A world where you can buy, sell, or share things online without needing a big company in the middle, that is the promise of Web3, and the rate at which it is advancing is one of exponential proportions. From finance to healthcare, the benefits across industries are immense.

Experts have reputed the technology as the future of the internet, and while such pronouncements might indicate a radical disruption in the status quo, others have called it a gimmick. It aims to give people more control over their data, money, and online activities by removing intermediaries, or “middlemen.” But is this new system truly fair, or are we just replacing old gatekeepers with new ones?

Understanding Web3 and Disintermediation

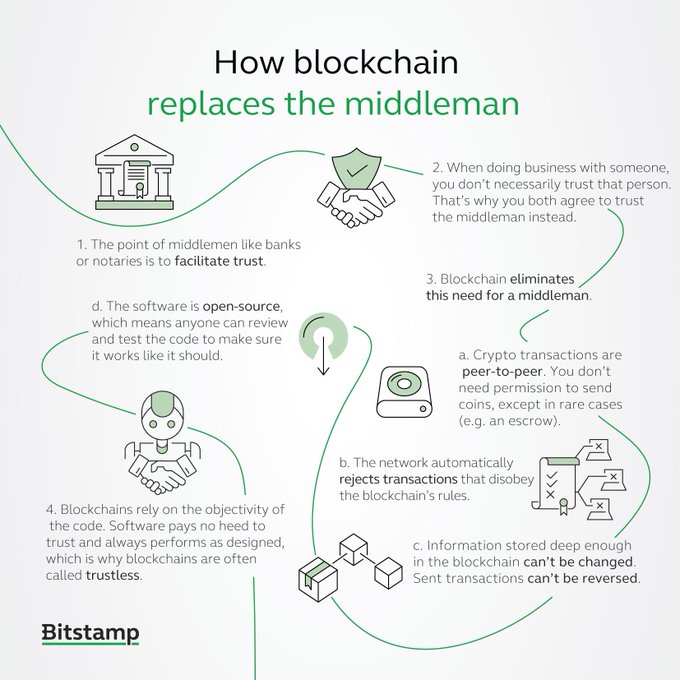

Web3 is the next big upgrade of the internet, and it’s all about decentralization, which means spreading power and control out instead of putting it all in one place. Right now, on Web2, big companies like Facebook, Google, or Amazon act as Web3 middlemen. They own your data, track what you do, and make money off your information by selling it to advertisers. You don’t really have a say, and you don’t get paid for your own data.

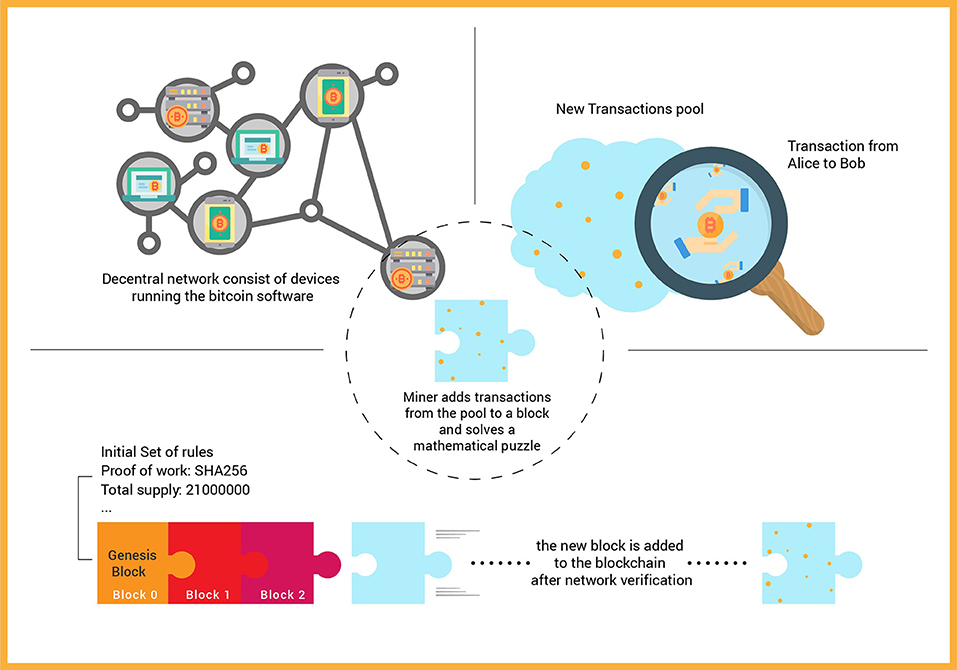

Web3 wants to change that through something called disintermediation. That’s just a fancy word for “removing the middlemen.” Instead of using big tech companies to connect, Web3 uses blockchain, and lets people trade, share, and work together directly, without needing someone in the middle to manage everything. The idea is that if we cut out the middlemen, we can build a fairer, more open internet where users have more control and can earn rewards for their time, data, or creativity.

But it’s not all perfect and even in this new world, there can still be hidden power groups, like early investors or developers, who hold lots of tokens or influence. These are sometimes called protocol gatekeepers, and they can shape how things run behind the scenes. This brings up big questions about crypto power structures and how we make sure Web3 stays fair for everyone, not just the people who got in early or have the most money.

This is where Web3 economics and decentralization ethics come in. We need to think carefully about who has power, how decisions are made, and how to create systems that work for everyone, not just a lucky few. So while Web3 is full of exciting ideas, we still need to watch out for new kinds of gatekeepers and make sure the system stays truly open and just.

The Promise of Decentralization

Decentralization is one of the most important ideas behind Web3. Instead of putting all the power into the hands of one company, government, or organization, Web3 spreads it out across many different users and computers in a network. This helps stop any single person or group from becoming too powerful or controlling everything. It’s kind of like a group project where everyone gets a say and no one boss is calling all the shots.

This makes things more democratic, meaning everyone has a voice. In Web3 systems, users can vote on decisions, help run platforms, and even suggest changes. This is very different from how things work today with big companies like banks or social media platforms that make all the decisions for you.

A good example is decentralized finance (DeFi). Normally, if you wanted to borrow or lend money, you’d go to a bank. But in DeFi, you can do this directly with other people online—no bank needed. Smart contracts (which are like computer programs that run automatically) make sure the deals are fair, safe, and follow the rules. This cuts out the middleman and gives people more control over their own money.

Decentralization also helps build trust. Because everything is recorded on the blockchain—a kind of digital notebook that everyone can see but no one can change—people know the system is open and honest. As Web3 grows, this new way of sharing power and making decisions could change not just how we use the internet, but how we think about money, ownership, and community.

New Gatekeepers in the Web3 Ecosystem

Despite its goals, Web3 isn’t entirely free from centralization. Certain entities, like protocol developers and large token holders, can exert significant influence over decentralized platforms. These “protocol gatekeepers” can shape the direction of projects and make decisions that affect the entire community. This raises concerns about whether Web3 is truly decentralized or if it’s creating new forms of centralized power.

Economic Implications of Web3

Web3 brings fresh ideas about how people can make and share money online. One of the biggest changes is that creators, like artists, gamers, or writers can earn money directly from their fans or users. They don’t have to depend on big platforms like YouTube or Spotify, which usually take a big chunk of the profits. This is called a new economic model, and it gives people more control over their work and earnings.

But even though this sounds fairer, Web3 economics still has some problems. One issue is that the people who got into Web3 early; called early adopters or those who already had a lot of money, were able to buy up a lot of tokens (which are like digital coins or shares). Because of this, they often get more power and more say in how projects are run. This creates something called crypto power structures, where some users end up with way more control than others.

Even though Web3 tries to remove middlemen, sometimes new kinds of middlemen appear. These are called protocol gatekeepers, people or groups who control the tools and rules of a Web3 platform. For example, they might decide who can join a project, how tokens are shared, or what upgrades get approved. So while Web3 wants to be open and fair, it can still end up with gatekeepers who have a lot of influence, just like in the old internet.

This shows that decentralization ethics; the idea of keeping power truly spread out are super important. If Web3 is going to create a better internet, it needs to make sure that everyone, not just a few, can succeed and have a voice. As Blockchain Magazine explains, the goal isn’t just to get rid of the old middlemen—it’s to make sure we don’t create new ones in their place.

Ethical Considerations in Decentralization

Decentralization brings ethical challenges and without centralized moderation, harmful content can spread more easily. Additionally, the lack of regulation can lead to scams and fraudulent activities. Balancing freedom with responsibility is crucial to ensure that decentralized platforms are safe and inclusive for all users.

Striving for True Decentralization

Web3 holds the potential to create a more equitable and user-driven internet by removing intermediaries and giving everyday people more control over their data, money, and online identity. Instead of relying on big tech companies to manage everything, Web3 allows users to connect directly, share value, and even help shape the platforms they use. This is a big step toward digital freedom and fairness, but while the idea of a fully open and decentralized web is exciting, we have to be careful.

Even in Web3, new gatekeepers can appear—like developers or early investors who hold a lot of tokens or make key decisions for a platform. These protocol gatekeepers might not wear suits or run giant companies, but they can still have too much power. That’s why it’s important to keep asking tough questions about who really controls what and to make sure Web3 economics doesn’t just repeat the same inequalities found in Web2.

To reach the true promise of Web3, we need to push for systems that are fair, open, and built on ethical decentralization. This means creating rules and tools that let everyone participate, not just the wealthy or well-connected. It also means promoting transparency, where decisions are made in the open, and fair distribution, where the benefits of a project are shared with its community, not just a few at the top.

Web3 is still growing, and we all have a role to play in shaping its future. If we get it right, we can build an internet where creativity, ownership, and opportunity are truly for everyone—not just the new digital elite.

Disclaimer: This article is intended solely for informational purposes and should not be considered trading or investment advice. Nothing herein should be construed as financial, legal, or tax advice. Trading or investing in cryptocurrencies carries a considerable risk of financial loss. Always conduct due diligence.

If you want to read more market analyses like this one, visit DeFi Planet and follow us on Twitter, LinkedIn, Facebook, Instagram, and CoinMarketCap Community.

Take control of your crypto portfolio with MARKETS PRO, DeFi Planet’s suite of analytics tools.”