TRON is rapidly cementing its position at the center of the global stablecoin economy, with over 8.29 million USDT transactions recorded on-chain during the week ending August 3, 2025. The surge marks a new milestone for the network and underscores its rising relevance as both a retail and institutional settlement layer.

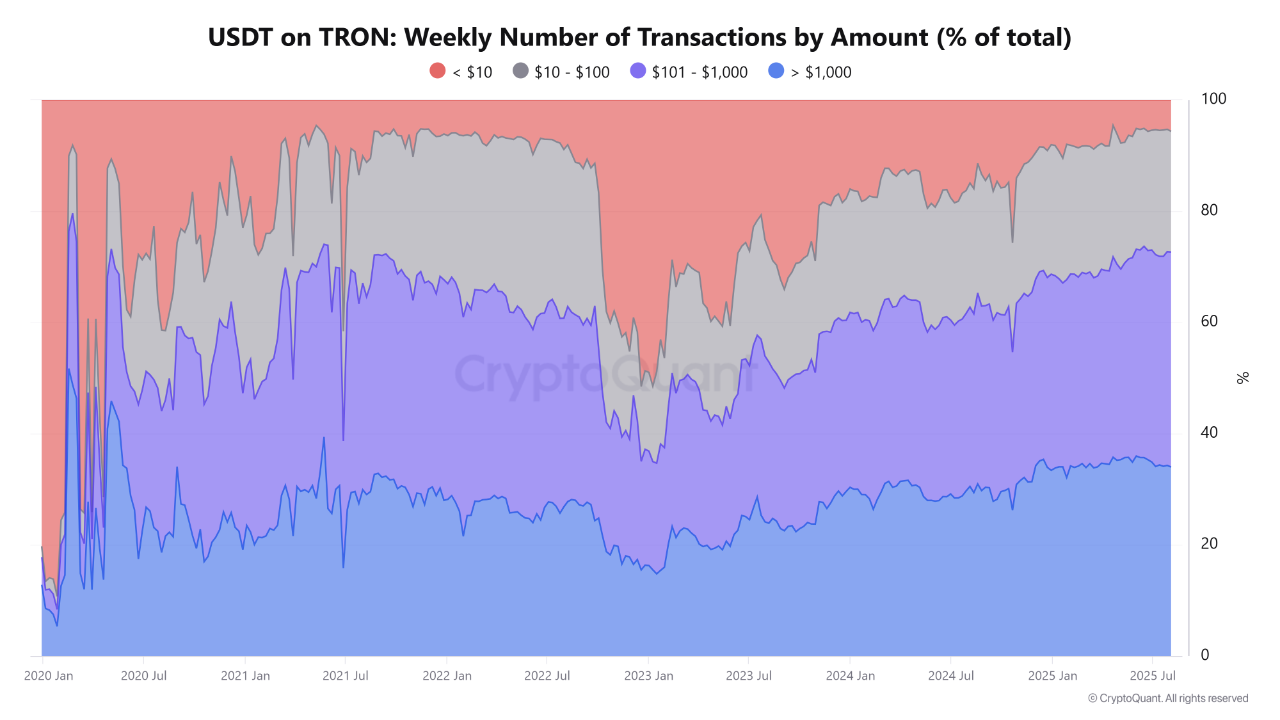

Mid-sized transfers between $101 and $1,000 made up the largest share of activity (38.66%), pointing to strong adoption among freelancers, e-commerce vendors, and remittance corridors. Transactions exceeding $1,000 nearly one-third of the total highlight growing traction among professional traders, high-net-worth individuals, and potentially institutional players.

Microtransactions below $10, meanwhile, accounted for just 5.63% of weekly activity, a notable drop that signals a shift away from low-value or test transactions toward high-utility, real-world use cases.

This transaction breakdown illustrates TRON’s dual-purpose evolution: while Ethereum maintains dominance in large institutional transfers, TRON is positioning itself as the de facto network for high-frequency, real-economy payments, offering low fees and rapid settlement. Analysts view this as a sign of TRON’s growing utility across cross-border payrolls, DeFi applications, and crypto-native commerce.

Momentum accelerated further following the passage of the GENIUS Act on July 18, the first U.S. federal law establishing a regulatory framework for payment stablecoins. Just days after the bill was signed, $1 billion in USDT was minted on TRON, pushing its USDT supply to over $83 billion, more than 51% of the total USDT in circulation globally.

The GENIUS Act has provided the regulatory clarity needed to drive institutional stablecoin adoption in the U.S., and TRON appears poised to benefit most. With demand for tokenized dollars on the rise, TRON’s infrastructure now stands at the forefront of a digitized global dollar economy.

Meanwhile, on-chain signals from CryptoQuant suggest Bitcoin could be nearing a bullish trend reversal, with narrowing gaps between perpetual and spot prices on Binance — a key indicator of market sentiment shift.

If you want to read more news articles like this, visit DeFi Planet and follow us on Twitter, LinkedIn, Facebook, Instagram, and CoinMarketCap Community.

“Take control of your crypto portfolio with MARKETS PRO, DeFi Planet’s suite of analytics tools.”