The Federal Reserve Bank of Chicago (FRBC) has published a comprehensive research report explaining the causes and driving forces behind the 2022 cryptocurrency crisis that sparked multiple bank runs and impacted the global financial markets.

According to the report, influential account holders, crypto whales on regulated exchanges, and institutional players primarily instigated the bank runs. Their large-scale withdrawals sent shockwaves throughout the market and exacerbated the crisis.

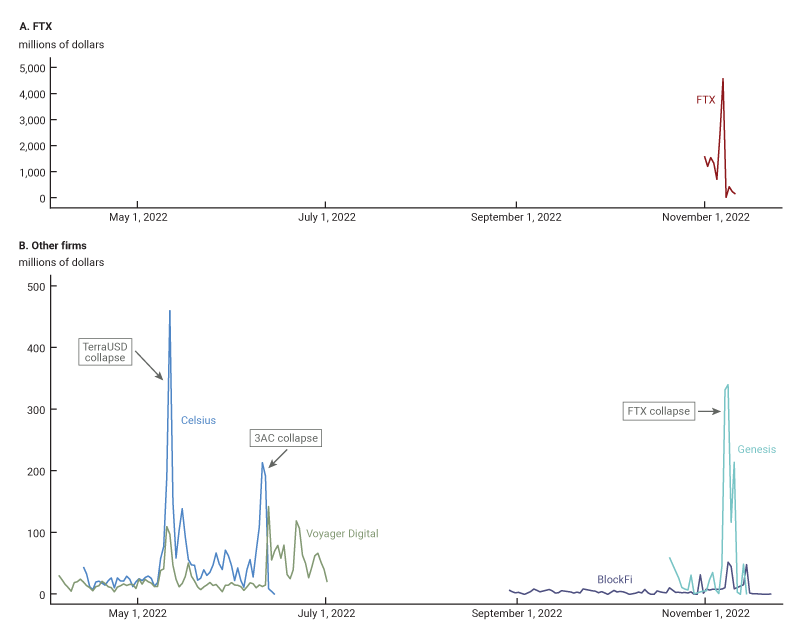

The 2022 crypto crisis began with the crash of TerraUSD. The crash prompted a cascade of client outflows from cryptocurrency lenders exposed to the Terra-Luna ecosystem. Prominent platforms such as Celsius and Voyager Digital were hit hard, experiencing outflows of 20% and 14% of customer funds, respectively, within a mere 11-day period following the collapse. Celsius invested approximately $1 billion in Terra’s ill-fated algorithmic stablecoin.

The second major crisis unfolded as high customer withdrawal rates led to the downfall of Three Arrow Capital (3AC) in July 2022. Celsius and Voyager Digital were also exposed to 3AC, and they faced another wave of outflows, with Celsius witnessing a 10% decrease and Voyager Digital experiencing a significant 39% outflow.

The collapse of Three Arrow Capital had far-reaching implications for the cryptocurrency market. Numerous businesses had lent billions in cryptocurrency assets to the hedge fund, including Genesis with $2.4 billion in loans, BlockFi with $1 billion, Celsius with $75 million, Voyager Digital with $350 million plus an additional 15,250 bitcoins (valued at around $328 million in July 2022).

The third crisis and final straw struck in November with the collapse of FTX. As news of its financial instability spread, the cryptocurrency exchange suffered a loss of nearly 37% of its customer assets. In response, investors in Genesis and BlockFi withdrew 21% and 12% of their investments, respectively, compounding the aftermath of FTX’s failure.

However, the most significant crisis was initiated by sophisticated institutional clients, although these bankrupt crypto platforms had a substantial retail customer base. Before June 9, 2022, several institutional clients had provided funding totalling $1.9 to $2.0 billion to Celsius.

The report noted that large-sized account owners, those with investments exceeding $500,000, were the quickest to withdraw their funds. These entities withdrew their funds faster compared to other account holders. For instance, account owners with over $1 million in investments accounted for 35% of all withdrawals from Celsius accounts.

The report also highlighted the role played by crypto lending companies, which enticed customers with high rewards through questionable investments. Unlike traditional banks, these platforms did not provide any protection or insurance against such failures, leading to panic among users during the market collapse.

If you want to read more news articles like this, visit DeFi Planet and follow us on Twitter, LinkedIn, Facebook, Instagram, and CoinMarketCap Community.

“Take control of your crypto portfolio with MARKETS PRO, DeFi Planet’s suite of analytics tools.”