With a downfall of 4% in the last week and an almost 40% fall from its all-time high (ATH) near $69K, Bitcoin struggles to grip tightly to the $40K psychological mark.

From the glassnode insights, an on-chain analytics firm brings forth the news that 30% of Bitcoin supply is at a loss.

The 30% mark of Supply remains a crucial support level that has pushed the BTC price higher multiple times. The previous two attempts came at the onset of the Covid-19 crisis in 2020 and the Bitcoin mining crackdown in China in the summer of 2021. Many analysts find this level as the spot of bullish reversal but the liquidation of this level can result in a dramatic downfall.

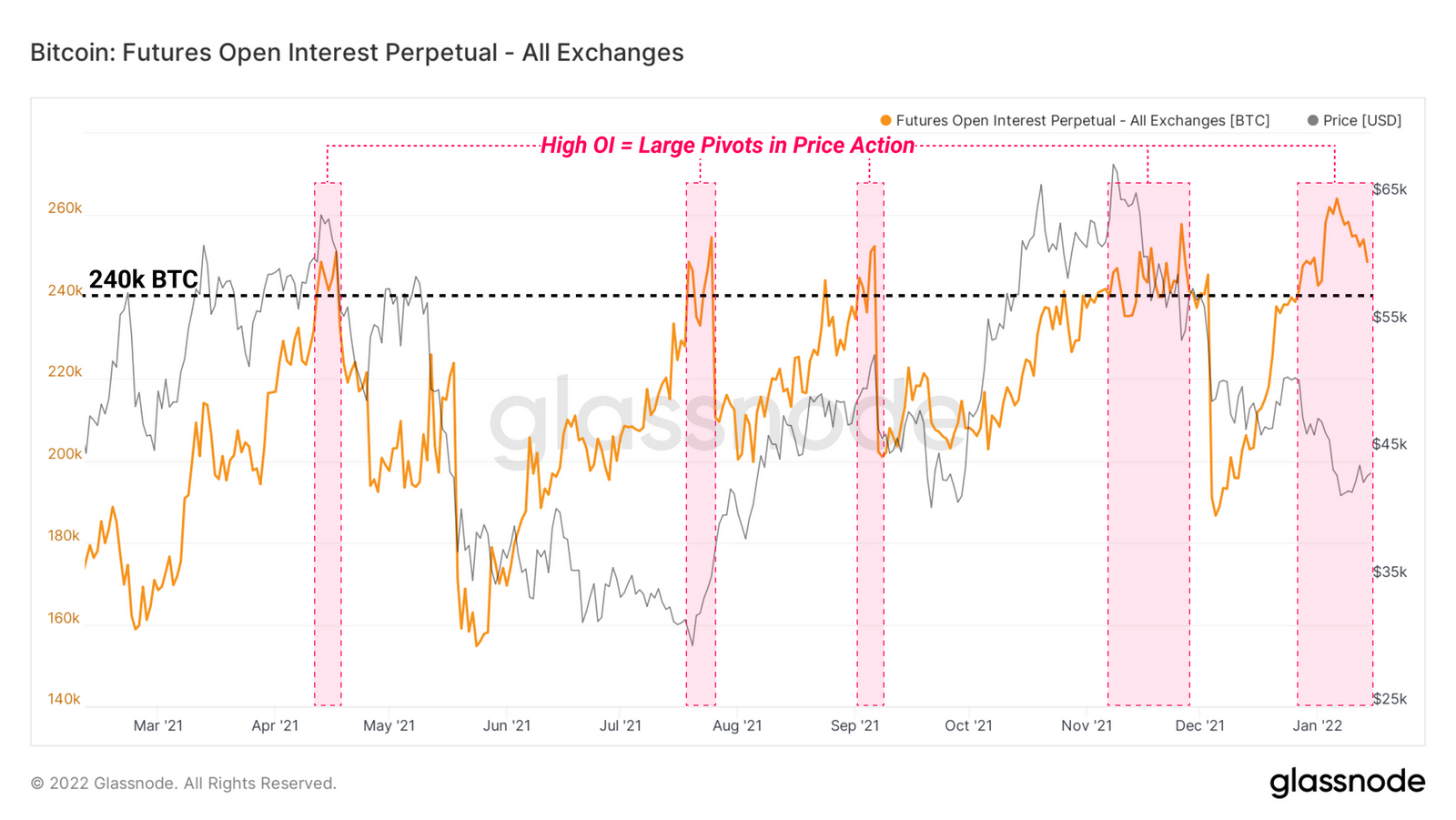

Moving onto the next derivative data, the Open Interests Data (Number of Future Contracts) and the Funding Rates (cost of holding positions) tease turbulence ahead.

The Bitcoin Perpetual Future Contracts reach abnormally high Open Interests (OI) at ~250,000 BTC. The increased number of positions in the Future contracts can decide the upcoming trend in the BTC price with a spike in volatility.

The high OI rates indicate an increased leverage-based position that in turn makes the market volatile as the chances of long/short squeeze increase. A short squeeze occurs when the leveraged-based positions fail to hold because of increased BTC prices resulting in forced closure due to reduced margin (liquidation) of multiple short positions. This creates a loop and drives the prices higher. An opposite scenario occurs during a long squeeze.

Taking the OI alone showcases the only amount of money trapped in the derivatives but lacks the direction as to whether the bears are in control or bulls. Enters funding rates.

The funding rate is the fees of holding a derivatives contract or in this case a perpetual futures contract. Negative rates insinuate the short positions paying long contracts for bearish exposure and positive rates reflect an opposite situation.

At press time, the funding rates recover as multiple exchanges like Binance, FTX, and Bybit showcase a rise. However, the rates are still slightly negative but the growth in the last few days showcases a bullish revolt.

Market Sentiments Is Another Threat For Bullish Traders

Pankaj Balani, CEO of the crypto derivatives exchange, Delta Exchange, recently warned bullish traders that the BTC prices can breach the $40K mark due to the alarming reduction in buying demand.

“We are not seeing any bottom fishing at these levels, and the interest to own bitcoin risk around $40,000 remains low,” Balani said in a chat. “We could retest $40,000 and should that break, we can see a fresh round of selling come through.”

Speaking of sentiments, the increased levels of fear in the market are not ready to fall any time soon. At 24, the Fear and Greed Index showcases a sentiment of extreme fear for the past three days.

Factors Weakening The Crypto Market

Before we get to the factors influencing bearishness in the crypto market, let’s first get to know the factors that influenced its growth in the past two years. The major factors that drove the market were:

- Low-interest rates

- Inflating balance sheets of central banks

- Need for new financial instruments during the pandemic

- Availability of high leveraged positions

- Growing social media presence

…and many other factors that played a role in the growth of Bitcoin and Altcoins (coins other than Bitcoin, such as Ether, SOL, MATIC, and so on).

However, the suddenly-active government interventions around the world that seemed to have woken up to crypto and the falling bullish attention on social media along with the dire threat of high leveraged-based positions undermines the growth of Bitcoin and the crypto market as a whole.

The use of crypto as a payment service or to help the use case of the platform should have been the driving force in the growth of the crypto market rather than the speculative trading of tokens as a risky asset. However, the latter part seems to be the case in current times.

Technical Takeaways

In the daily BTC chart, the coin price approaches the long-coming resistance trendline as it struggles to find support near the $40K. However, the price action reflects a possible double bottom pattern with significantly lower price rejection evident by the long tail formations. Moreover, the RSI indicators suggest bullish divergence in the past two dip formations at the support zone.

Therefore, a breakout above the resistance trendline can result in the bullish breakout of the double bottom pattern. Traders can expect the BTC price to reach the $45K mark with the post-breakout bullish momentum.

Taking a slightly more bullish stand, the breakout of the resistance trendline can reach the $46,200 mark as per whalemap. Whalemap showcases a significant gap between the prices in the on-chain volume profiles.

Hence, traders and investors need to keep an eye on the price action and remain patient as to how the price action works out.

If you would like to read more articles like this, visit our Website. You can also follow DeFi Planet on Twitter, Facebook, Instagram, and LinkedIn.