrency regulations. He warned that without coordinated policies, cryptocurrency traders might relocate their investments to more favourable environments like the UAE or Bahrain, where regulatory clarity and tax incentives are more attractive.

For instance, Dubai’s clear legal framework, zero capital gains tax, and competitive 9% corporate tax rate have contributed to its ranking as the top global crypto business hub for 2024, according to a report by Social Capital Markets (SCM).

Is Saudi Arabia Crypto Friendly?

Saudi Arabia, on the other hand, lacks specific legislation governing cryptocurrencies. Is it legal to trade crypto in Saudi Arabia? Currently, the Saudi Central Bank (SAMA) has issued multiple warnings against digital assets, reflecting the Kingdom’s cautious stance. While it is not explicitly illegal to trade crypto in Saudi Arabia, the absence of a comprehensive regulatory framework creates uncertainty for both investors and businesses. This fragmented approach could hinder Saudi Arabia’s ability to attract blockchain startups and crypto-focused investments, potentially ceding ground to its more innovative neighbors.

Economic Impact of a Unified Crypto Framework – Boosting Investment and Innovation

A unified GCC crypto framework could significantly boost investment and innovation across the GCC countries. The UAE’s proactive approach has already attracted numerous blockchain startups, crypto exchanges, and digital asset firms. For example, Dubai’s VARA has established itself as a leader in virtual asset regulation, promoting transparency and investor protection while reducing the risks of financial crime. This has made the UAE a preferred destination for global crypto firms.

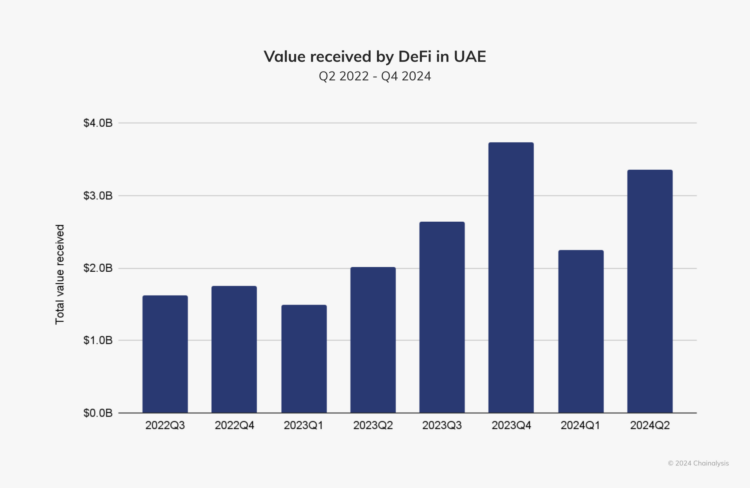

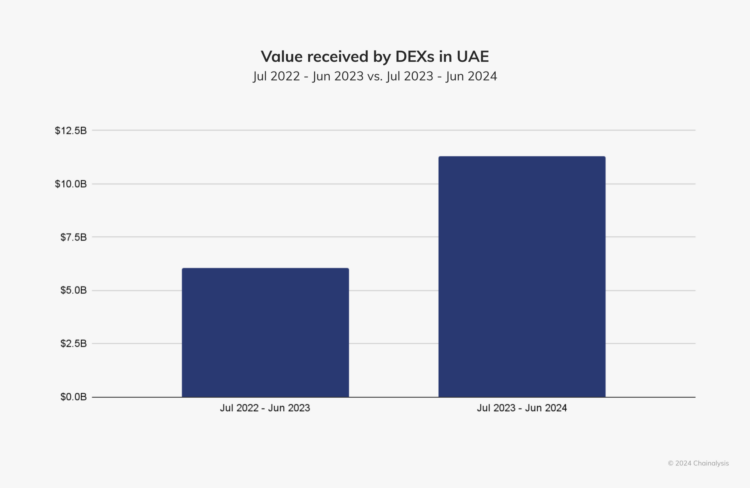

Additionally, the UAE’s progressive stance on decentralized finance (DeFi) has contributed to a 74% growth in total DeFi value received in 2024, with decentralized exchanges (DEXs) alone seeing an 87% increase, from $6 billion to $11.3 billion in 2023.

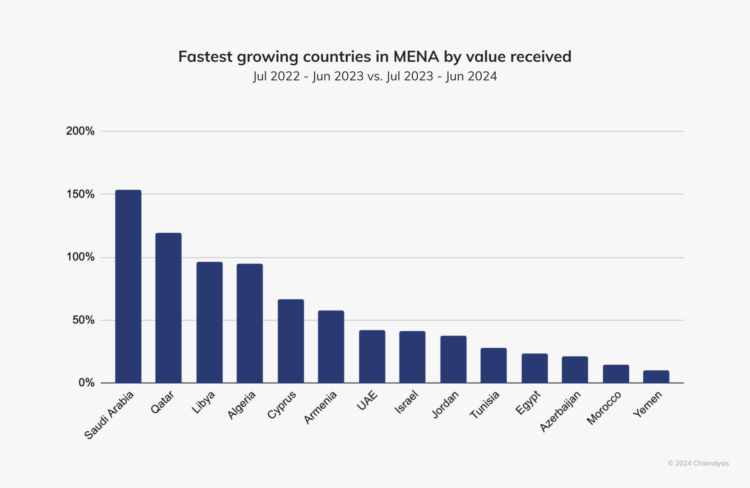

In contrast, Saudi Arabia, despite being the fastest-growing crypto economy in the Middle East and North Africa (MENA) region with a remarkable 154% year-over-year growth, risks being left behind without a unified regulatory approach.

This rapid growth is driven by the Kingdom’s increasing interest in blockchain innovation, central bank digital currencies (CBDCs), gaming, and fintech innovation. However, without clear and comprehensive regulations, Saudi Arabia might struggle to attract the next wave of digital finance pioneers.

Critically, Saudi Arabia’s young, tech-savvy population presents a significant opportunity. The Kingdom’s population is not only eager to adopt emerging technologies but also well-positioned to drive innovation in the digital finance sector. This demographic advantage can be a powerful catalyst for the country’s digital transformation, fostering a new generation of crypto entrepreneurs and blockchain developers.

Moreover, Saudi Arabia’s Vision 2030 plan, which aims to empower citizens, attract global investment, and create a vibrant, diversified economy, aligns perfectly with the growth potential of the digital asset market. The global digital coin market, projected to grow at a compound annual growth rate (CAGR) of 15.20% from 2024 to 2031, presents a massive opportunity for the Kingdom to establish itself as a leader in this space. However, without a unified regulatory framework, Saudi Arabia risks missing out on significant economic gains, as investors and innovators may opt for more predictable and supportive markets, such as the UAE and Bahrain.

Ultimately, if Saudi Arabia aims to remain competitive in the rapidly evolving digital economy, it must move beyond its cautious stance and embrace a unified, forward-looking crypto framework that fosters innovation, attracts global investment, and nurtures homegrown talent.

Lessons from the UAE and Bahrain – Its Gulf Neighbours

Saudi Arabia can draw valuable lessons from the UAE and Bahrain, both of which have developed robust regulatory frameworks to support the growth of their crypto sectors. These two GCC countries have adopted a progressive approach, focusing on innovation, compliance, and international competitiveness, which Saudi Arabia can emulate to strengthen its position in the crypto market.

Bahrain was an early mover in crypto regulation within the GCC, introducing its Crypto-Asset Module in 2019 through the Central Bank of Bahrain (CBB). This framework covers licensing, trading, supervision, and custody of digital assets. It sets clear guidelines for Virtual Asset Service Providers (VASPs) on issues like Anti-Money Laundering (AML) and Combating the Financing of Terrorism (CFT), ensuring high standards of transparency and consumer protection. The CBB’s approach has attracted major global players like Binance, which obtained a Category 4 license in 2022, allowing it to operate as a fully regulated crypto-asset service provider in Bahrain.

The UAE has implemented both federal and emirate-specific regulations, including the Federal Decree-Law No. (20) of 2018 and Cabinet Resolution No. (24) of 2022, which have been critical in shaping the country’s virtual asset market. These laws establish strict customer due diligence, risk assessment, and transaction monitoring requirements, creating a secure environment for digital asset businesses. For example, the UAE’s Securities and Commodities Authority (SCA) regulates digital asset offerings and trading. At the same time, the Abu Dhabi Global Market (ADGM) and Dubai International Financial Centre (DIFC) have developed their own tailored crypto regulations to attract global fintech firms.

Also Read: Cryptocurrency Salaries and UAE’s Ambitions of Leading The Digital Economy Revolution

Balancing Security and Innovation – Addressing Risks While Encouraging Growth

Balancing security and innovation is a critical challenge for Saudi Arabia. While concerns about financial stability, money laundering, and terrorist financing are valid, an overly cautious approach may stifle innovation. Saudi Arabia’s religious and cultural sensitivities also play a role, as Islamic financial principles emphasize transparency and fairness, potentially conflicting with the speculative nature of cryptocurrencies.

However, the UAE and Bahrain have demonstrated that we must balance innovation and regulation for crypto to really thrive. Their regulatory frameworks emphasize both security and innovation, creating environments where digital asset businesses can thrive while minimizing financial crime risks. Saudi Arabia can adopt a similar approach.

Conclusion – The Path Forward for Saudi Arabia

As the world races toward a digital financial future, Saudi Arabia can either seize the moment, positioning itself as a regional powerhouse in the blockchain and crypto sectors, or risk being left behind as its GCC neighbours, like the UAE and Bahrain, sprint ahead with supportive regulations and thriving digital economies.

To stay competitive, Saudi Arabia needs more than just cautious observation—it requires a bold, forward-thinking approach that aligns with its Vision 2030 goals of economic diversification and global leadership. A unified GCC crypto framework could be a game-changer, reducing regulatory fragmentation, attracting foreign investment, and fostering homegrown innovation. This isn’t just about keeping pace with regional rivals; it’s about creating an environment where Saudi startups, developers, and digital finance entrepreneurs can thrive.

By collaborating on common standards for digital assets, the Kingdom can enhance investor confidence, reduce compliance hurdles, and ensure its young, tech-savvy population has the tools to shape the next wave of financial innovation. In a world increasingly defined by digital assets, Saudi Arabia’s choice is clear: lead, innovate, and grow, or risk being overshadowed by more agile and ambitious economies within the GCC.

Disclaimer: This article is intended solely for informational purposes and should not be considered trading or investment advice. Nothing herein should be construed as financial, legal, or tax advice. Trading or investing in cryptocurrencies carries a considerable risk of financial loss. Always conduct due diligence.

If you want to read more market analyses like this one, visit DeFi Planet and follow us on Twitter, LinkedIn, Facebook, Instagram, and CoinMarketCap Community.

Take control of your crypto portfolio with MARKETS PRO, DeFi Planet’s suite of analytics tools.”