Quick Breakdown

- Crypto ETPs recorded $3.17 billion inflows despite a massive flash crash.

- Trading volumes hit a record $53 billion, with Bitcoin funds leading inflows.

- Ether and altcoin funds saw slower inflows amid market uncertainty.

Crypto investment funds hold strong despite flash crash

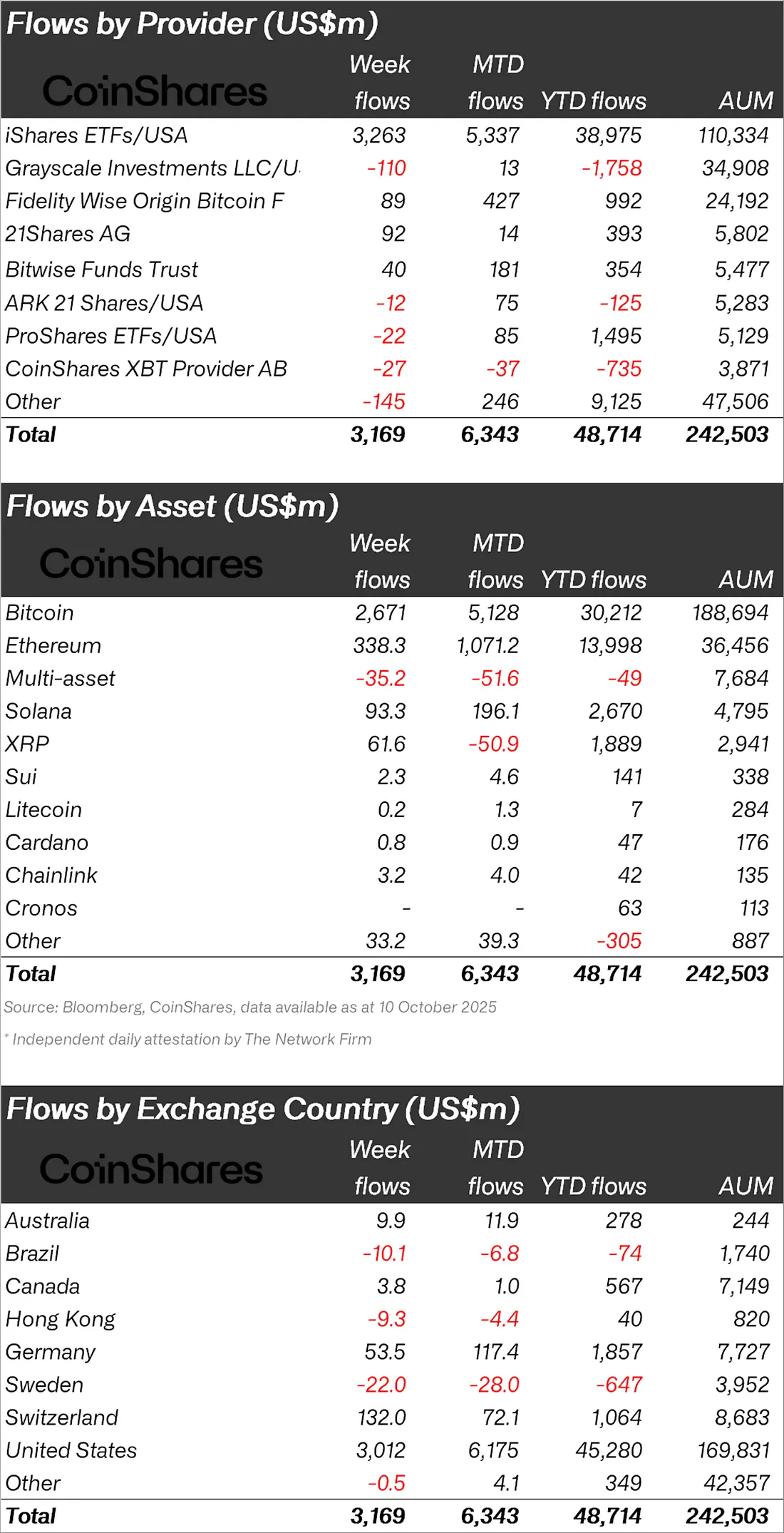

Cryptocurrency investment products remained resilient amid last Friday’s flash crash, attracting significant capital inflows even as global markets reeled from renewed trade tensions. According to CoinShares’ weekly report published on Monday, crypto exchange-traded products (ETPs) recorded $3.17 billion in inflows over the past week signaling strong investor confidence despite a $20 billion market liquidation.

James Butterfill, CoinShares’ head of research, noted that Friday’s sell-off had only a limited effect on investor sentiment. “Friday saw little reaction with a paltry $159 million outflows,” he said, highlighting the sector’s resilience to the panic triggered by new China tariff treats from U.S. President Donald Trump.

Year-to-date, total inflows have climbed to $48.7 billion, surpassing the entire inflow figure for 2024.

Trading volumes soar to all-time highs

CoinShares also reported that trading activity surged to unprecedented levels, with weekly volumes reaching $53 billion, including $15.3 billion traded on Friday alone. Despite the inflows, total assets under management (AUM) slipped from $254 billion to $242 billion week-over-week as market valuations fell.

Bitcoin funds dominated the scene, securing $2.7 billion in inflows, pushing year-to-date totals to $30.2 billion — though still roughly 30% lower than last year’s record $41.7 billion. Butterfill added that Friday marked the highest daily trading volume ever for Bitcoin funds at $10.4 billion.

Ether leads outflows while Altcoin momentum slows

While Ether investment products brought in $338 million in inflows over the week, they suffered the largest single-day outflow on Friday at $172 million. Altcoin-focused funds also saw reduced interest compared to previous weeks. Solana products drew $93.3 million, and XRP funds added $61.6 million, both significantly lower than the prior week’s $706.5 million and $219 million, respectively.

U.S. shutdown delays ETF flood

With the U.S. government shutdown entering its third week, at least 16 pending crypto ETF applications remain in limbo. ETF analyst and NovaDius Wealth Management president Nate Geraci predicted a “flood” of new spot crypto ETFs once the shutdown ends, potentially unlocking a fresh wave of institutional demand.

If you want to read more news articles like this, visit DeFi Planet and follow us on Twitter, LinkedIn, Facebook, Instagram, and CoinMarketCap Community.

“Take control of your crypto portfolio with MARKETS PRO, DeFi Planet’s suite of analytics tools.”