Index Coop introduced the Metaverse Index (MVI). It is a collection of tokens designed to reflect the trend of online entertainment, sports, and commerce. The index is represented by an ERC-20 coin.

It is a collection of tokens created to reflect the trend of entertainment, sports, and commerce moving online. An ERC20 coin serves as the index’s representation.

The MVI combines liquidity weighting and the square root of market capitalization to determine the final index weights. Overall, the market is still relatively young, which makes on-chain rebalancing and portfolio allocation difficult.

The following formula is used to determine the final index weights: TW = 75%_RMCW + 25%_LW. TW refers to the token weight in the $MVI, while RMCW is the square root of the market cap weighted allocation, liquidity-weighted allocation, or LW.

This article comprehensively explores the Metaverse Index, its history, and its components.

What is the Metaverse Index?

The Metaverse Index (MVI) refers to a root capitalization-weighted, liquidity-adjusted index designed to track the movement of sports, business, and entertainment into virtual worlds.

The $MVI investing universe includes tokens from Coingecko’s non-fungible tokens (NFTs), entertainment, virtual reality, augmented reality, and music categories with market caps of more than $30 million and at least three months of trading history.

History of Metaverse Index

The Metaverse Index was introduced in April 2021 by crypto index product supplier Index Cooperative (IndexCoop). IndexCoop is a decentralized, community-led organization responsible for creating, maintaining, and advancing numerous crypto indices. The company has worked on several index products, including the Bankless BED Index and the DeFi Pulse Index.

The indices are determined and maintained by holders of the Index Cooperative (INDEX) token.

Constituents of the Metaverse Index must meet the following requirements:

- The token must be supported by the Ethereum blockchain.

- The protocol must fall under one of these token categories on Coingecko: augmented reality, entertainment, non-fungible tokens, virtual reality, or music. More categories will be introduced as the market develops.

- The market capitalization must be greater than $30 million.

- The protocol must have been in operation for at least three months, and its token must not have less than a three-month price and liquidity history.

- The Ethereum DEX must provide adequate and reliable liquidity for the token.

- The protocol must have undergone an independent security audit, with the results reviewed by the product methodologist. If there isn’t an audit, the methodologist will use the above criteria and discussions with the team to make a subjective evaluation of the protocol.

- If a security issue arises, the project team and the methodologist will work together to identify the problem and any implications for the $MVI holdings. The team must provide users of the protocol with a solid solution as well as sufficient documentation to ensure that everyone understands the incident.

- Tokens will not be staked when the index is launched.

- This may change as liquidity increases, and it becomes feasible to generate yield through secure staking.

Components of Metaverse Index

Enjin ($ENJ)

Enjin makes it easy for enterprises in the gaming sector to develop, trade, monetize, and promote using blockchain technology. Enjin has more than 20 million users and a wide range of products, which could give companies that want to use tokenized digital assets as part of their strategies for customer acquisition, retention, engagement, and revenue generation an advantage.

Enjin Coin ($ENJ) is the fuel that powers the Enjin ecosystem. The $ENJ currency is converted into gaming NFTs through a minting procedure. Reversing this technique will melt the NFT back into $ENJ. The $ENJ inside the NFTs sets a floor price by linking the value of the NFT to the backing $ENJ.

The Multiverse project exemplifies the potential of Enjin’s Platform-as-a-Service model. The Enjin Multiverse was established in late 2018 when six games (9Lives Arena, Bitcoin Hodler, Age of Rust, Forest Knight, CryptoFights, and War of Crypta) decided to collaborate and develop a set of shared blockchain assets. It was the first multiverse for blockchain gaming. It has grown to include more than 30 games since then.

The Sandbox ($SAND)

Fans of Minecraft and Roblox may be familiar with the Sandbox, a community-driven platform where anybody can develop and monetize blockchain-based gaming experiences using voxel NFT assets. The Sandbox ecosystem consists of the following elements:

Voxel Editor

This editor enables users to design and animate 3D assets using a simple 3D voxel modelling program.

Marketplace

A web-based market where users can buy and sell their assets in the form of ERC721 and ERC1155 tokens.

Game Maker

This game mode allows anyone with ASSETS to use and place them on their LAND. Users can script their ASSETS to decorate their LAND or add gameplay elements.

RedFOX Labs ($RFOX)

RedFOX Labs is a startup incubator for new technologies based in Southeast Asia. Its mission is to develop, launch, and scale high-growth enterprises in e-commerce, e-media, e-travel, and ride-sharing/ logistics throughout Southeast Asia. They were established as a joint-stock company in Vietnam. The ecosystem accepts payments made with the $RFOX token.

New businesses can take advantage of the platform economics of the RedFOX product suite. For instance, KOGs (another RedFOX product) are collectible NFTs that can be used in-game to unlock skins, tournaments, and VIP access to special events. RFOX Games is a collection of interoperable, tournament-based video games.

Another exciting topic is RedFOX Labs’ announcement of Virtual Space. This virtual store will combine online and offline shopping into one seamless process. The Virtual Space aspires to provide an immersive shopping and retail experience by incorporating gaming and VR/AR technologies.

Decentraland ($MANA)

Decentraland, the first entirely decentralized environment, is a platform for virtual reality where users can create and sell content and experiences. Users can creatively control what content is released on their parcel by purchasing virtual land on-chain. The DAO, the entity that owns the platform’s smart contracts, has complete control over the virtual world.

The Decentraland economy is based on two crypto-assets: $MANA, an ERC20 token used to make in-game purchases of products and services; and LAND, the non-fungible parcels into which the virtual world is divided.

In Decentraland, corporate headquarters for legitimate companies such as Kraken and Atari have been built. We believe that more businesses will open stores there because these virtual locations have low overhead costs and a constant presence.

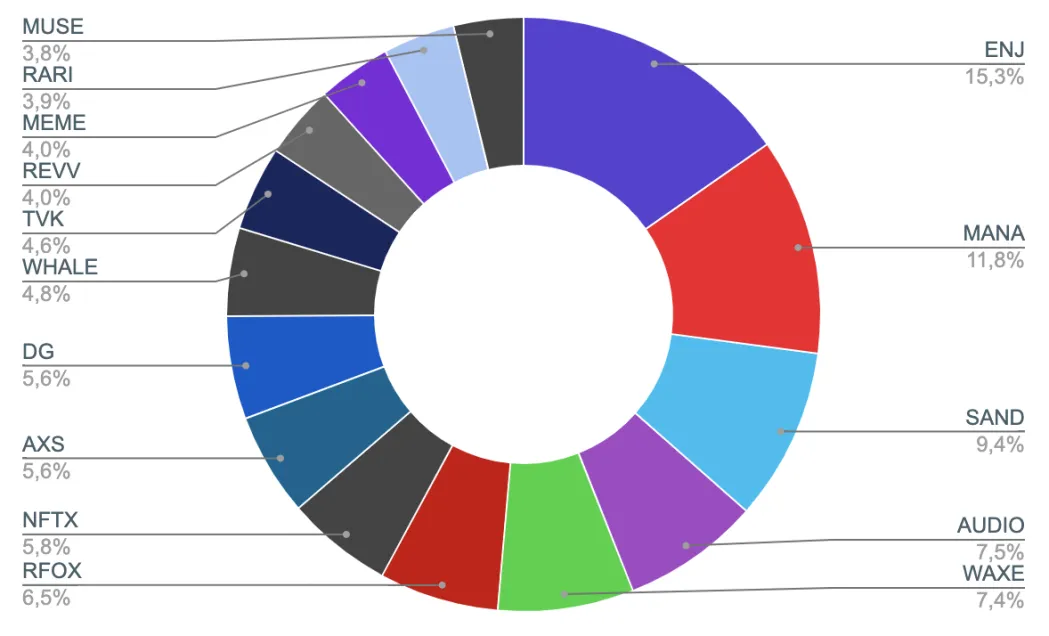

The Metaverse Index also includes the following components:

- Axie Infinity ($AXS)

- WHALE ($WHALE)

- Rarible ($RARI)

- Meme Protocol ($MEME)

- Audius ($AUDIO)

- Muse ($MUSE)

- Decentral Games ($DG)

- Terra Virtua Kolect ($TVK)

- NFTX ($NFTX)

- Worldwide Asset eXchange ($WAXE)

- REVV ($REVV)

How to Buy Metaverse Index Token ($MVI)

Get a Metamask wallet

You can download Google Chrome and the Wallet Chrome extension using a desktop computer. If you prefer a mobile wallet, you can download it from the iOS App Store or Google Play. Visit the Metamask website to ensure you get the genuine Chrome extension and mobile app.

Set Up Your Metamask wallet

Register and set up the wallet using the Google Chrome extension for the wallet or the mobile app you downloaded in the step above. You can use the wallet’s support page as a resource. Make a note of your wallet address and keep your seed phrase secure.

Buy ETH as your primary currency

After configuring your wallet, log into your Binance account and buy Ethereum.

Transfer Ethereum from Binance to your Metamask wallet

Go to your Binance wallet section and search for the Ethereum you purchased. Click “withdraw” and provide the required information. Set the network to Ethereum, enter your wallet address, and then enter the amount you want to transfer. When your Ethereum is ready, click the withdraw button and wait for it to reflect in your Metamask wallet.

Select a Decentralized Exchange (DEX)

There are numerous DEXs available; all you need to do is confirm that the exchange supports the wallet you chose in Step 2. For example, if you use the Metamask wallet, you can go to 1inch to complete the transaction.

Connect Your Wallet to the DEX

Using your wallet address from Step 2, link your Metamask wallet to the DEX you wish to use.

Exchange your Ethereum for the desired cryptocurrency

Select Metaverse Index as the token to purchase and Ethereum as the payment method.

Swap

When you’ve completed the preceding steps, click the Swap button.

In Conclusion

- The general overview of the Metaverse Index reflects how it can completely change how people interact with the metaverse.

- A detailed examination of MVI’s operations reveals that it aggregates the best metaverse platforms and tokens into a single pool. Any MVI token owner can choose the best tokens and metaverse platforms based on their specific requirements.

Disclaimer: This article is intended solely for informational purposes and should not be considered trading or investment advice. Nothing herein should be construed as financial, legal, or tax advice. Trading or investing in cryptocurrencies carries a considerable risk of financial loss. Always conduct due diligence.

If you would like to read more articles like this, visit DeFi Planet and follow us on Twitter, LinkedIn, Facebook, and Instagram.

“Take control of your crypto portfolio with MARKETS PRO, DeFi Planet’s suite of analytics tools.”