Last updated on June 20th, 2025 at 06:01 pm

Imagine strolling through a bustling market, the scent of sizzling meat in the air, when you hear someone mention Pig Butchering. You might picture a butcher sharpening his knife, preparing for the day’s work. But here’s the twist—the “pig” being butchered isn’t livestock. It’s people. And the blade? A meticulously crafted scam.

Pig Butchering, or “Sha Zhu Pan” in Chinese, isn’t about farms or slaughterhouses—it’s about deception at its finest. This cruel con blends romance fraud and investment fraud into one seamless trap. Scammers fatten up their victims with affection, attention, and false promises, convincing them to invest small amounts at first. Then, just as their targets start to believe in the dream of easy riches, the con artists go in for the kill, draining them of everything and vanishing into thin air.

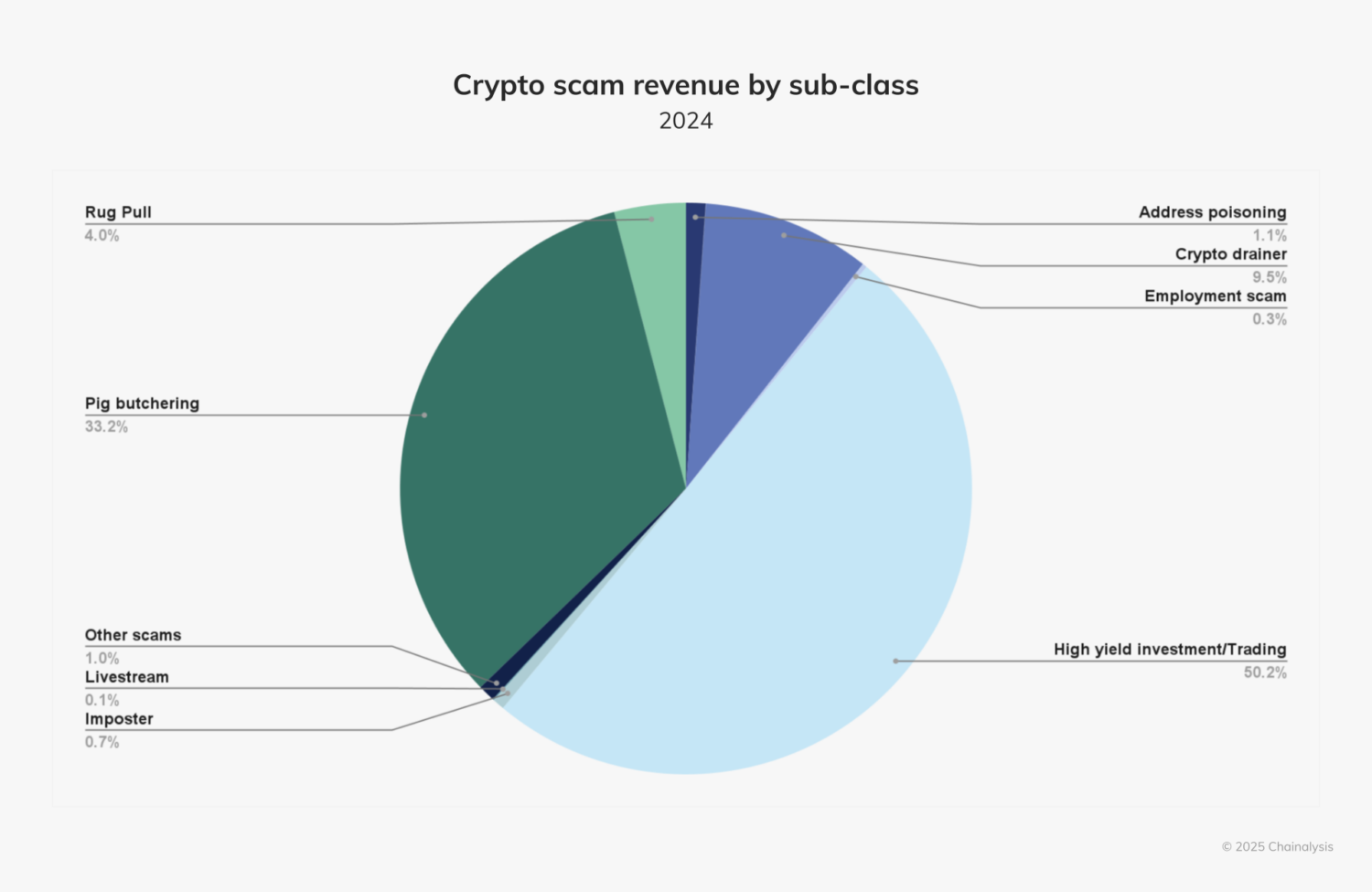

This scheme isn’t just a minor threat—it has become one of the most profitable scam types worldwide. According to Statista, pig butchering scams account for the largest share of cryptocurrency fraud, receiving 33.2% of all scam-related crypto transactions. The impact is staggering.

This scheme isn’t new, but according to the U.S. Federal Bureau of Investigation (FBI), it first surfaced in China in 2019 before spreading worldwide through dating apps, social media, and even text messages. No one is truly safe—if you have emotions and a bank account, you’re a potential target.

So, how exactly do these scams work? And more importantly, how can you avoid being the next “pig” led to slaughter? Let’s break it down.

How Does a Pig Butchering Scam Work?

Every pig butchering scam begins with a carefully crafted fake identity. Scammers set up attractive profiles on social media or dating platforms, often using stolen pictures to appear charming and trustworthy.

Once the fake profile is ready, the scammer initiates contact—sometimes through a dating app, a random social media message, or even a “wrong number” text. They act as though the connection was purely coincidental, making the interaction seem natural.

Scammers don’t rush to ask for money. Instead, they spend weeks or even months carefully cultivating a relationship, making their victim feel special and emotionally attached. They share fabricated personal stories, pretend to be successful investors, and gradually earn trust.

Once trust is established, the scammer introduces a seemingly lucrative investment opportunity—often in cryptocurrency trading. They claim to have made huge profits and offer to help the victim do the same. To make it look real, they might even provide fake screenshots of massive returns or claim to have inside knowledge of market trends.

At first, the scammer encourages the victim to invest a small amount—and they actually allow them to withdraw some profits. This gives the illusion that the investment is real, making the victim confident enough to invest larger amounts.

Once the victim has poured in a substantial sum, the scammer cuts all ties and disappears. The victim finds themselves unable to access their funds, and all communication channels go silent. By the time they realize they’ve been scammed, the fraudster is already on to the next target.

Examples of Real-Life Cases of Pig Butchering

- Heartland Tri-State Bank Collapse : Shan Hanes, the former CEO of Heartland Tri-State Bank in Kansas, embezzled $47 million from customer accounts to invest in a fraudulent cryptocurrency scheme. Deceived by scammers, Hanes’s actions led to the bank’s collapse and his subsequent sentencing to over 24 years in prison.

- Namibian Scam Operation (2023): In Namibia, authorities arrested 20 individuals, including 11 Chinese nationals, for operating a pig butchering scam targeting U.S. citizens. Over 80 young Namibians were recruited under false pretenses and forced to work in call centers, defrauding victims of substantial sums.

- Connecticut Resident’s Loss (2025): Jacqueline Crenshaw from East Haven, Connecticut, lost nearly $1 million in a pig butchering scam. She was deceived into investing her retirement savings into a fraudulent cryptocurrency platform by an online acquaintance, leading to severe financial and personal repercussions.

How to Avoid Pig-Butchering Scams

1. Verify Who You’re Talking To

Scammers often use fake identities, stolen photos, and elaborate backstories to build trust. If you meet someone online—whether on social media, dating apps, or messaging platforms—take the time to verify their identity. Reverse image searches and video calls can help confirm if they are who they claim to be. If they refuse to verify themselves, that’s a red flag.

2. Be Skeptical of Investment Talk

If someone you barely know suddenly starts talking about investing in a new type of asset or a new approach to investing in old asset types, proceed with caution. Fraudsters often disguise themselves as successful investors offering “exclusive” opportunities. Genuine investments don’t come from strangers sliding into your DMs.

3. Research Before You Invest

Always investigate investment platforms before committing your money. Scammers create professional-looking websites and apps that appear legitimate but lack proper regulation. Check for official licensing, read independent reviews, and verify if the platform is recognized by financial authorities. If you can’t find concrete information, it’s safer to walk away.

4. Protect Your Personal and Financial Information

Never share your banking details, passwords, or cryptocurrency wallet keys with anyone online. Scammers can use this information to steal from you or manipulate you into further investments. If someone insists on knowing private financial details, they likely have bad intentions.

5. Avoid Responding to Random Contacts

One of the most common tactics used in pig butchering scams is “mistaken identity” messages. Fraudsters may send seemingly harmless texts like, “Hey, long time no see,” or “Are you coming to the event tonight?” to lure you into a conversation. Ignoring unknown messages and calls is the best way to avoid falling into their trap.

6. Pay Attention to Inconsistencies

Scammers slip up when crafting their fake personas. If someone claims to be from one country but communicates in an unrelated language, or if their story keeps changing, trust your instincts and cut off contact. Genuine individuals don’t have to work hard to make their identity seem convincing.

7. Watch for High-Pressure Tactics

Pig butchering scammers will try to create urgency, claiming you must act quickly to secure an investment. They may use emotional manipulation, guilt-tripping, or even threats to keep you engaged. Legitimate opportunities allow time for research and consideration—if you’re being rushed, take that as a warning sign.

8. Limit Online Exposure

Fraudsters often target individuals based on publicly available information. Be mindful of the details you share on social media, dating apps, or professional networking sites. The less personal data scammers have, the harder it is for them to craft a believable story to deceive you.

9. Trust Your Instincts

If something feels off, don’t ignore your gut feeling. Whether it’s a stranger professing love too soon, an investment that seems too perfect, or a person avoiding direct questions—take a step back. Scammers thrive on doubt and hesitation, so staying firm in your skepticism can save you from financial loss.

Final Thought

Pig butchering scams thrive on deception, manipulation, and misplaced trust. The scammers aren’t just after your money—they’re after your confidence, your emotions, and your belief in something too good to be true. But now, you know the game. You know the tricks, the tactics, and the warning signs.

So, the next time a stranger slides into your messages with a “golden investment opportunity” or a chance encounter that feels a little too perfect—pause. Ask yourself: Am I the one being fattened up for slaughter? Because in the end, the best way to beat the butcher is to never step into the pen in the first place. Stay vigilant, stay informed, and most importantly—stay scam-proof.

Disclaimer: This article is intended solely for informational purposes and should not be considered trading or investment advice. Nothing herein should be construed as financial, legal, or tax advice. Trading or investing in cryptocurrencies carries a considerable risk of financial loss. Always conduct due diligence.

If you want to read more market analyses like this one, visit DeFi Planet and follow us on Twitter, LinkedIn, Facebook, Instagram, and CoinMarketCap Community.

Take control of your crypto portfolio with MARKETS PRO, DeFi Planet’s suite of analytics tools.”