Quick Breakdown

- BitMine Immersion Technologies purchased 104,336 ETH worth $417 million, expanding its Ethereum holdings.

- The firm now holds 3.03 million ETH (≈$12.2 billion) as part of its goal to control 5% of Ethereum’s total supply.

- Chairman Tom Lee predicts ETH could reach $10,000–$12,000 by year-end, citing “true price discovery.”

BitMine Immersion Technologies has deepened its Ethereum exposure, purchasing 104,336 ETH valued at roughly $417 million, according to blockchain data from Lookonchain. The acquisition marks the latest in a series of aggressive accumulation moves by the firm as it aims to secure a significant stake in the world’s second-largest cryptocurrency.

BitMine targets 5% of ethereum’s total supply

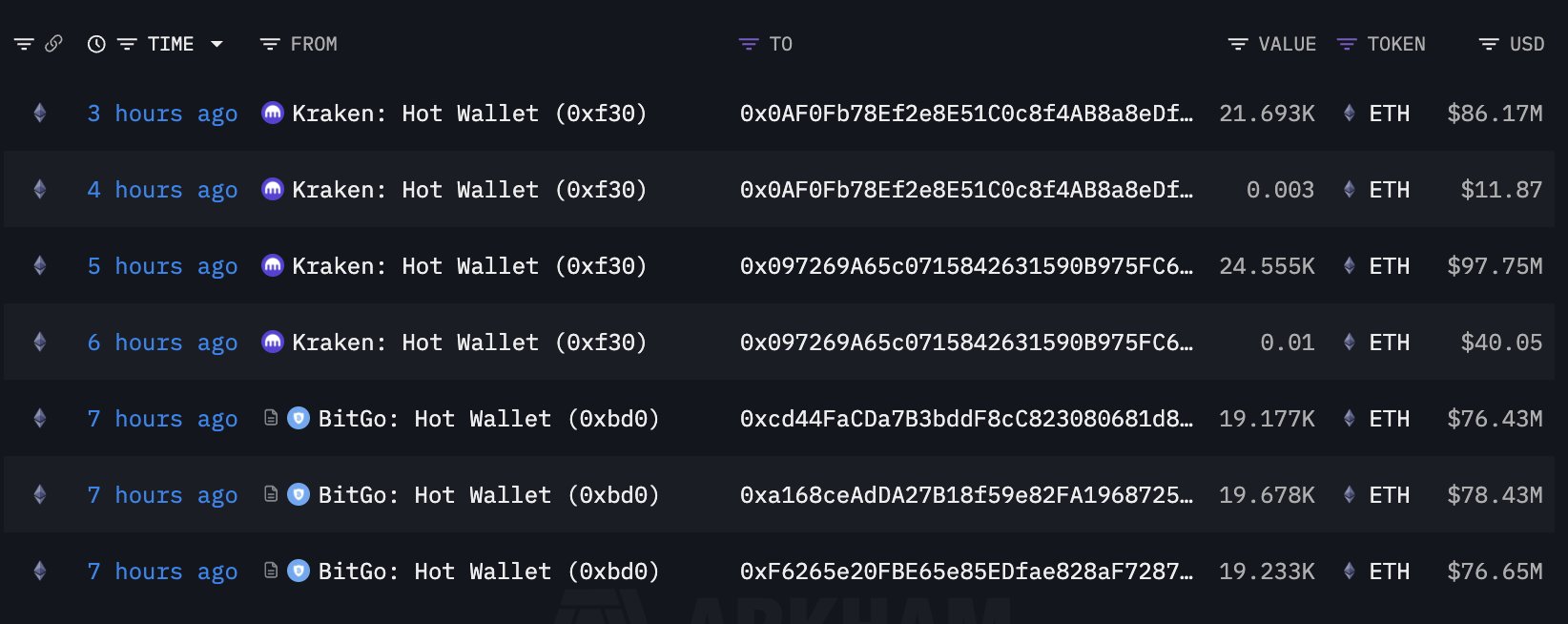

The new batch of ETH reportedly arrived in three fresh addresses via seven transactions sourced from wallets linked to Kraken and BitGo, though BitMine has not publicly confirmed the transfers. With this addition, the company’s total holdings have now reached approximately 3.03 million ETH, worth an estimated $12.2 billion.

The accumulation aligns with BitMine’s long-term strategy to control about 5% of Ethereum’s total circulating supply, a move analysts say could strengthen ETH’s liquidity role within institutional markets. The company’s chairman, Tom Lee, a well-known crypto advocate, has consistently emphasized Ethereum’s potential to serve as a key digital asset in future financial systems.

Lee pojects ETH to hit $10,000–$12,000

Speaking on a recent podcast, Lee predicted that Ethereum could reach between $10,000 and $12,000 before the end of the year, describing the anticipated rally as a phase of “true price discovery.” He noted that BitMine’s latest acquisition follows a similar accumulation during a recent market downturn, when the company spent over $827 million buying ETH amid a weekend selloff that wiped out $19 billion in leveraged positions.

That timing, according to blockchain analysts, reflected BitMine’s strategic entry during heightened market fear — a signal of the firm’s long-term conviction in Ethereum despite short-term volatility.

Meanwhile, Bit Digital has unveiled plans to raise $100 million through a convertible senior note offering, with an optional $15 million extension. The proceeds will fund additional ETH acquisitions and broader corporate expansion, signaling that institutional appetite for Ethereum exposure remains strong despite recent market turbulence.

If you would like to read more articles like this, visit DeFi Planet and follow us on Twitter, LinkedIn, Facebook, Instagram, and CoinMarketCap Community.

Take control of your crypto portfolio with MARKETS PRO, DeFi Planet’s suite of analytics tools.”