The performance of the NFT market in the first quarter of 2023 was a mixed bag. According to a report released by the Balthazar NFT Marketplace, the market had an impressive start to the year, with Q1 being its strongest quarter since Q2 of 2022. The report was based on a detailed analysis of ten major NFT markets in the industry.

However, despite the market’s positive start, it also encountered some challenges and experienced changes in its composition and dynamics. This report examines the significant trends and developments that influenced the NFT market during Q1 2023. So, let’s dive in!

How the NFT Market Fared from January to April 2023

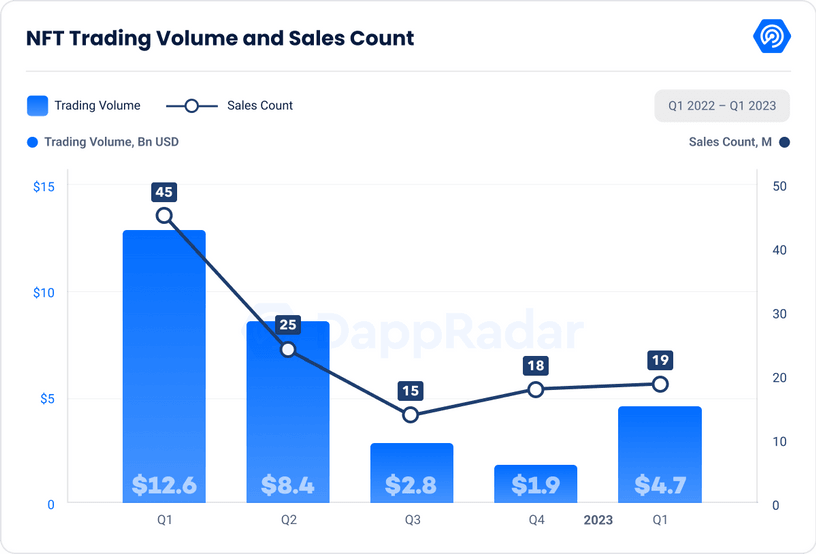

The NFT market had an impressive start in Q1 2023, surpassing its performance in the previous quarters since Q2 2022. Between January and April 2023, the market achieved a total sales volume of $6.97 billion, marking an 84.2% increase compared to the same period in the previous year ($3.08 billion). It is worth mentioning that this recovery brought the market back to the levels seen in July 2022, following a steady decline from its peak in Q1 2022.

In February 2023, the NFT market witnessed a surge in trading volume, which slipped into immediate decline in March. The total trading volume across the ten markets analyzed was $2.04 billion in March, 9.8% lower than the $2.26 billion volume recorded in February.

The downward trend continued in April. There was an 18.76% drop in trading volume, equivalent to $1.4 billion, and a 9.72% decrease in sales count (now standing at 5.6 million). Additionally, the number of unique NFT traders reached a 20-month low of 364,911, representing a 28% decline compared to the previous month.

However, despite the slight declines in March and April, the overall market performance remained positive, defying critics who deemed the sector half-sunk. In Q1 2023, the NFT market’s trading volume increased by 137%, reaching a total value of $4.7 billion.

Changing Market Dynamics and the Rise of Blur

The NFT market is known for rapidly evolving, with new players entering the scene and shifting market dynamics. Blur emerged in Q1 2023 as a major player in the market, showing impressive growth in trading volume and market dominance.

During this period, Blur achieved a trading volume of $2.7 billion, a remarkable 783.89% increase from Q4 2022, and captured 57.44% of the market share. Despite a slight decline in trading volume of 6.56% to $1.2 billion in March 2023, Blur managed to maintain a market share of 70.5%.

Blur’s swift rise to prominence can be attributed to its unique operational approach. The platform’s enticing promise of rewarding users with subsequent airdrops of the BLUR token has attracted professional traders in large numbers. The marketplace anticipates distributing approximately 300 million BLUR tokens during its upcoming season of giveaways. With a market capitalization of $2.5 billion, factoring in dilution, the Blur team aims to leverage its financial strength to entice NFT traders and retain their loyalty.

Previously dominating the NFT market, OpenSea achieved a trading volume of $1.4 billion and a market share of 31.10% in Q1 2023, representing a quarterly increase of 68.41%. However, its market share dwindled to 22% in March, with a trade volume of $381 million, marking a 35% decrease.

In April 2023, the total user base across ten markets experienced a 19.4% decline compared to March 2023. Only ThetaDrop witnessed a surge in users, with a 10.3% increase during the month. X2Y2 suffered the most significant decline, with a 48.3% drop in users from the previous month, followed by NFTX with a 38.4% decrease and Blur with a 38.6% reduction in users. Interestingly, OpenSea maintained its position as the market with the highest number of users, boasting 641,281 registered users in April 2023, compared to Blur’s 158,809.

Regarding trading volume, Blur continued outperforming OpenSea in April, recording nearly $1.05 billion in sales compared to OpenSea’s $200.74 million, which had decreased from $293.86 million in March.

In terms of market share, Blur marginally increased its dominance from 67.4% in March to 68.1% in April, solidifying its position as the leading marketplace among the ten. OpenSea’s market share, on the other hand, declined by 1.30 percentage points, falling to 13.0%.

Opensea’s Attempt to Regain Market Dominance

In April 2023, OpenSea launched a new platform called OpenSea Pro (OS Pro) in response to competition from Blur. OS Pro targets professional traders and offers a temporary 0% marketplace cost, along with a minimum creator royalty of 0.5%. The objective is to attract high-volume trading. Despite this new offering, OpenSea experienced a 28% decrease in trading volume, amounting to $274 million, resulting in a market share of 21.93%.

Meanwhile, Blur maintained its dominance in the NFT market with a 65.94% market share, despite a 33.19% decrease in trade volume, which amounted to $826 million. To build on its remarkable momentum, Blur partnered with venture capital firm Paradigm to launch Blend, a peer-to-peer perpetual loan protocol, on May 1, 2023.

According to data from Dune Analytics, within just one day of its launch, Blend facilitated loans worth 8,820 ETH (approximately $16.37 million) through its permanent NFT lending protocol, indicating a strong interest in the new product.

NFT Markets in the Coming Months: Predictions on Market Outlook

John Stefanidis, co-founder and CEO of Balthazar, has reported that the NFT trade volume has remained relatively stable over the past 11 months, fluctuating between $1 billion and $2 billion across the top ten platforms.

This is a significant improvement compared to the previous year, which experienced more volatility. Stefanidis believes that this pattern indicates a new phase of growth for the NFT market, characterized by increased stability and maturity.

Stefanidis highlighted the emergence of innovative NFT applications in various fields, offering practical solutions to real-world problems. He specifically mentioned the video gaming industry, valued at over $200 billion, and predicted that significant breakthroughs in this sector would materialize due to the substantial investments made in NFT technology over the past two years.

NFT consultant and data analyst Kermit predicts that while there may be short-term market turbulence, a new culturally diverse NFT market is on the verge of emerging. Kermit asserts that the core technology of NFTs is here to stay and foresees the enormous potential for mainstream acceptance in the near future.

Here’s my prediction: while the market may experience some turbulence in the short-term

We’re about to witness the rise of a new NFT market that’s far richer in culture than anything we’ve ever experienced before.

(12/13)

— Kermit ???? (@crypto__kermit) May 1, 2023

The future trajectory of the NFT market remains uncertain. The recent quarter’s activities indicate that there is still much to unfold and observe. According to a report by NFTGo, there has been an increase in sellers and a decrease in buyers, which is not a positive sign. However, the overall performance of the NFT market in 2023 will be determined by the next quarter of the year.

Disclaimer: This piece is intended solely for informational purposes and should not be considered trading or investment advice. Nothing herein should be construed as financial, legal, or tax advice. Trading or investing in cryptocurrencies carries a considerable risk of financial loss. Always conduct due diligence.

If you want to read more market analysis articles like this, visit DeFi Planet and follow us on Twitter, LinkedIn, Facebook, Instagram, and CoinMarketCap Community.

“Take control of your crypto portfolio with MARKETS PRO, DeFi Planet’s suite of analytics tools.”