Imagine a world where every financial move—every payment, transfer, and purchase—is recorded and monitored. That’s not a distant dystopia; it’s rapidly becoming the norm. And as governments escalate their crackdown on crypto privacy tools, a critical question emerges: Is this about combating crime, or is it about controlling how we transact?

At the heart of this debate are crypto mixers, tools designed to obscure transaction trails on public blockchains. Once seen as privacy-preserving instruments, they’re now under intense scrutiny. Regulators argue that mixers help criminals launder money and evade sanctions. Privacy advocates say they offer protection in an era of growing financial surveillance. The controversial case of Tornado Cash—a decentralized mixer sanctioned by the U.S. Treasury—illustrates the escalating conflict.

This raises a deeper issue: Do bans on crypto mixers signal a necessary move to fight illicit activity, or are they the beginning of a broader erosion of financial privacy?

What Are Crypto Mixers?

Crypto mixers blend cryptocurrency transactions to make it difficult to trace the origin and destination of funds. They collect deposits from multiple users, mix them, and send back equivalent amounts to new addresses. The result is anonymity.

Techniques vary—from smart contracts and chain hopping to Tor-based routing—but the goal remains the same: break the traceability that defines public blockchains. Tools like Tornado Cash brought this process into mainstream crypto privacy. But they also attracted the attention of regulators.

READ MORE: What Are Crypto Mixers? – A Comprehensive Overview of Tornado Cash

Why Regulators Want Them Gone

The regulatory response to mixers varies from region to region, but a hardening stance is evident in several major jurisdictions.

The U.S. leads the charge in mixer crackdowns. In addition to sanctioning Tornado Cash, Congress introduced the Blockchain Integrity Act, which proposes a two-year ban on mixers. Violations could result in fines of up to $100,000. This suggests the U.S. is committed to rooting out mixer usage—at least for now.

Japan has also implemented stringent measures on cryptocurrency transactions, including laws that effectively ban the use of crypto mixers to combat money laundering. The country’s Financial Services Agency (FSA) has taken a firm stance against privacy tools that offer anonymity, introducing a comprehensive ban on cryptocurrencies that provide sufficient levels of privacy or conceal transaction details.

The European Union (EU) has adopted strict Anti-Money Laundering (AML) rules that target anonymous crypto transactions. While not outright banning mixers, these rules make it difficult for any privacy tool to remain compliant. The Markets in Crypto-Assets (MiCA) regulation also includes provisions that could limit mixer usage.

Authorities argue that mixers enable bad actors to launder money, evade sanctions, and commit cybercrime with impunity. Here are the core concerns raised by regulators:

1. Money Laundering

The most common regulatory complaint is that mixers are used to clean “dirty” crypto—funds obtained through hacks, scams, or illegal trade. A key example is Tornado Cash. In 2022, the U.S. Department of the Treasury sanctioned the protocol, claiming it helped launder over $7 billion, including funds linked to North Korea’s Lazarus Group.

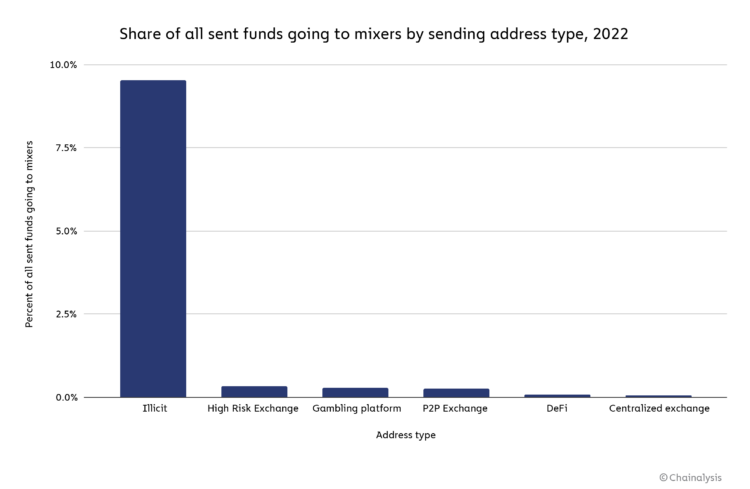

However, the reality is more nuanced. Not all mixer activity is criminal. Chainalysis reported that while Tornado Cash processed $7.6 billion in ETH between 2019 and 2022, only about 28.2% came from illicit sources. The vast majority of users may have simply been seeking privacy.

2. Obstruction of Criminal Investigations

By anonymizing transaction trails, mixers make it more difficult for law enforcement to follow the money. The case of Larry Dean Harmon, operator of the Helix mixer, is frequently cited. Harmon was sentenced to three years in prison for laundering over $300 million, much of it connected to darknet markets.

3. Sanctions Evasion

Perhaps the most politically sensitive use of mixers is their role in sanctions evasion. U.S. officials claim that Tornado Cash was used by sanctioned entities, including state-sponsored hackers, to move funds undetected. In one of the strongest public statements on this issue, U.S. Congressman Sean Casten argued that “half of North Korea’s nuclear program is funded through cryptocurrency theft made possible by mixers.”

From the government’s point of view, mixers are a serious national security threat. These examples feed the regulatory narrative, but they don’t tell the whole story.

The Privacy vs. Security Debate

Given the number of criminal activities linked to crypto mixers, it’s easy to see why some might assume these tools exist solely for illicit purposes.

Yet the same logic could be applied to cash, which also allows anonymous transactions. Unlike fiat systems, where privacy is assumed, blockchain’s transparency makes user activity publicly traceable—creating risks not just from governments but from hackers, advertisers, and corporations.

Privacy tools like mixers give users control over their financial footprint. In authoritarian regimes, where financial surveillance is rampant, these tools can be essential. Even in democratic nations, privacy isn’t guaranteed, and financial data can be weaponized.

The legal fight over Tornado Cash brought this tension into sharp focus. After the U.S. sanctioned the protocol, lawsuits were filed challenging the decision. One major issue: Tornado Cash isn’t a company or a person—it’s a decentralized smart contract on Ethereum. There’s no CEO, no physical headquarters, and no clear owner. So how can you sanction it?

In a recent decision, a U.S. Federal Appeals Court ruled that the Treasury Department overstepped its authority in sanctioning Tornado Cash, arguing that the open-source protocol couldn’t be classified as property. The ruling was seen as a win for privacy advocates and a setback for aggressive regulatory overreach.

This case has set a precedent that could influence future enforcement strategies, especially when it comes to decentralized technologies.

Is There a Middle Ground?

The central tension in the mixer debate is the trade-off between individual privacy and collective security. Regulators argue that privacy tools endanger the public. Privacy advocates argue that without tools like mixers, people are exposed to surveillance, censorship, and even danger.

Is there a compromise?

Some propose “regulated privacy”—tools that allow users to preserve anonymity while including opt-in audit features for legal compliance. Others suggest decentralized privacy protocols, like those based on Zero-Knowledge Proofs (ZKPs), that minimize custodial risk while still deterring misuse.

The challenge is building systems that preserve privacy without enabling criminal impunity. That’s not an easy line to walk—but it may be the only way forward.

Conclusion: What’s at Stake?

The debate over crypto mixers is not just about tech or crime—it’s about principle. It tests the line between privacy and security in a digital economy. Will users have the right to protect their financial privacy, or will governments impose blanket restrictions in the name of security?

Banning mixers may solve some problems,but it risks creating others. It could set a precedent for banning other decentralized tools. It may discourage innovation and erode trust in the crypto ecosystem. Most importantly, it raises a philosophical question: in a digital economy, how much privacy should you be allowed to have?

The answer to that question won’t be settled by courts or regulators alone. It will be shaped by the choices of developers, the actions of users, and the evolving norms around privacy in a surveillance-heavy world.

The crackdown on crypto mixers may be just the beginning. The broader battle—between privacy and control—is only heating up.

As we move forward, the real question isn’t whether crypto mixers survive—it’s whether we’re willing to accept a future where financial freedom comes second to control. And if we do, who gets to decide where that line is drawn?

Financial privacy is not a loophole—it’s a fundamental right. Just as we defend freedom of speech and association, we must defend the right to transact privately.

Disclaimer: This article is intended solely for informational purposes and should not be considered trading or investment advice. Nothing herein should be construed as financial, legal, or tax advice. Trading or investing in cryptocurrencies carries a considerable risk of financial loss. Always conduct due diligence.

If you want to read more market analyses like this one, visit DeFi Planet and follow us on Twitter, LinkedIn, Facebook, Instagram, and CoinMarketCap Community.

Take control of your crypto portfolio with MARKETS PRO, DeFi Planet’s suite of analytics tools.”