As the global crypto industry matures and shifts toward regulation, nations are jockeying for position as the world’s leading crypto hub. But what is a crypto hub exactly? It’s not just a regulatory safe haven; it’s a dynamic intersection of innovation, investor confidence, institutional participation, and public-private collaboration.

Among the frontrunners, Hong Kong, the United Arab Emirates (UAE), and Singapore are locked in a high-stakes race, each deploying strategic policies, infrastructure, and capital to attract blockchain talent, institutional players, and innovation. Which country is leading in cryptocurrency as of 2025? Let’s break it down.

The Regulatory War Room: Who’s Writing the Best Rules?

The race to build the most attractive and future-proof crypto regulatory framework is heating up. Each contender is staking its claim to be the country that becomes the global crypto hub.

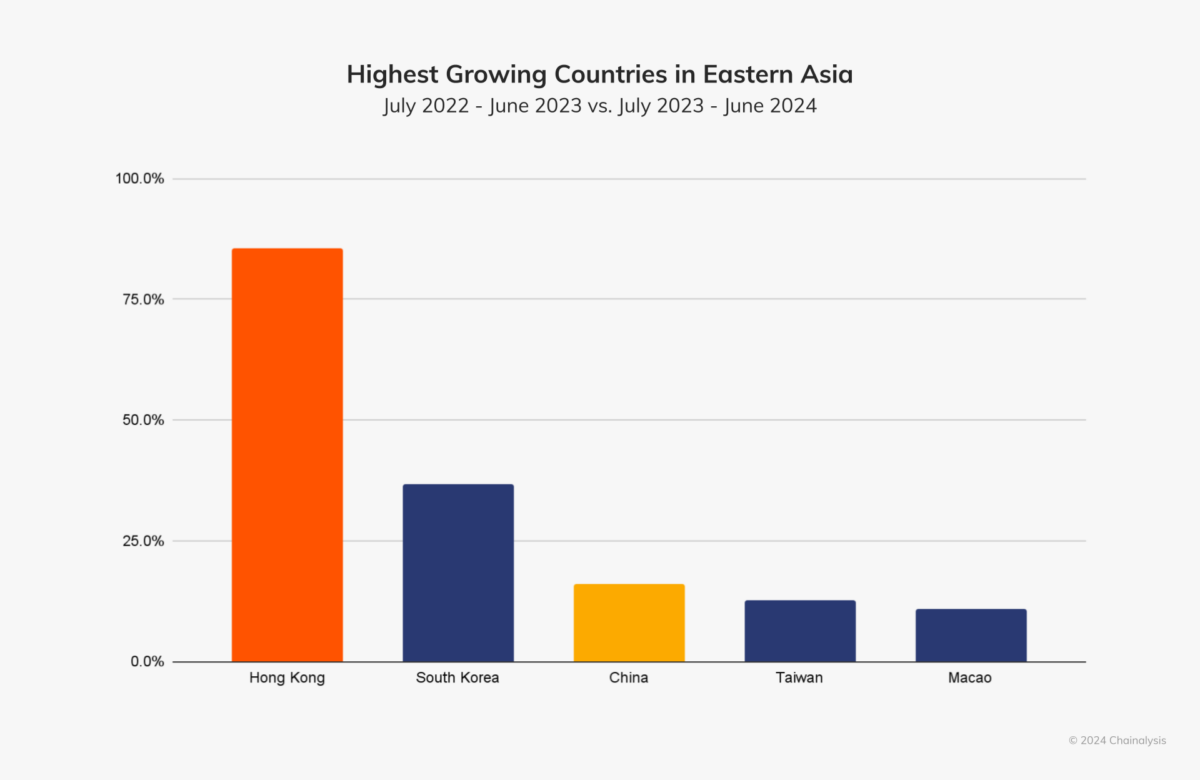

Hong Kong has bounced back with purpose. Once sidelined by China’s crypto ban, it now boasts a licensing regime for Virtual Asset Trading Platforms (VATPs), with 11 licenses granted as of June 18, 2025. While 15 applications were rejected or withdrawn and 9 are still pending, Hong Kong’s efforts show commitment, not chaos. The launch of the ASPIRe roadmap—focused on Access, Safeguards, Products, Infrastructure, and Relationships—signals a long-term vision to address market fragmentation and build a resilient crypto ecosystem. It’s paying off: a 2024 Chainalysis report shows Hong Kong leading Eastern Asia with an 85.6% growth in crypto activity.

Is Dubai a crypto hub in the Middle East? All signs point to yes. The UAE has moved quickly and boldly. With the launch of VARA in 2022, the world’s first dedicated crypto regulator, Dubai, set new standards for regulatory speed and scope. It’s clear that comprehensive rules cover everything from NFTs to staking and custody, making it a go-to destination for global crypto firms seeking structure without excessive friction.

Also Read: Evaluating the United Arab Emirates’ Crypto Ambitions

Singapore remains the most measured of the three. Governed by the Monetary Authority of Singapore (MAS), the city-state’s regulatory architecture is defined by stability, compliance, and long-term risk management. Under the Payment Services Act (PSA) and the Digital Payment Token (DPT) regime, firms are required to meet high standards in risk mitigation and consumer protection.

While this has earned Singapore a reputation for safety and trust, it also means a slower pace of adoption. Notably, MAS has now mandated that crypto firms halt overseas Digital Token (DT) activities by June 30, 2025, unless they secure a Digital Token Service Provider (DTSP) license, signalling an even tighter grip on cross-border compliance. But is Singapore a crypto-friendly country? Absolutely—though in a cautious, institutional way.

Related: Hong Kong and Singapore Lead Asia’s Race to Become Crypto Hubs Amid Global Boom

Taxation, Capital Controls, and Institutional Appeal

The heart of what makes a country a crypto hub often lies in taxation and capital mobility. Which country is the crypto hub material based on these factors? Let’s dig in.

Hong Kong is making a calculated push. With a territorial tax system taxing only locally derived profits at 15–16.5%, it already offers a competitive edge. However, in November 2024, the government proposed a significant increase: tax exemptions on cryptocurrency gains for hedge funds, private equity firms, and institutional investment vehicles. This move, aimed at positioning Hong Kong as Asia’s top crypto hub, pairs well with its gateway access to both mainland China and global capital markets, creating an irresistible formula for institutional players.

The UAE, however, might have the ultimate cheat code. With zero income tax, no capital gains tax, full foreign ownership in free zones like DMCC and DIFC, and crypto-friendly banks, it has become a magnet for high-net-worth individuals and crypto whales. The freedom to move capital with no restrictions only sweetens the deal. Is Dubai a crypto hub in the truest sense? Yes—and it’s built for whales and wealth managers.

Singapore remains strategic. While there’s no capital gains tax, crypto earnings from business activities are taxed as income. Still, MAS’s support for innovation like the Global Finance and Tech Network (GFTN) keeps it appealing for fintech builders, even if it’s more measured.

Culture and Politics: Trust, Risk, and the Vibe Check

Crypto may be built on code, but trust, perception, and politics shape where people put their money. Culture counts, especially when determining which country is leading in crypto adoption at both institutional and retail levels.

Hong Kong is a paradox. While it’s part of China, its legal system still operates independently under the “one country, two systems” principle. This has kept institutional confidence high. Ranked the second most crypto-friendly city globally, with an average of $97,000 in crypto holdings per user, Hong Kong signals a deep conviction from both retail and institutional investors. There’s legal trust, market access, and a hunger for relevance on the global crypto stage.

The UAE, on the other hand, is unabashedly bullish. With strong backing from the top, including Sheikh Mohammed’s pro-crypto vision, it has quickly evolved into a beacon for global crypto elites. The Golden Visa program makes Dubai a true crypto hub, and the recent removal from the FATF grey list boosts its legitimacy. Blockchain already powers many government services, and Dubai’s lifestyle, combined with its regulatory boldness, makes it feel like a true crypto capital.

Singapore remains the disciplined player. Globally respected, politically stable, and tech-forward, it offers unmatched safety and regulatory maturity. Yet, its cautious stance—especially on retail-facing crypto advertising—keeps the cultural vibe reserved.

CBDC and Stablecoin Experimentation: The Innovation Race

In the competition to become the leading crypto hub, it’s not enough to just regulate—you’ve got to innovate. What is a crypto hub without experimentation? And that’s exactly what these regions are doing through bold experimentation with CBDCs and stablecoins.

Hong Kong is firing on all cylinders. The e-HKD pilot, launched in 2023 by the Hong Kong Monetary Authority (HKMA), is testing advanced use cases like programmable payments, tokenized deposits, and cross-border remittances. In May 2025, Hong Kong passed the Stablecoin Ordinance, with licensing requirements set to take effect by August. Adding its wholesale CBDC work through Project Ensemble and experimentation with AI-finance sandboxes, Hong Kong appears both regulatory and experimental.

The UAE isn’t far behind. Its Digital Dirham, expected by late 2025, is designed to boost real-time settlements, especially in trade finance. Through mBridge, the UAE partners with China, Thailand, and the BIS to explore the use of cross-border CBDCs. Meanwhile, the DFSA has already recognized USDC and EURC as regulated tokens—setting a precedent for stablecoin legitimacy.

Singapore is taking a measured yet forward-looking approach to digital currency innovation. Through Project Orchid, it is exploring retail-focused CBDC use cases, including 2024 pilots of Purpose-Bound Money (PBM) with firms like Grab, enabling tokenized retail vouchers and programmable payments. In the stablecoin space, XSGD, launched by StraitsX in 2020, stands out for being fully backed 1:1 by reserves held with DBS Bank and Standard Chartered. StraitsX is licensed by the Monetary Authority of Singapore (MAS) as a Major Payment Institution, giving XSGD regulatory legitimacy and multi-chain deployment capabilities. Since Q3 2022, XSGD has consistently recorded quarterly transfer volumes exceeding $200 million, highlighting strong market confidence.

This trust is further supported by MAS’s August 2023 stablecoin regulatory framework, which sets strict rules for issuer reserves, asset segregation, and custody. Singapore’s careful blend of innovation and regulation positions it as a trusted leader in retail digital finance. Is Singapore a crypto-friendly country? When it comes to retail trust and innovation, yes—quietly so.

Final Scorecard

So Who’s Winning the Crypto Crown in 2025?

As the digital dust settles in 2025, the race to become the world’s leading crypto hub has transformed into a fierce contest of execution, vision, and adaptability. From regulation to innovation, each contender, Hong Kong, the UAE, and Singapore, has carved out a distinct identity in the global crypto landscape.

Hong Kong stands out as one of the most remarkable comeback stories. It has successfully blended regulatory clarity with bold innovation. With the ASPIRe roadmap, a robust stablecoin licensing regime, and CBDC pilots backed by financial giants, Hong Kong isn’t just reopening its doors—it’s reinventing its crypto economy. Add to that new tax incentives and deep institutional interest, and the city positions itself as the nexus of East-meets-West capital and regulation.

The UAE brings unmatched tax advantages, capital freedom, and cultural momentum. Its early mover status with VARA, plus the rapid rollout of the Digital Dirham and mBridge collaborations, shows that it’s not just a playground for crypto elites—it’s serious about building a compliant, innovative ecosystem. Dubai’s allure as a lifestyle and business destination only strengthens its appeal as a crypto magnet.

Singapore, while less flashy, plays the long game with methodical precision. Its cautious stance on retail exposure and advertising might limit immediate hype. Still, its global respect, financial discipline, and consistent support for tokenization through Project Orchid and GFTN keep it firmly in the game.

Verdict: In 2025, Hong Kong wears the crown—fast, fearless, and institutionally backed. The UAE is the closest challenger, offering freedom, tax power, and a compelling lifestyle. Singapore remains a silent force, disciplined, stable, and always a contender in the long run. The global crypto race isn’t over, but the frontrunners are now unmistakably clear.

Disclaimer: This article is intended solely for informational purposes and should not be considered trading or investment advice. Nothing herein should be construed as financial, legal, or tax advice. Trading or investing in cryptocurrencies carries a considerable risk of financial loss. Always conduct due diligence.

If you want to read more market analyses like this one, visit DeFi Planet and follow us on Twitter, LinkedIn, Facebook, Instagram, and CoinMarketCap Community.

Take control of your crypto portfolio with MARKETS PRO, DeFi Planet’s suite of analytics tools.”