The rise of cryptocurrencies has ignited a global conversation around financial freedom in the digital age. With the total crypto market cap surpassing $2 trillion, according to CoinGecko, digital assets are increasingly viewed as a pathway to wealth creation that bypasses the limitations of traditional financial systems.

However, this influx of interest and capital hasn’t necessarily translated into widespread financial empowerment. Despite crypto’s promise of decentralization, the industry continues to wrestle with issues of manipulation, fraud, and systemic instability. These contradictions raise an urgent question: is cryptocurrency truly delivering on its promise of financial freedom, or is it simply recreating existing inequalities under a new banner?

In this article, we explore this question through four critical lenses: financial inclusion, volatility and risk, regulatory challenges, and the tension between genuine success stories and overhyped narratives. By examining both the possibilities and the pitfalls, we aim to understand whether crypto offers a real chance at financial independence—or if the promise remains just that: a promise.

Financial Inclusion: Bridging the Gap for the Unbanked

Cryptocurrency is often described as a modern-day equalizer—a decentralized finance solution that can serve unbanked individuals globally. Unlike traditional banking systems, financial freedom with crypto removes barriers like credit scores, paperwork, and physical infrastructure. All one needs is a smartphone and internet access—an accessible entry point into the global economy.

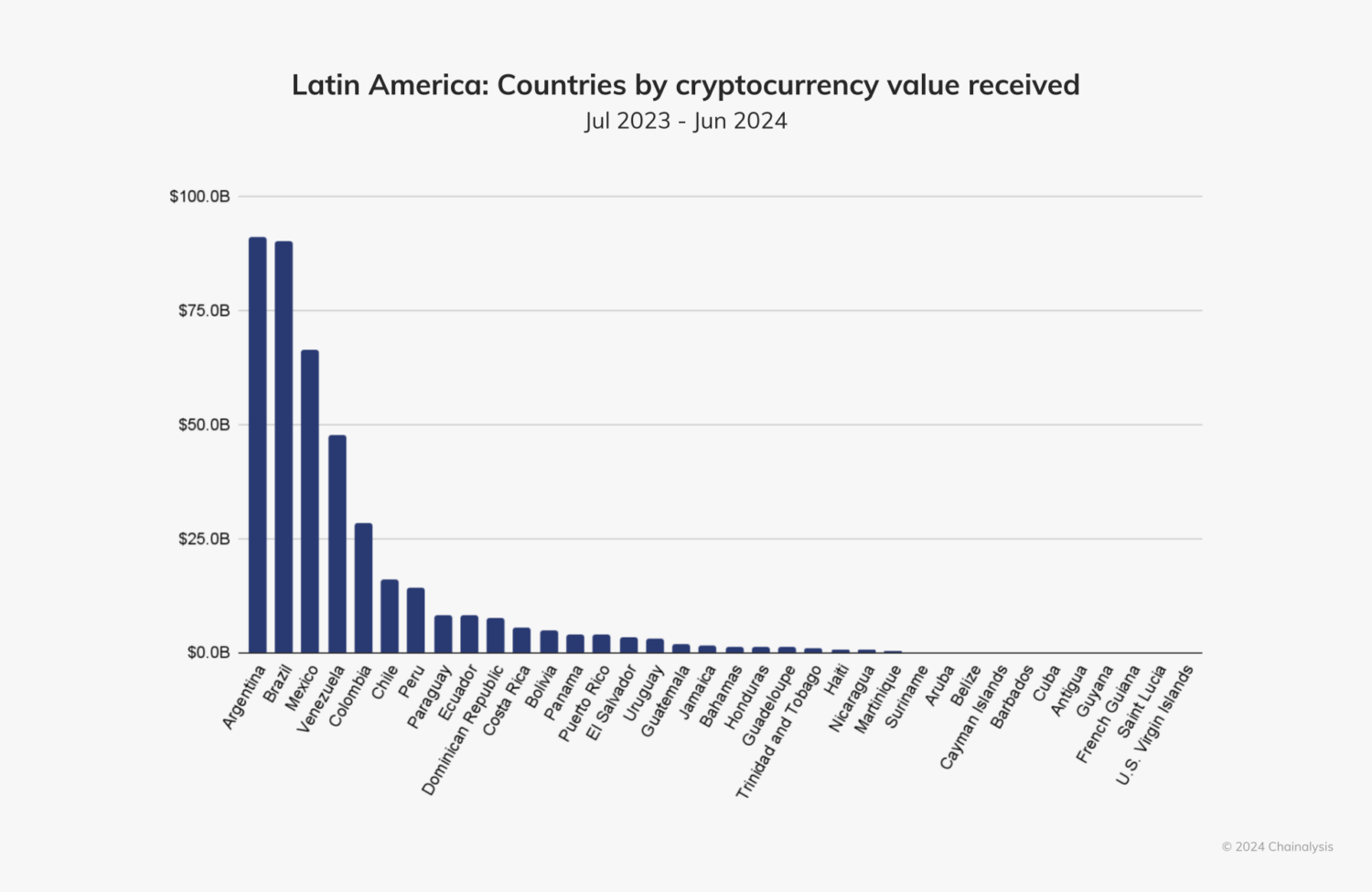

Take Argentina, where soaring inflation rates exceeding 200% in 2024 have eroded the value of the local currency. Many citizens have turned to Bitcoin to preserve their wealth. According to Chainalysis’ 2024 Global Crypto Adoption Index, Argentina received approximately $91.1 billion in crypto, slightly ahead of Brazil ranking 15th globally and showcasing significant grassroots adoption.

This signals that in places like Argentina, Bitcoin as a financial tool isn’t just a passing trend—it’s a financial necessity.

Nigeria presents a similar case. With strict controls over foreign currency access, crypto has emerged as a reliable workaround. Peer-to-peer platforms like Binance and KuCoin gained massive traction, making Nigeria rank top in P2P trading volume according to the 2023 Geography of Cryptocurrency Report by Chainalysis. This grassroots growth underscores the role of crypto financial independence in offering financial alternatives to underserved populations.

The evolution of DeFi further broadens access. Protocols like Aave and Uniswap allow users to lend, borrow, and earn yields without a bank. However, this promise is not without barriers. A third of the global population still lacks internet access (ITU, 2023), and digital literacy remains a challenge. Understanding private keys, gas fees, and wallet security requires education that many don’t yet have.

Moreover, network fees can be prohibitive. Ethereum transactions during peak periods can cost anywhere from $10 to $50, which is exorbitant for individuals living on just a few dollars a day. So while financial freedom with crypto holds potential, it’s not yet universal.

Volatility and Risk: A Double-Edged Sword

One of the most debated aspects of crypto is its volatility. While some celebrate its high-reward potential, others view it as a major obstacle to genuine crypto financial independence. For many, investing in crypto feels more like gambling than securing a future.

For instance, Bitcoin as a financial tool demonstrated its volatility when it surged to $40,000 in April 2022, only to crash to $16,000 by November of the same year.

Such dramatic fluctuations are risky, especially for those using crypto as a primary savings method. In traditional finance, a 5% market dip is a red flag. In crypto, double-digit swings are a daily affair, undermining the security essential for financial freedom with crypto.

Stablecoins like TerraUSD (UST) were created to address this instability. But the 2022 collapse of UST—once a top 10 cryptocurrency—proved that even “stable” assets can unravel. Over $40 billion in market value disappeared almost overnight, decimating the savings of countless investors.

Efforts to mitigate such risks include more robust stablecoins like USDC and DAI, which are backed by reserves and overcollateralized assets. Still, these alternatives aren’t invulnerable. USDC’s brief depeg in March 2023 during the Silicon Valley Bank collapse highlights ongoing fragility.

For low-income earners or those in volatile economies, such risks are more than inconvenient—they’re life-altering. The lack of stability means that crypto investment risks remain a central concern, challenging the notion that crypto is a pathway to true financial freedom.

Regulatory Challenges: A Global Legal Minefield

The fragmented and inconsistent regulatory landscape surrounding crypto is another significant barrier to widespread adoption and sustained crypto investment strategies. The lack of unified legal frameworks breeds confusion, deters newcomers, and sometimes punishes innovation.

China’s crypto crackdown illustrates this perfectly. After initially embracing Bitcoin mining, the government imposed a series of bans—from ICOs in 2017 to trading and mining by 2021. These abrupt policy shifts forced miners and investors to flee, significantly impacting global hash rates and user confidence.

In contrast, El Salvador embraced Bitcoin as a financial tool, becoming the first country to make it legal tender in 2021. The goal? To boost financial inclusion and reduce the cost of remittances. While ambitious, the policy has faced criticism for its volatility and uneven adoption.

Meanwhile, the United States continues to grapple with enforcement-led regulation. The SEC has filed lawsuits against major exchanges like Coinbase and Binance, alleging violations of securities laws. These legal actions generate fear and uncertainty, particularly for retail investors who struggle to understand which tokens or platforms are considered compliant.

India’s approach has also fluctuated, ranging from banking bans to a 30% capital gains tax on crypto, and a 1% transaction tax. These mixed signals discourage long-term crypto investment strategies, particularly among average users who can’t afford legal counsel.

This global inconsistency limits access, increases the risk of scams, and further highlights the crypto investment risks that users must navigate. Regulatory gaps also empower bad actors.

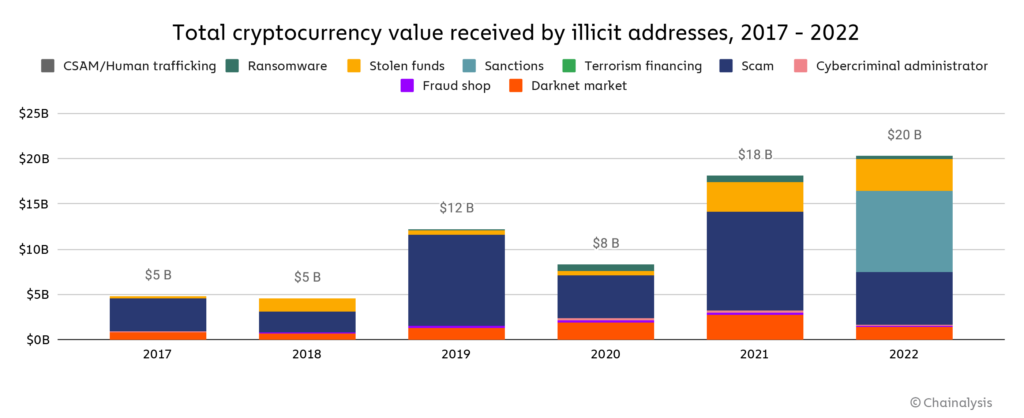

Chainalysis reports that illicit crypto activity totalled $20.1 billion in 2022, mainly scams and sanctions violations exacerbated by a lack of oversight.

Success Stories vs. Hype: Sorting Signal from Noise

While crypto has generated real opportunities, it’s equally responsible for creating unrealistic expectations. The ecosystem is filled with tales of overnight wealth, but for every success, there are far more stories of loss. The reality is that genuine crypto financial independence often requires more than luck—it demands knowledge, discipline, and time.

We have the likes of Cooper Turley, who became a millionaire through early investments in Ether and Bitcoin. Or Beeple, whose NFT art fetched $69.3 million at Christie’s in 2021. These cases showcase the immense potential of Web3. But they are exceptions, not the rule.

More common are the stories of users who fall victim to scams, FOMO-driven decisions, or exploitative platforms. Crypto investment strategies based on social media hype often end in disappointment. Market volatility, lack of regulation, and technical complexity make the space risky for the uninformed.

Nonetheless, there is a quieter, more resilient side to the crypto world. Builders and long-term users are leveraging DeFi for remittances, savings, and even identity management. These users prioritize real-world utility over speculation.

The promise of financial freedom with crypto is real, but it’s often overstated when filtered through the lens of media hype. Success in this space usually comes from careful planning, continuous learning, and respect for crypto investment risks—not viral TikToks or moonshot promises.

Conclusion:

So, is financial freedom overstated with crypto? I’d say yes and no.

Cryptocurrency is like a double-edged sword wrapped in opportunity: decentralized finance, borderless access, and digital ownership on one side; volatility, scams, and regulatory chaos on the other. It’s not the get-rich-quick machine some crypto bros on TikTok make it out to be—but it’s also not just smoke and mirrors.

We’ve seen crypto offer lifelines in places like Argentina and Nigeria, where Bitcoin as a financial tool isn’t just convenient—it’s essential. We’ve also seen entire fortunes vanish in the blink of an eye due to crashes, hacks, or the collapse of so-called “stable” coins.

So, what’s the verdict? Achieving crypto financial independence is possible, but it’s not automatic. It requires realistic expectations, continuous education, diversified crypto investment strategies, and, perhaps most importantly, patience. The rollercoaster is real, and not everyone has the stomach (or bandwidth) for the ride.

Financial freedom with crypto isn’t a myth—neither is it magic. It’s a long game, not a lottery ticket.

In the end, crypto won’t give you freedom. But if you play your cards right, it might just help you earn it.

Disclaimer: This article is intended solely for informational purposes and should not be considered trading or investment advice. Nothing herein should be construed as financial, legal, or tax advice. Trading or investing in cryptocurrencies carries a considerable risk of financial loss. Always conduct due diligence.

If you want to read more market analyses like this one, visit DeFi Planet and follow us on Twitter, LinkedIn, Facebook, Instagram, and CoinMarketCap Community.

Take control of your crypto portfolio with MARKETS PRO, DeFi Planet’s suite of analytics tools.”