Canada’s financial system has long been considered a model of stability, but beneath the surface, frustration is building. According to Coinbase’s Canadian country director, Lucas Matheson, 86% of Canadians believe their financial system could use an update, 80% see it as fundamentally unfair, and 76% feel it’s in urgent need of modernization. This isn’t just a fleeting sentiment – it signals a deep-rooted dissatisfaction with a system struggling to keep pace in a rapidly digitizing world.

With calls for transparency, faster transactions, and lower fees growing louder, the question arises: could cryptocurrency be the answer? Let’s break it down.

Poll Results and Financial Dissatisfaction

The numbers are telling. An estimated five million Canadians already own cryptocurrency, reflecting a significant appetite for alternatives to traditional finance. This isn’t surprising given that Canada’s stance on cryptocurrency has evolved substantially, with increasing interest in digital assets and growing debates about how to regulate the Canadian crypto market growth effectively. Coinbase’s Canadian country director, Lucas Matheson, recently warned that without swift regulatory action, Canada risks becoming less integrated into the global digital economy, potentially stifling innovation and limiting financial options for its citizens.

The growing appetite for change isn’t just about chasing profits or jumping on the latest tech trend, it’s about fairness, accessibility, and financial empowerment. For many Canadians, the traditional financial system feels like an exclusive club, designed to benefit the few while placing unnecessary burdens on the majority. High fees, slow processing times, and strict eligibility requirements are just a few of the challenges that leave millions underserved. This frustration is particularly acute for those relying on costly remittance services or living in rural areas with limited access to physical banking infrastructure. For them, cryptocurrency adoption in Canada offers not just an investment opportunity but a chance to bypass these roadblocks and participate fully in the digital economy.

How Crypto Aligns with Reform Demands

As Canada pushes for digital transformation across various sectors, cryptocurrency fits seamlessly into this broader modernization strategy. The rise of digital wallets, blockchain-based identity systems, and tokenized assets aligns closely with the government’s push for a more connected, data-driven economy. This makes crypto not just a financial tool but a crucial component of Canada’s digital future.

In short, the rise of crypto in Canada isn’t just about speculative trading or tech enthusiasm. It reflects a deeper, more fundamental shift in how people want to manage and move their money. For a country looking to modernize its financial landscape, this could be the disruptive force that finally breaks the mould.

If there’s one thing Canadians have made clear, it’s that they want their financial system to evolve. The current system, marked by high fees, slow processing times, and limited transparency, feels increasingly outdated in a world driven by digital innovation. So, where does crypto fit into this demand for reform?

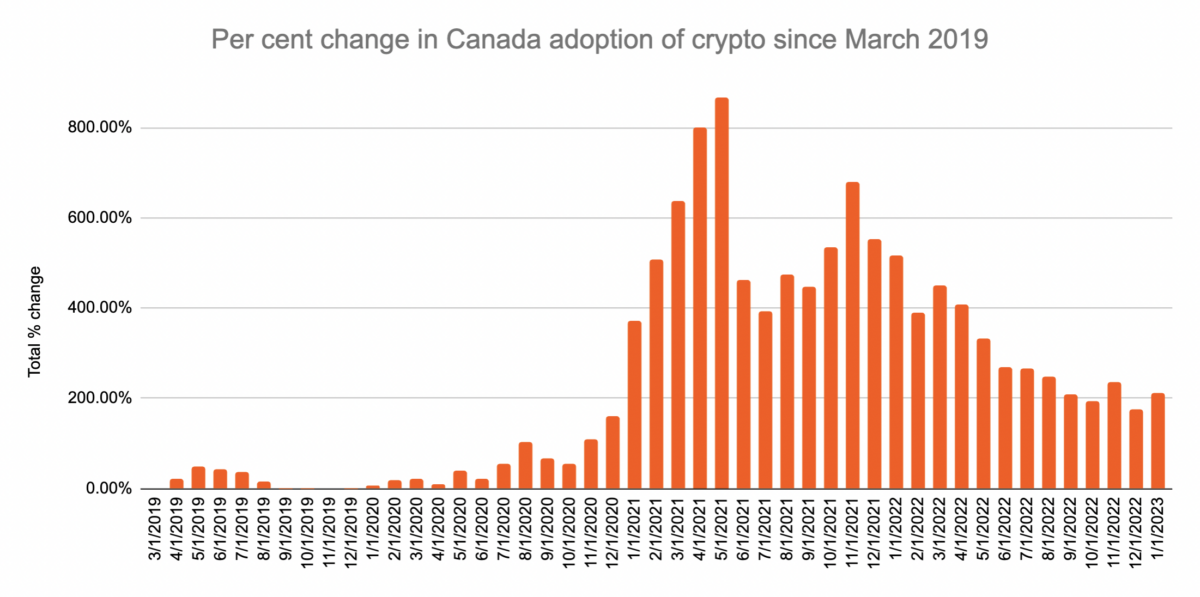

To begin with, the numbers tell a compelling story. According to Chainalysis, Canada has seen a steady rise in crypto adoption in Canada, moving from 26th in the Global Crypto Adoption Index in 2021 to 22nd in 2022, and climbing further since then. This isn’t just a minor shift, it reflects a growing appetite for alternatives to traditional banking. Canadian engagement with crypto ATMs, decentralized exchanges, and centralized platforms surged nearly 213% between 2019 and early 2023, driven largely by interest in DeFi, a sector that promises financial autonomy without the bureaucratic overhead.

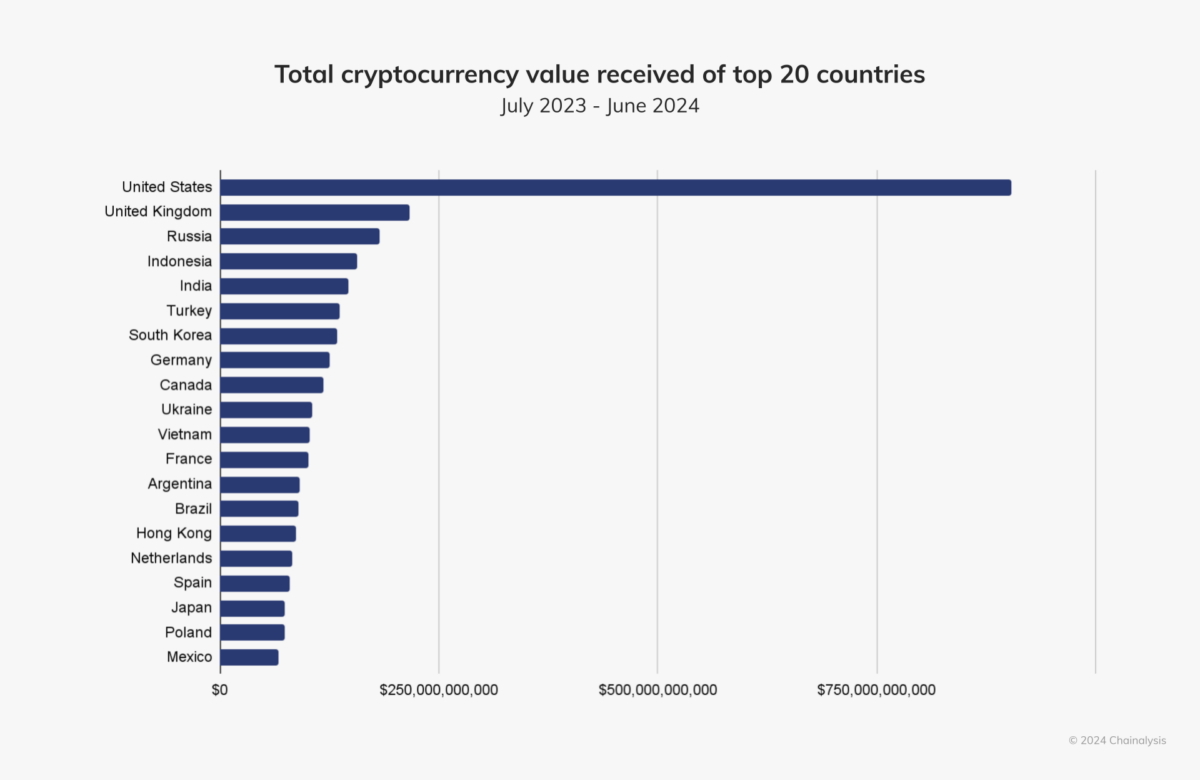

North America as a whole remains a powerhouse in the global crypto scene, receiving roughly $1.3 trillion in on-chain value between July 2023 and June 2024, accounting for about 22.5% of global activity. Canada plays a significant role in this market, receiving approximately $119 billion in value over the same period, although smaller than its U.S. counterpart.

This is a clear sign that Canadians are not just curious about crypto—they are actively engaging with it as a financial alternative.

What makes this shift even more interesting is how closely it aligns with the reforms Canadians are calling for. Cryptocurrencies address many of the pain points that frustrate users in the traditional banking system. For instance, their decentralized nature cuts out the middlemen, reducing transaction fees and speeding up processing times. In a world where bank transfers can still take days, crypto networks offer near-instant settlement, 24/7 availability, and borderless transactions.

Additionally, smart contracts hold the potential to eliminate costly intermediaries in everything from real estate deals to complex financial derivatives. These contracts are trustless, automated, and tamper-proof, offering a level of transparency and efficiency that traditional financial systems struggle to match.

In short, the rise of crypto in Canada isn’t just about speculative trading or tech enthusiasm. It reflects a deeper, more fundamental shift in how people want to manage and move their money. For a country looking to modernize its financial landscape, this could be the disruptive force that finally breaks the mould.

Barriers to Adoption: Trust, Education, and Regulation

Despite the buzz surrounding crypto and its potential to transform finance, mainstream adoption in Canada still faces significant hurdles. If the promise of a decentralized financial future is to be realized, these barriers must be addressed head-on. They can broadly be grouped into three main challenges: trust, education, and regulation.

Trust and Perception

When it comes to money, trust is everything. Yet, cryptocurrencies often struggle to inspire confidence, and for good reason. One of the biggest stumbling blocks is their notorious volatility. For many, this unpredictability makes crypto feel like a high-stakes gamble rather than a reliable store of value.

Related: Does Cryptocurrency Encourage a Gambling Mentality in Investments?

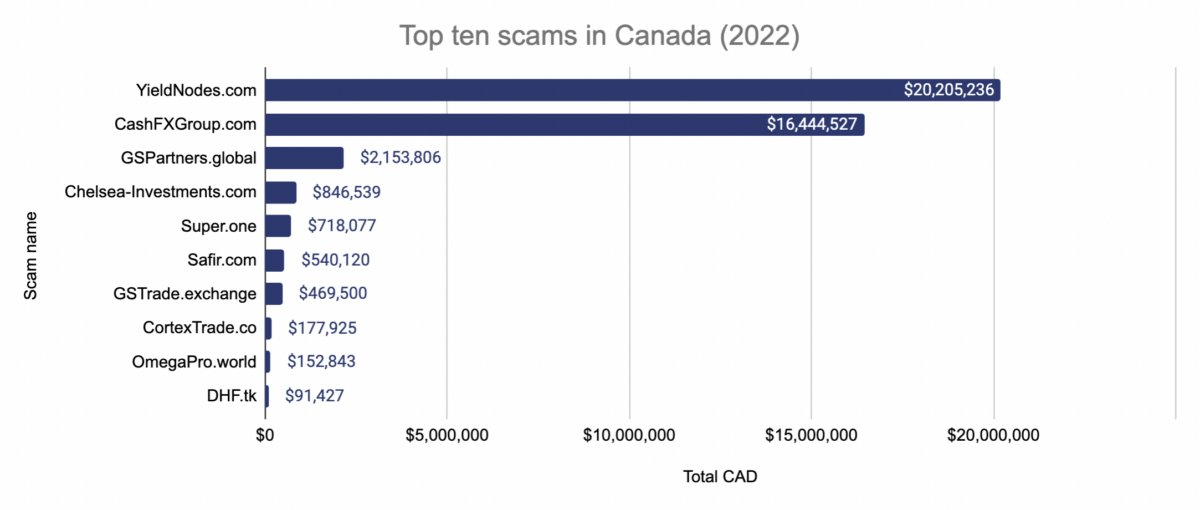

Then there’s the darker side of digital assets – their potential misuse for illicit activities. Despite the transparency promised by blockchain technology, cryptocurrencies have occasionally been exploited for fraud and money laundering. In 2022 alone, Canadians faced an average exposure of approximately $1,144 CAD to illicit crypto activities for every 1,000 citizens. Over the same period, this misuse collectively accounted for more than $41.7 million CAD across Canada, highlighting the ongoing challenges of securing the digital finance space.

This echoes broader concerns about the impact of scams on crypto’s reputation. These concerns create a trust gap that the industry must address if it hopes to gain mainstream acceptance.

Education and Awareness

Knowledge is power, but when it comes to crypto, it’s also a barrier. A significant portion of the Canadian public still lacks a clear understanding of blockchain technology and its benefits. According to Statistics Canada, only 0.3% of Canadian businesses utilised blockchain in 2021, underscoring the steep learning curve that stands between the average consumer and their first cryptocurrency transaction.

Misinformation is another major obstacle. Scams are rampant, and without proper education, newcomers are more likely to fall victim to too-good-to-be-true investment schemes. This not only erodes trust but also adds to the already complex reputation that crypto has among the general public.

Moreover, the technology itself can feel daunting. Unlike the familiar, user-friendly interfaces of traditional banking apps, managing digital assets often requires a higher level of digital literacy. This complexity can deter even the most enthusiastic would-be adopters. For financial advisors, this gap in understanding presents both a challenge and an opportunity, as highlighted in the article ‘Why Ignoring Crypto is No Longer an Option for Financial Advisors.’ With the right guidance, they can play a critical role in bridging this knowledge gap, helping clients navigate the evolving world of digital assets and make informed investment decisions.

Regulatory Uncertainty

Finally, there’s the regulatory elephant in the room. Canada crypto regulation remains a key concern, as policymakers grapple with how to balance innovation with consumer protection. Canada’s approach to crypto regulation has been cautious and sometimes fragmented. For instance, the Canadian Securities Regulators (CIRO) recently tightened rules by excluding crypto funds from reduced margin eligibility, citing their high volatility and liquidity risks. Moves like these make leveraged trading more expensive and signal a generally wary stance toward the sector.

In contrast to the clearer, though sometimes controversial, frameworks in the United States, Canada’s patchwork approach creates uncertainty for businesses and investors alike. This lack of regulatory clarity can stifle innovation and slow adoption.

However, there are calls for reform. Companies like Coinbase are advocating for a more supportive regulatory environment, including the establishment of a government-led cryptocurrency task force, the creation of a Bitcoin reserve, and federal regulations for stablecoins. Such measures could provide the much-needed clarity and confidence for the industry to thrive while also protecting consumers.

Final Thoughts: A Critical Crossroads for Canada’s Financial Future

Canada stands at a critical financial crossroads, with the choices it makes today set to shape its economic landscape for decades to come. The potential for innovation is immense, but without clear regulations, public trust, and widespread understanding, this promise risks fading into a missed opportunity.

The demand for financial reform is clear. Canadians want faster transactions, lower fees, and greater transparency – precisely the advantages that cryptocurrencies offer.

But the road ahead isn’t without its challenges. For crypto to move from the fringes to the financial mainstream, it must overcome critical barriers: trust, education, and regulation. These aren’t small hurdles. Building confidence in digital assets, demystifying blockchain technology, and creating a supportive yet secure regulatory framework will be essential.

As Canadians push for a financial system that better serves their needs, the question isn’t just whether crypto can rise to the occasion – it’s whether the country is ready to embrace this digital revolution. One thing is certain: the time for decision is now.

Disclaimer: This article is intended solely for informational purposes and should not be considered trading or investment advice. Nothing herein should be construed as financial, legal, or tax advice. Trading or investing in cryptocurrencies carries a considerable risk of financial loss. Always conduct due diligence.

If you want to read more market analyses like this one, visit DeFi Planet and follow us on Twitter, LinkedIn, Facebook, Instagram, and CoinMarketCap Community.

Take control of your crypto portfolio with MARKETS PRO, DeFi Planet’s suite of analytics tools.”