Last updated on July 28th, 2025 at 04:23 pm

As the cryptocurrency market evolves, artificial intelligence (AI) is becoming an increasingly dominant force in shaping trading strategies. From high-frequency AI trading bots to algorithmic crypto trading systems that scan thousands of data points in milliseconds, AI is transforming how trades are executed and who (or what) profits. But is AI the future of crypto, enhancing the market, or a disruptive force endangering its stability?

The Rise of AI-Powered Trading Bots

AI crypto trading has surged in popularity, particularly within the crypto space, where 24/7 markets and extreme volatility create ideal conditions for automation. AI trading bots can analyze vast datasets, identify patterns, and execute trades in milliseconds — capabilities far beyond what human traders can manage.

Platforms like 3Commas, Pionex, and Kryll provide accessible bot frameworks for retail investors, while institutional players utilise proprietary systems. The global algorithmic trading market is experiencing significant growth, projected to reach $42.99 billion by 2030, with a compound annual growth rate (CAGR) of 12.9% from 2025 to 2030.

This surge is largely attributed to the increasing adoption of AI and machine learning technologies, which enable traders to develop sophisticated algorithms capable of analyzing massive datasets in real time.

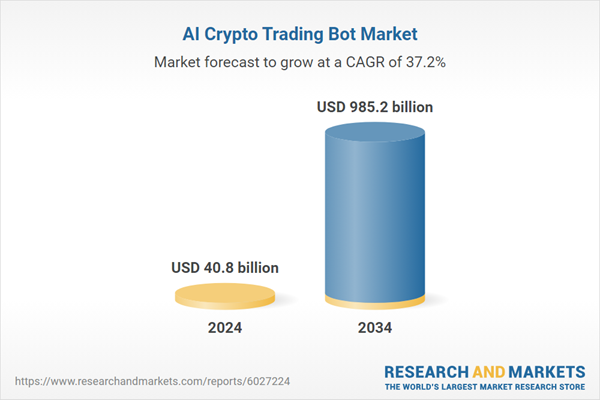

Even more striking is the projected expansion of the AI crypto trading bot market specifically. Valued at USD 40.8 billion in 2024, this segment is expected to grow at a staggering 37.2% CAGR, reaching an estimated USD 985.2 billion by 2034.

These numbers highlight the scale of automation being infused into crypto and pose the question again: Can AI be used for crypto trading to strengthen market dynamics, or does it threaten to destabilize them?

Enter the Agentic Era: AI Wallets, Onchain Autonomy & Exploding Market Caps

We’re now entering what some call the Agentic AI era. In December 2024, VanEck reported that approximately 10,000 AI agents were operating within Web3, and that number is expected to cross 1 million by the end of 2025.

These agents, autonomous by design, already generate millions of dollars weekly via on-chain activities.

Coinbase Ventures predicts that soon, AI agents will not only manage crypto portfolios but also own crypto wallets, autonomously transact, and pay humans or other agents using stablecoins to complete tasks — all in pursuit of fulfilling their algorithmic objectives.

The Pros of AI in Crypto: Efficiency, Speed, and 24/7 Market Mastery

One of the most compelling arguments in favour of AI-driven trading in the crypto market is the remarkable combination of efficiency, speed, and round-the-clock functionality it brings to the table.

Unlike human traders, who are prone to emotional decisions influenced by fear, greed, or fatigue, AI operates purely on logic and data. This emotional detachment is one of AI’s greatest strengths — it eliminates the psychological pitfalls that often lead traders to make impulsive or irrational moves. Whether the market is surging or crashing, AI sticks to the strategy, ensuring a level of discipline and consistency that’s difficult for most humans to maintain.

Speed is another significant edge. In a market where prices can swing dramatically in seconds, being able to execute trades in milliseconds can mean the difference between profit and loss. AI bots are designed to detect and respond to market signals almost instantaneously. They can scan multiple exchanges, track token prices, monitor order books, and execute trades faster than any human, all without hesitation.

Then there’s the advantage of availability. Unlike traditional stock markets, which shut down at the end of the trading day, cryptocurrency markets never sleep. They run 24/7, across all time zones. AI fits perfectly into this non-stop environment, tirelessly analyzing data and making decisions around the clock without the need for rest, weekends off, or coffee breaks.

Beyond these core advantages, AI also empowers traders with access to advanced strategies. For instance, arbitrage bots can monitor decentralized exchanges (DEXs) for price discrepancies and act instantly to exploit them. AI systems equipped with natural language processing can perform sentiment analysis by scanning news sites, Reddit threads, or crypto Twitter in real-time, gauging market mood and adjusting trades accordingly. Some algorithms are even capable of learning from evolving conditions, becoming more refined with each cycle of data they process.

Many now wonder: Is AI the future of crypto? If the goal is speed, data accuracy, and continuous operation, then the answer might be yes.

The Dark Side of AI Trading: Flash Crashes and Black Box Models

While AI trading offers unprecedented speed, efficiency, and data analysis capabilities, it also introduces serious risks, chief among them are flash crashes and a troubling lack of transparency in decision-making. These issues are deeply interconnected and pose significant threats to both traditional and decentralized financial systems.

Flash crashes are rapid, steep declines in asset prices that can occur within seconds, often triggered by AI algorithms responding to abrupt market shifts. These algorithms may execute large-scale sell-offs, which can create a domino effect across the market. Because multiple AI systems often act on the same data cues simultaneously, their actions can reinforce one another, amplifying market volatility rather than reducing it. In DeFi, the absence of centralized safeguards such as circuit breakers makes the impact even more severe, disrupting liquidity and investor confidence.

Compounding the problem is the use of black-box models—advanced neural networks whose inner workings are not easily understood by humans. These models make decisions that may be statistically sound but are difficult to interpret, complicating efforts to audit or regulate AI-driven trades. When something goes wrong—like an AI-induced flash crash—determining who is accountable becomes unclear: is it the developer, the user, or the algorithm itself? As more traders ask, Can AI be used for crypto trading responsibly, it becomes clear that human oversight and auditability are non-negotiable.

Balancing the power of AI with the need for transparency is no small task. Scholars like Professor Michael Osborne of Oxford have called for greater openness in AI systems. Without it, the very technologies meant to optimise financial markets could instead destabilize them.

Trust, it turns out, is still fragile. A CoinGecko report surveying 2,632 crypto users found that:

- 87% were willing to let AI manage at least 10% of their portfolios

- 36% would entrust AI with most of their holdings

- 1 in 7 would hand over their entire stash

Yet 37.5% said they don’t trust AI with their wallets, and 13% flatly rejected AI management, citing self-confidence or discomfort with surrendering control.

The message is clear: if we’re to embrace AI in trading, we must do so responsibly—with robust oversight, clear accountability, and systems that are as transparent as they are powerful.

Together, these issues underscore the urgent need for greater oversight, transparency, and responsibility in the development and deployment of AI trading systems. Without them, the very tools designed to optimize markets could become the source of their greatest instability.

Can AI Improve Market Liquidity and Risk Management?

Despite its challenges, AI holds significant promise for enhancing market liquidity and strengthening risk management, particularly when implemented with care and accountability. One of its most valuable contributions lies in its ability to efficiently place bid and ask orders, helping to reduce spreads and boost liquidity across trading platforms. Additionally, AI systems can monitor market activity in real time, detecting unusual patterns or potential exploits as they emerge—an essential capability in the fast-paced and often unpredictable world of crypto.

AI also supports dynamic risk management by adjusting trading exposure in response to current market trends or sentiment analysis. This adaptability allows traders and institutions to respond more effectively to sudden shifts in market conditions. Already, platforms like dYdX and Uniswap V4 are leveraging AI to power real-time analytics and optimize automated market making (AMM), showing how AI can be a strategic asset in decentralized finance.

Large institutions are also harnessing AI to build more resilient portfolios. A notable example is BlackRock, which uses AI-driven models to manage risk across its extensive holdings, including products with cryptocurrency exposure. Similarly, XTX Markets, a leading algorithmic trading firm, leverages advanced AI and machine learning technologies to process vast amounts of market data.

As of 2024, the firm handles approximately $250 billion in daily trading volume across various markets, ranging from currencies and equities to commodities and cryptocurrencies. This remarkable capacity is underpinned by a powerful infrastructure of over 25,000 AI chips, primarily sourced from Nvidia, making XTX one of the chipmaker’s largest corporate clients. This scale of deployment highlights the growing reliance on AI, not just for speed but for stability and liquidity provision in complex markets.

The Role of Human Traders in an AI-Driven Future

Will AI make human traders obsolete? Not quite.

While AI excels at crunching numbers, spotting patterns, and executing trades at lightning speed, it still falls short in areas where human insight truly shines — like contextual judgment, ethical reasoning, and emotional intelligence. These are the intangibles that machines can’t replicate, at least not yet.

Moreover, AI systems are only as reliable as the data they’re trained on. Feed them biased, incomplete, or outdated information, and they can produce flawed or even dangerous outcomes.

In this vision of the future, AI crypto trading is not about replacing people, but augmenting them. That’s why the question isn’t just “Is AI the future of crypto?“ but rather, how do we shape that future in a way that benefits everyone?

Final Thoughts: Innovation or Instability?

AI in crypto trading is not inherently good or bad — it’s a tool. Whether it becomes the future of innovation or a threat to stability depends on how it’s regulated, monitored, and integrated into the broader financial ecosystem.

To harness AI’s benefits while minimizing its dangers, stakeholders must focus on transparency, ethical design, robust risk controls, and human oversight.

Because in the fast-moving world of crypto, the only constant is change, and how well we prepare for it.

Disclaimer: This article is intended solely for informational purposes and should not be considered trading or investment advice. Nothing herein should be construed as financial, legal, or tax advice. Trading or investing in cryptocurrencies carries a considerable risk of financial loss. Always conduct due diligence.

If you want to read more market analyses like this one, visit DeFi Planet and follow us on Twitter, LinkedIn, Facebook, Instagram, and CoinMarketCap Community.