Last updated on October 20th, 2025 at 05:12 pm

Fractional NFTs bring a fresh perspective to how we understand ownership in the world of NFTs. They represent a shift in the way we own assets and highlight how NFTs are continually reshaping our ideas about ownership.

NFTs are already unique in their ability to secure ownership of both digital and physical assets due to their resistance to forgery and reproduction.

Fractional NFTs take this uniqueness further by introducing shared ownership. In simpler terms, investors can now own a piece of an NFT rather than the whole thing, much like owning shares in the stock market.

This article delves deeply into the exciting trend of Fractional NFTs (F-NFTs), exploring their advantages and how they function in the world of NFTs.

How Do Fractional NFTs Work?

A Fractional NFT (F-NFT) is an NFT that has been divided into bits for multiple people to claim ownership. This process usually involves a smart contract breaking down the NFT into smaller tokens, each representing a portion.

These fractional tokens are then traded to investors, granting them ownership in the NFTs. The smart contract sets rules for ownership, including profit sharing, governance, and other decisions among fractional owners, if applicable.

Fractional NFTs are exchanged on special platforms designed for them. These platforms let investors buy, sell, or trade their partial NFT shares in what’s typically seen as a less liquid market.

This democratization of asset access allows more people to engage in trading valuable or trendy digital assets.

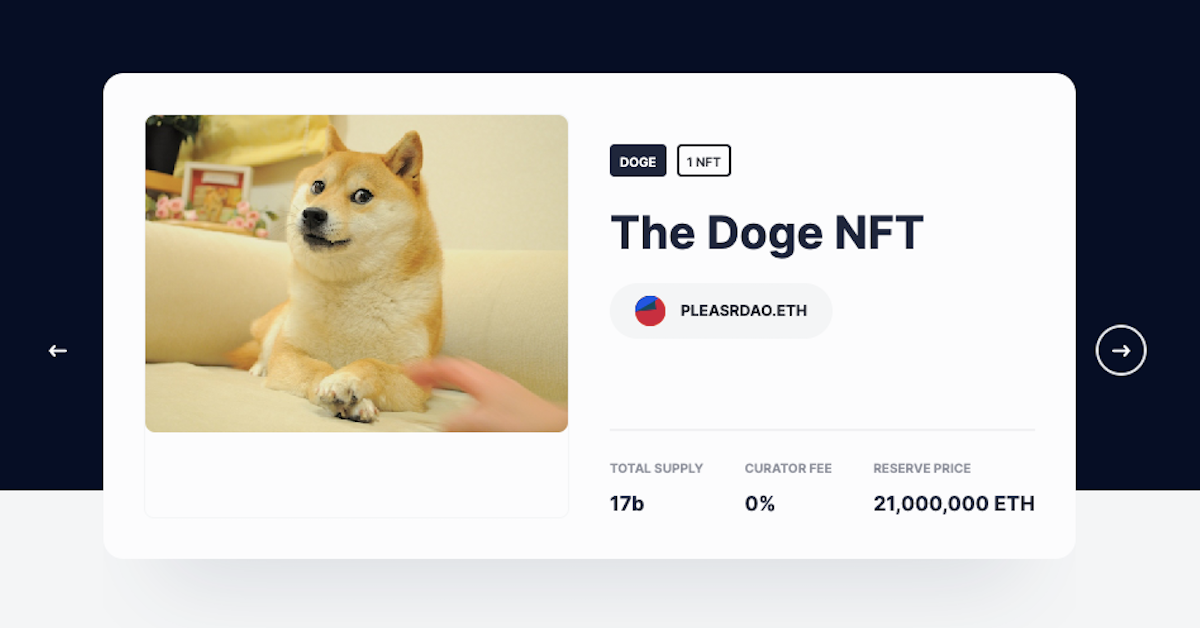

The DOGE NFT sale is a clear example of how fractional ownership works in the NFT space. In June 2021, PleasrDAO bought the DOGE meme NFT for $4 million but wanted to share it with fans. So, they offered fractional ownership for as little as $1 to let more people be part of it.

Why are Fractionalize NFTs?

Observing NFT trends, you’ll see popular NFTs are often valued in millions of dollars. This makes it difficult for average investors to own one.

For example, the Norwegian artist Edvard Munch’s NFT, “The Stream,” sold at Sotheby’s Impressionist and Modern Art auction for $120 million.

Instead of one person buying it, imagine if it was split into 10,000 tokens. Now, interested individuals can own a piece for as low as $12,000 each, making it more accessible than the original $120 million price.

Fractionalizing NFTs addresses this by allowing small investors to acquire portions, enabling ownership of valuable art at a more affordable price. This approach democratizes investment in high-value NFTs, expanding access beyond the wealthy.

Fractionalized NFTs introduce pricing mechanisms that determine the value of a specific NFT. Consider an NFT originally priced at $10,000; through fractionalization, it can be divided so that even small investors can own a portion for as little as $100. This approach makes high-value NFTs more accessible to a broader range of investors.

Fractional NFTs not only enable investors to join the NFT market but also offer advantages to NFT owners. Selling fractions of an NFT allows owners to earn money and enhance the liquidity of their assets.

Because regular NFTs can’t be copied or split, they might also take a while to sell. Fractionalized NFTs, on the other hand, can be easily traded in secondary markets.

This makes it simpler for investors to buy smaller parts at a lower cost and also boosts market activity and liquidity, which in turn contributes to raising the overall value of the NFT.

Beyond art, they find utility in real estate, where fractional ownership allows sharing benefits, profits, and losses tied to an NFT possession.

In real estate, investors with fractional ownership receive a deed representing their shares, and as such, the income and usage rights are distributed among shareholders. If the NFT’s value rises over time, the value of owners’ shares will also increase.

What Are The Drawbacks of Fractional NFTs?

Let’s delve into some of the drawbacks of buying a portion of an NFT:

Unexpected Auction Takeovers

F-NFT auction buyouts typically assist the original NFT owner in regaining full control. However, if undesired, these buyouts can result in financial losses for the initial holder.

Here’s how it works: Imagine you fractionalize your NFT, selling 60% to person A, making both of you partial owners. Now, another investor outbids both of you in an auction buyout. They acquire full ownership; you and person A only get 60% of the earnings each.

Possible Legal Concerns

Hester Peirce, a commissioner at the Securities and Exchange Commission (SEC), has advised caution for creators of Fractional NFTs, urging them to avoid minting tokens that might be viewed as securities.

Securities are interchangeable assets used for fundraising, in contrast to NFTs, which are unique and irreplaceable. Since F-NFTs involve shared ownership, the SEC could categorize them as somewhat similar to fungible securities.

To comply, these securities would need SEC registration, including sellers providing detailed transactional information. For those supporting decentralized and anonymous practices in the NFT space, adhering to these regulations poses a significant challenge.

Security Depends On Smart Contracts

The safety of a fractionalized NFT relies on the smart contract it uses. A properly written and audited smart contract is generally secure. However, if a smart contract has security issues, it can expose all connected addresses.

Cybercriminals may steal funds from all addresses involved with the flawed system. In December 2021, a hacker stole $31 million from MonoX Finance by exploiting a bug in the software tool used for creating smart contracts.

Market Volatility

Despite F-NFTs enhancing accessibility, it’s still an emerging market, and with market volatility, buyers can make losses. NFTs and F-NFTs are closely tied to the crypto market, known for its significant ups and downs.

For instance, CryptoPunk #4156 sold for 2,500 ETH ($10.25 million), while two months later, CryptoPunk #5577 went for 2,500 ETH ($7.7 million).

The varying values, with a $2.55 million gap within a year, were due to crypto market fluctuations, particularly the “crypto winter” from late 2021 to mid-2022.

Popular Fractionalized NFT platforms

As we discussed earlier, there are specialized platforms that offer services for fractionalizing NFTs and buying and selling them.

In this section, we will introduce you to three of these platforms.

ThePiece.io

ThePiece.io is a marketplace for fractional NFTs where users can safely buy, sell, and trade digital art, collectibles, and gaming assets. It has a clear fee structure and a user-friendly interface for easy portfolio management and investment tracking.

ThePiece.io is well-known for its advanced security, featuring two-factor authentication, data encryption, and a secure trading process.

Beyond security, the platform fosters a lively community of traders and collectors, creating an excellent environment for those involved in fractional NFT trading.

Fractionalized.art

This platform allows investors to buy, sell, and create NFTs and fractionalized NFTs.

Fractional.art offers diverse digital assets and a lively community of traders and collectors. What sets it apart is its user-friendly interface and advanced security, incorporating features like two-factor authentication and a variety of risk management tools.

Additionally, the platform offers diverse liquidity options, empowering users to maximize the potential of their investments.

Unicly

This platform offers a solution for investors seeking to turn their NFT collection into a tradable asset with guaranteed liquidity.

Users can utilize the platform’s functionality to convert individual NFTs into tokens, allowing the creation of tradeable collections of varying sizes.

This process not only enhances the liquidity of the NFT assets but also provides flexibility in building and managing diverse tradeable portfolios.

In addition to being an NFT marketplace, Unic.ly serves as a marketplace for diverse artwork, collectibles, and gaming assets.

In Conclusion,

The platform’s user-friendly interface simplifies portfolio management and investment tracking. It also features advanced security tools like two-factor authentication and data encryption.

For those interested in the NFT space, getting involved in fractionalized NFTs is a promising opportunity to participate. However, as exciting as fractionalized NFTs are, it’s crucial to “Do Your Own Research” (DYOR) before investing in any of them.

You should take your time to understand what they are all about so you can make the best decision.

Disclaimer: This article is intended solely for informational purposes and should not be considered trading or investment advice. Nothing herein should be construed as financial, legal, or tax advice. Trading or investing in cryptocurrencies carries a considerable risk of financial loss. Always conduct due diligence.

If you would like to read more articles (news reports, market analyses) like this, visit DeFi Planet and follow us on Twitter, LinkedIn, Facebook, Instagram, and CoinMarketCap Community.

“Take control of your crypto portfolio with MARKETS PRO, DeFi Planet’s suite of analytics tools.”