This week in crypto, the U.S. finally woke up to its crypto innovation gap with SEC Chair Paul Atkins introducing an “innovation exemption” to bring builders back home.

Across the globe, regulators tightened their vice grip, hackers faced justice, and the crypto market roared back to life, hitting $4 trillion. Crypto, this week, has proven again that it never sleeps.

If you haven’t subscribed, now’s the perfect time to hit that button and stay up-to-date with the latest news in Web3.

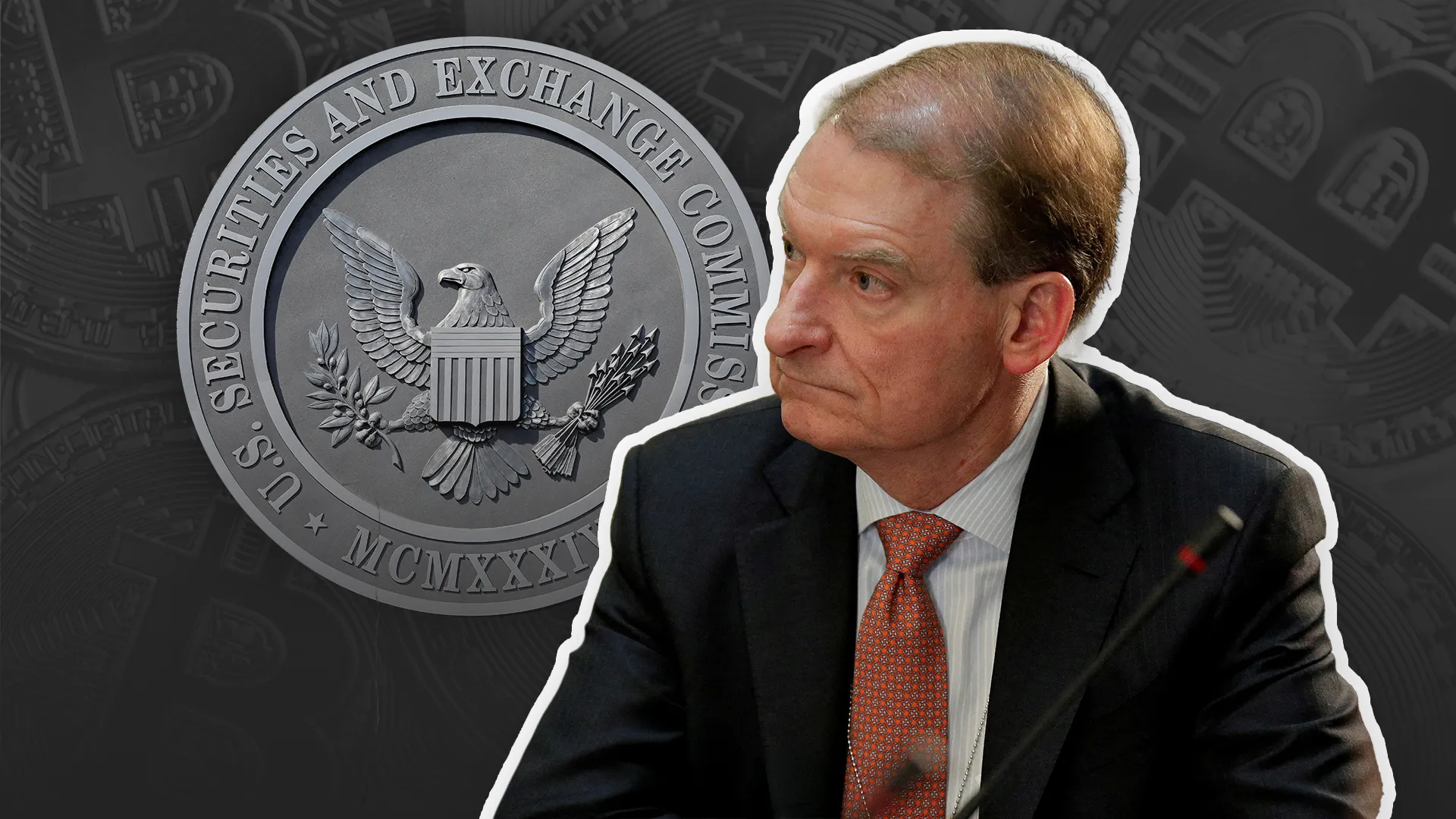

SEC Chair Paul Atkins Says U.S. Is “10 Years Behind” in Crypto, Plans Innovation Exemption

U.S. SEC Chair Paul Atkins has admitted that the United States is “probably 10 years behind” in cryptocurrency innovation, pledging to close the gap by creating a more welcoming regulatory environment. Speaking at DC Fintech Week, Atkins said the SEC’s priority is to attract innovators back to the country, emphasizing a new openness toward digital assets. “We want a strong framework that attracts people who may have fled,” he stated.

To drive this change, Atkins revealed plans for an “innovation exemption” that allows safe experimentation with blockchain projects while maintaining investor protection. He also backed the development of regulated financial superapps, signaling a broader shift toward modernization and cross-agency coordination in U.S. financial regulation.

Other News Making Waves

- Bank of England Deputy Governor Sarah Breeden said proposed stablecoin limits are temporary safeguards, designed to ensure a stable transition to digital assets, with a public consultation to refine caps and exemptions before year-end. (More)

- The U.S. Department of Justice has charged Prince Group founder Chen Zhi, accusing him of running a multi-billion-dollar crypto investment fraud and human trafficking ring in Cambodia, in one of the largest crypto crime cases in U.S. history. (More)

- OKX has frozen accounts linked to Huione Group, following its designation by the U.S. Treasury as a major money laundering concern, citing ties to billions in illicit crypto flows connected to scams, trafficking, and cybercrime. (More)

- WazirX has received Singapore High Court approval for its restructuring plan after a $234 million Lazarus-linked hack, clearing the path for user repayments. (More)

- Circle has ruled out launching a Hong Kong dollar-backed stablecoin, focusing instead on expanding the reach of USDC and EURC, while maintaining its Singapore license and evaluating a potential office in Hong Kong. (More)

- Hyperliquid CEO Jeff Yan has called out centralized exchanges like Binance for underreporting liquidations by up to 100x, urging the industry to embrace full onchain transparency, neutrality, and verifiability. (More)

- The global crypto market cap has rebounded above $4 trillion after a sharp sell-off, with Ether, BNB, and Dogecoin surging over 10% in 24 hours, as institutional players like BitMine bought the dip. (More)

Around the World: Bold Moves and Regulations

- Australia will expand AUSTRAC’s powers to oversee crypto ATMs, as scam-related losses surge nationwide, with new transaction limits and stricter compliance rules introduced to combat fraud and illicit activity. (More)

- New York City has launched the first-ever municipal Office of Digital Assets and Blockchain, appointing Moises Rendon as executive director, to drive crypto adoption, policy innovation, and public-private collaboration across the city. (More)

- Japan’s SESC will gain authority to investigate and penalize crypto insider trading, as the FSA prepares a new framework by 2026, with pro-tech leadership under Sanae Takaichi. (More)

- Bhutan has become the first country to migrate its National Digital Identity system to the Ethereum blockchain, marking a historic leap from Hyperledger Indy to Polygon and now Ethereum, as part of its “Digital Drukyul” vision. (More)

- Kenya’s parliament has passed the Virtual Asset Service Providers Bill, creating the country’s first crypto regulatory framework, with the Central Bank overseeing stablecoins and the Capital Markets Authority regulating exchanges. (More)

- Poland has accused Russia of using cryptocurrencies to finance espionage and sabotage across Europe, with officials citing GRU-linked networks funded through digital assets, as Warsaw drafts new legislation to tighten oversight and block crypto-based covert operations. (More)

Market Trends: Winners and Losers

Top 5 Gainers 📈

According to data from CoinGecko, these are the five biggest gainers of the week:

- BNB Attestation Service +505.82%, from $0.02310077 to $0.139914

- Nockchain +244.56%, from $0.02292923 to $0.079003

- KGeN +95.94%, from $0.198291 to $0.388650

- ChainOpera AI +223.66%, from $6.72 to $21.75

- Zerebro +263.67%, from $0.01115190 to $0.04056144

Top 5 Losers 📉

According to data from CoinGecko, the five biggest losers of the week are:

- DORA −63.91%, from $0.137923 to $0.04977281

- Paparazzi Token −61.95%, from $0.03005728 to $0.01144005

- Kava −7.78%, from $0.171857 to $0.158471

- Railgun −16.87%, from $3.32 to $2.76

- Camp Network −17.05%, from $0.02020977 to $0.01676589

Project Spotlight

CoinLander Bridges Real Estate and DeFi with Mortgage-Backed Crypto Yields

CoinLander has launched a blockchain platform that converts real-world mortgage assets into tokenized crypto investments, offering investors over 6% APR backed by verified property liens. Founded by RΞN, a 20-year asset management veteran, the platform blends traditional finance and DeFi, enabling users to earn stable, real-estate–secured returns through an automated system. Investors fund pools with USDT, receive monthly interest from mortgage repayments, and can track yield and loan data transparently on-chain.

Why It Matters:

By tying blockchain yields to tangible real estate assets, CoinLander introduces stability, transparency, and trust to the DeFi space, signaling a major step toward sustainable Real World Asset (RWA)-backed crypto income.

Disclaimer: This article is intended solely for informational purposes and should not be considered trading or investment advice. Nothing herein should be construed as financial, legal, or tax advice. Trading or investing in cryptocurrencies carries a considerable risk of financial loss. Always conduct due diligence.

If you want to read more market analyses like this one, visit DeFi Planet and follow us on Twitter, LinkedIn, Facebook, Instagram, and CoinMarketCap Community.