Midas Investment, a cryptocurrency investment platform, has announced that it will cease operations due to significant losses in 2022.

Iakov Levin, also known as “Trevor,” the company’s founder and CEO, stated that the decision was partly due to the DeFi portfolio losing $50 million, or 20% of its $250 million in assets under management (AUM).

Trevor stated:

“I’m Trevor, the CEO of Midas Investments, and I am writing to you today with a heavy heart to announce that the Midas platform is closing down. In the spring of 2022, Midas DeFi portfolio suffered a cumulative loss of 50 million dollars (20% of $250 million AUM).”

Levin stated that the platform experienced the withdrawal of over 60% of AUM following the Celsius and FTX incidents, leading to a significant asset deficit. This forced the management to make the difficult decision to close the platform based on this circumstance and the current state of the CeFi market.

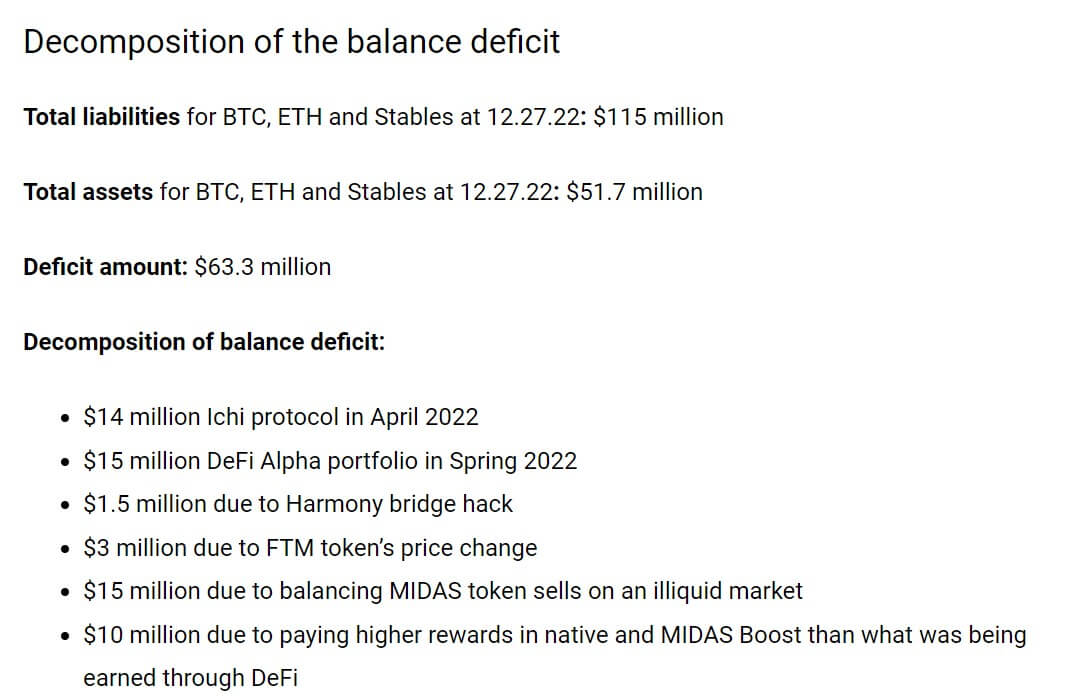

As of December 27, Midas’s total liabilities were $115 million in stablecoins, Ethereum (ETH), and Bitcoin (BTC). However, the platform only owns approximately $51.7 million of these assets, resulting in a $63.3 million gap. Trevor also mentioned that only the company’s C-level executives were aware of the asset deficit.

Trevor revealed that 55% of each user’s account balance and any earned rewards would be removed to rebalance their accounts, allowing users to withdraw 45% of their holdings. Customers with balances under $5000 will simply have their earnings withdrawn, and Midas will cover the difference between its native tokens and the tokens of its new enterprise.

Midas plans to eventually offer CeDeFi methods for both CeFi and DeFi users, using liquidity to connect competing protocols, in order to create a new win-win situation.

If you would like to read more news articles like this, visit DeFi Planet and follow us on Twitter, LinkedIn, Facebook, and Instagram.

“Take control of your crypto portfolio with MARKETS PRO, DeFi Planet’s suite of analytics tools.”