Sequoia Capital, a renowned venture capital firm, stated in a letter to its limited partners that it had reduced the value of all of its investments in FTX to zero.

Sequoia cited FTX’s “liquidity crunch” and “solvency risk” as justifications for its decision in a letter to investors. Last year, the VC company invested over $214 million in FTX worldwide and US companies.

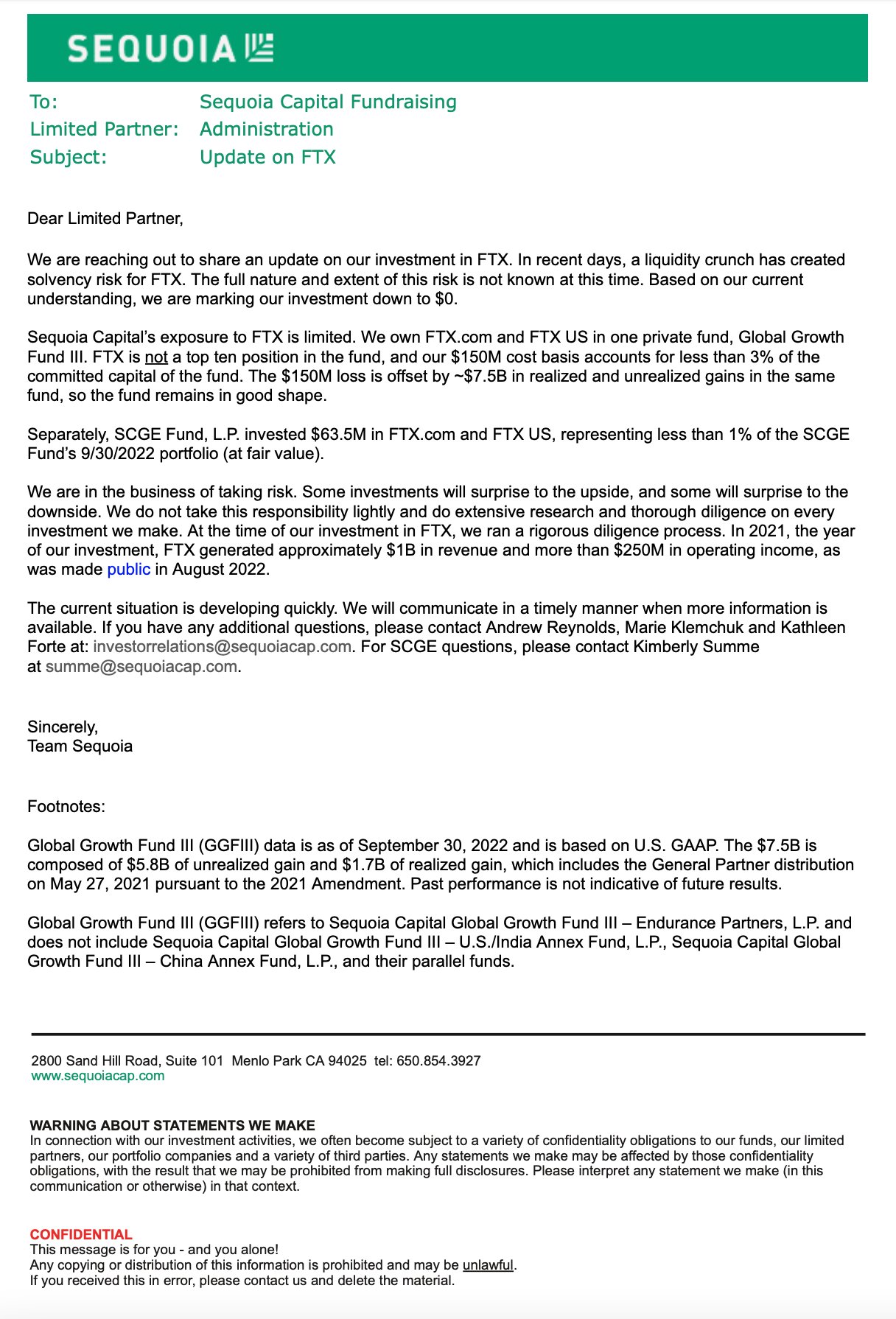

The firm’s exposure to FTX across two different funds—FTX.com and FTX US—was detailed in the letter sent by the Sequoia Capital team and released by the company on Twitter.

The venture capital firm disclosed that it had “limited” exposure to FTX and did not hold a top-ten position in the fund. According to Sequoia, the fund with FTX accounted for less than 3% of committed capital. Sequoia stated in the letter that the fund “remains in good shape” and has realized gains of around $7.5 billion.

In the letter’s conclusion, Sequoia stated that taking risks is part of its business. Adding that “some investments would surprise to the upside. And some would surprise to the downside.”

The corporation also stated that they conducted a “rigorous diligence procedure” at the time of their investment in SBF’s business. In 2021, the year they made their investment, FTX achieved close to $1 billion in sales and more than $250 million in operating income.

Additionally, the corporation promised in its message to investors that it would always conduct “thorough research” and “thorough diligence.”

The letter was sent following the shocking collapse of FTX. Binance had appeared as though it might acquire FTX, but it abruptly pulled out of the deal.

Sam Bankman-Fried, the founder of FTX, also deleted a string of tweets that guaranteed the security of all the assets on the exchange. Given FTX’s current situation, investors have been staying away from it.

The letter was sent in the aftermath of FTX’s shocking collapse. Binance appeared interested in acquiring FTX but abruptly withdrew from the deal.

The founder of FTX, Sam Bankman-Fried, also deleted a series of tweets where he guaranteed the security of all assets on the exchange. Given FTX’s current situation, investors have avoided it like the plague.

If you would like to read more news articles like this, visit DeFi Planet and follow us on Twitter, LinkedIn, Facebook, and Instagram.

“Take control of your crypto portfolio with MARKETS PRO, DeFi Planet’s suite of analytics tools.”