As cryptocurrency grows from a niche innovation into a global asset class, investors are increasingly wondering: Should crypto be part of retirement planning? With questions like “Should older people invest in crypto?” and “Can you hold crypto in a 401k?” trending across financial forums, it’s clear that this debate is no longer reserved just for tech-savvy millennials. This article examines whether cryptocurrencies should be included in long-term retirement portfolios or avoided due to their notorious volatility.

Traditional vs. Alternative Retirement Investments

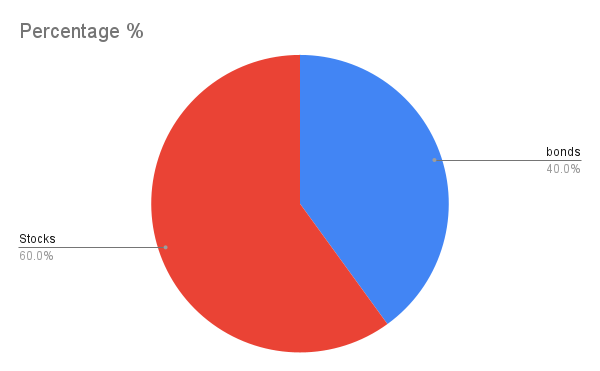

Historically, retirement portfolios have leaned heavily on a mix of stocks, bonds, and mutual funds. The standard 60/40 split (60% stocks, 40% bonds) has been the bedrock of portfolio design due to its balance of growth and stability.

However, the rise of alternative assets like real estate, gold, and now cryptocurrency signals a shift in investor behaviour.

Crypto, as a digital asset class, brings unique characteristics to the table: decentralization, a fixed supply (in the case of Bitcoin), and high liquidity. Unlike traditional investments, crypto operates 24/7 and lacks intermediaries like banks or brokers. This alternative profile has attracted both younger investors and, increasingly, older individuals looking to diversify beyond legacy systems.

Related: Why Ignoring Crypto is No Longer an Option for Financial Advisors

Balancing Risk and Reward: Should Crypto Be in Your Long-Term Portfolio?

There’s no sugarcoating it, crypto is a high-stakes game. It’s the textbook definition of high-risk, high-reward investing. This extreme volatility raises a critical question: Should you hold crypto long term, particularly within a retirement portfolio? For investors with a 10+ year investment horizon and a healthy risk tolerance, the answer could be yes, if approached with care. What percentage of your portfolio should be in crypto? Research from firms like Fidelity suggests that even a modest exposure to crypto —ranging from 2% to 5% —can meaningfully enhance overall portfolio performance. Their analysis revealed that such allocations have the potential to boost retirement spending by 1%–4% annually in optimistic market conditions, while limiting downside risk to under 1% of annual retirement income, even in the unlikely event that Bitcoin’s value drops to zero.

Still, there’s no ignoring volatility. The crypto market is notoriously erratic, swinging from euphoric highs to brutal crashes. For those nearing retirement, this kind of unpredictability can feel more like a threat than an opportunity. However, volatility isn’t inherently harmful. When managed strategically, it offers the potential for asymmetric returns, where limited downside is offset by significant upside, especially if your allocation is small and tightly controlled.

Yet the risks are real and sometimes very public. One striking example is the Quebec pension fund, which lost nearly $155 million due to heavy exposure to Celsius. The fallout from that decision serves as a stark reminder of the importance of due diligence, risk management, and a full understanding of the crypto instruments you’re investing in.

Events like these have not gone unnoticed in Washington. Several U.S. lawmakers—among them Senators Elizabeth Warren, Dick Durbin, and Tina Smith have voiced strong objections to allowing cryptocurrencies in 401(k) retirement plans.

So, where’s the middle ground? Many financial advisors recommend limiting crypto exposure in retirement accounts to no more than 5%, although some risk-tolerant investors may be willing to push slightly beyond that. And it’s not just about how much you invest, but what you invest in. Is it good to diversify a crypto portfolio? Absolutely. Spreading investments across multiple coins can help reduce single-asset risk and increase the likelihood of sustainable, long-term growth.

Related: The Pros and Cons of Adding Crypto to Your Retirement Fund

In the end, integrating crypto into a long-term portfolio isn’t about chasing overnight success. It’s about making a strategic, disciplined allocation—one that acknowledges the risks while embracing the innovation.

Regulatory Barriers to Crypto Retirement Integration

As enthusiasm for crypto grows, one of the most persistent challenges to its inclusion in retirement planning is the evolving, often cautious regulatory landscape. While the potential for outsized returns makes digital assets appealing to forward-looking investors, regulators have consistently prioritized the protection of retirement savings, usually erring on the side of conservatism.

A pivotal shift occurred on May 28, 2025, when the U.S. Department of Labour’s Employee Benefits Security Administration (DOL) issued Compliance Assistance Release No. 2025-01, officially rescinding its 2022 guidance. That earlier release had urged fiduciaries of 401(k) plans to “exercise extreme care” before offering cryptocurrencies as investment options, even warning of possible investigations into plans that chose to include them. The 2025 revision marked a notable departure from that stance, with the DOL neither endorsing nor discouraging the use of crypto in 401(k) retirement plans.

This neutrality represents progress, but it’s far from a green light. While it opens the door for further dialogue and experimentation, it also leaves plan sponsors in a regulatory grey zone. So, can you hold crypto in a 401(k)? Technically, yes. In fact, financial giant Fidelity made headlines in 2022 by offering Bitcoin exposure within select 401(k) plans.

Also, optimism within the industry is growing. Coinbase CEO Brian Armstrong recently stated, “Crypto is about to be in everyone’s 401(k),”

Two other thoughts:

1. Crypto is about to be in everyone’s 401k

2. My goal is that in 5-10 years, getting into COIN50 index will feel as good as this https://t.co/fXfk2tJ6g8— Brian Armstrong (@brian_armstrong) May 12, 2025

This reflects a broader shift in how digital assets are perceived, not as speculative bets, but as emerging components of diversified retirement portfolios.

Ultimately, navigating the regulatory environment around crypto retirement integration requires more than interest; it demands education, caution, and a long-term perspective. While the path is still being paved, momentum is building, and the conversation is no longer about whether crypto belongs in retirement, but how it can be integrated responsibly.

Case Studies: Crypto in Retirement Offerings

While much of the attention has been on whether 401(k) plans should include crypto, some of the most tangible developments have occurred outside of them, particularly in the realm of IRAs. For investors seeking greater control and flexibility, several options are emerging that integrate cryptocurrencies into retirement portfolios.

One of the most high-profile moves came from Fidelity, a global asset management giant. In 2022, the firm made waves by allowing Bitcoin exposure within select 401(k) plans, becoming the first major retirement provider to do so. This decision lent institutional credibility to the idea of crypto as a retirement asset. However, the rollout has been limited, adoption remains slow, and access is restricted by employer discretion, meaning not all participants can take advantage of the offering.

For those looking for indirect exposure, the Grayscale Bitcoin Trust (GBTC) provides another route. This publicly traded investment vehicle is available in many IRA accounts and offers exposure to Bitcoin without requiring investors to hold the digital asset themselves. However, it has come with its own set of challenges, notably the tendency for GBTC to trade at a discount to net asset value (NAV). This can lead to tracking issues and performance mismatches that investors must carefully evaluate.

More hands-on investors are turning to platforms like Alto CryptoIRA, which offers self-directed IRA accounts supporting over 250 cryptocurrencies. These platforms give users significant flexibility in managing their crypto retirement portfolios, but they also require a greater level of involvement and understanding. The tradeoff for access and autonomy is increased responsibility, making them better suited for individuals who are already familiar with crypto investing and comfortable managing their own financial strategy.

Institutional interest is also beginning to surface at the state level. In March 2025, North Carolina lawmakers introduced two bills aimed at exploring the inclusion of cryptocurrency in the state retirement system. This development signals that the integration of digital assets into retirement planning is no longer just a retail trend; it’s becoming part of the broader policy and financial infrastructure conversation.

These real-world examples highlight an important takeaway: Should you add crypto to your retirement portfolio? The answer isn’t one-size-fits-all. It depends on your understanding of the investment vehicle, your risk tolerance, and your timeline. As options grow and the ecosystem matures, investors must carefully weigh the benefits of innovation against the responsibility of informed decision-making.

Final Verdict: A Cautious Step into the Future

The question of whether crypto should be integrated into retirement portfolios or excluded for its volatility is no longer theoretical; it’s a real-world dilemma faced by investors, institutions, and policymakers alike. What was once dismissed as a fringe financial experiment has matured into a globally recognized asset class, drawing attention not only from retail investors but also from major players.

But enthusiasm alone doesn’t justify inclusion. The truth lies somewhere in the middle. On one hand, cryptocurrencies offer compelling benefits—decentralization, liquidity, and potential asymmetric returns. On the other hand, they carry undeniable risks—volatility, regulatory uncertainty, and custodial complexities, especially when tied to long-term financial goals like retirement planning.

From the Quebec pension fund’s costly Celsius misstep to cautious yet progressive shifts in U.S. 401(k) policy, the evidence shows that crypto can’t be treated like any other asset. It demands a different level of understanding, risk assessment, and ongoing attention. That’s why most experts recommend modest allocations tailored to one’s risk tolerance, investment horizon, and ability to absorb losses without derailing retirement plans.

The key takeaway? Crypto in retirement isn’t about betting big; it’s about thinking long. For the well-informed, disciplined investor, it can serve as a strategic diversifier, one that enhances rather than jeopardizes portfolio strength. But for those unprepared to navigate its nuances, it may do more harm than good.

Ultimately, as regulatory frameworks continue to evolve and platforms mature, the inclusion of crypto in retirement portfolios will likely become more mainstream. Until then, education, caution, and diversification remain your best tools. Crypto may be the future, but in retirement, the future should always be approached with a balanced, measured approach.

Disclaimer: This article is intended solely for informational purposes and should not be considered trading or investment advice. Nothing herein should be construed as financial, legal, or tax advice. Trading or investing in cryptocurrencies carries a considerable risk of financial loss. Always conduct due diligence.

If you want to read more market analyses like this one, visit DeFi Planet and follow us on Twitter, LinkedIn, Facebook, Instagram, and CoinMarketCap Community.