Chainlink (LINK) has recently shown strong signs of bullish momentum driven by intensified whale accumulation and robust network growth, painting an optimistic outlook for investors eyeing a potential surge to $30 and beyond. With a market capitalization of approximately $16.62 billion and a circulating supply of 678.1 million LINK tokens, Chainlink ranks as the 11th largest cryptocurrency.

Recent market dynamics, supported by institutional partnerships and whale accumulation, suggest a robust trajectory toward a $30 price target by late 2025. This analysis unpacks Chainlink’s market performance, technological prowess, and the catalysts propelling its ascent, while scrutinizing potential impediments.

Market Behaviour and Whale Movement

Since mid-August 2025, the Chainlink ecosystem has witnessed remarkable whale activity characterized by the aggregation of over 1.29 million LINK tokens, valued at approximately $31 million, concentrated in a single address following multiple large transactions from Binance.

This pattern of accumulation commonly precedes upward price pressure as liquidity tightens on exchanges, limiting supply availability for speculative selling. LINK faced resistance near $24-$26 after briefly peaking at $26, underscoring resilience amid volatility. However, the intensity of whale participation in such a condensed timeframe notably signals investor conviction at these levels, opening doors for a potent breakout toward the $30 Fibonacci extension target.

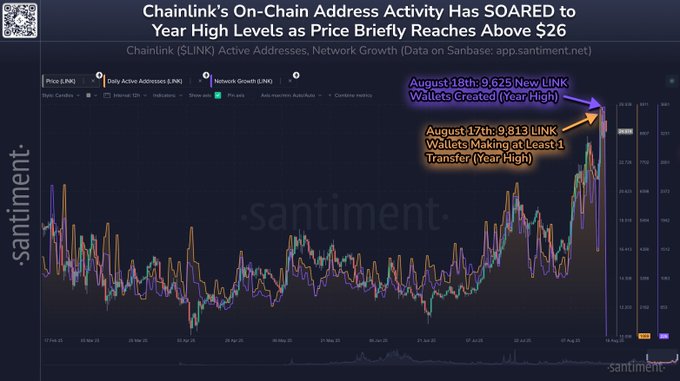

At the same time, over 9,600 new wallets have been created within just two days, marking record network expansion and reflecting increased adoption and awareness. This influx not only broadens Chainlink’s base of active users but also signals growing ecosystem maturity, a critical catalyst in reinforcing long-term price dynamics through network effects.

Catalysts of Growth: Institutional Alliances and Whale Frenzy

Chainlink’s rise is fueled by strong partnerships and heavy whale activity. Major financial institutions, including Mastercard, J.P. Morgan’s Kinexys, SWIFT, and Euroclear, have embraced Chainlink’s infrastructure to bridge TradFi with DeFi.

ALSO READ: TradFi Blockchain Adoption: Why Big Players are Embracing the Future

The partnership with the Intercontinental Exchange (ICE), parent of the NYSE, aims to integrate forex and precious metals data on-chain, tapping into a $7.5 trillion daily FX market. Additionally, Turkey’s Misyon Bank leverages Chainlink’s Proof of Reserve for tokenized asset audits, cementing its role in the burgeoning real-world asset (RWA) market, projected to reach $30 trillion by 2030.

Whale accumulation further amplifies Chainlink’s momentum. Over 1.29 million LINK tokens, valued at $31 million, were amassed in just four days, with 300,000 LINK withdrawn from Binance in two months, reducing sell-side pressure. Network activity has surged to an eight-month peak, with 6,400 daily wallets and 9,625 new wallets created in two days, reflecting robust adoption. The Chainlink Reserve, launched in Q2 2025, holds over 150,000 LINK, funded by enterprise revenue and token buybacks, ensuring long-term demand stability.

READ ALSO: A Closer Look at Chainlink’s CCIP: Could Blockchain Interoperability Finally Become the Norm

Macro and Micro Drivers: Institutional Partnership and Network Expansion

Chainlink’s resilience is driven by its growing role as an essential oracle provider to the DeFi space and broader financial ecosystems. The network’s total value secured (TVS) recently surpassed $93 billion, mainly concentrated on Ethereum, highlighting the prevailing integration of Chainlink’s oracle services with high-value smart contracts. This achievement spotlights Chainlink’s expanding footprint and technological indispensability.

Strategic collaborations amplify Chainlink’s long-term prospects. Notably, partnerships with the Intercontinental Exchange (ICE), parent company of the New York Stock Exchange, aim to integrate Chainlink’s oracle technology into forex and metals trading platforms. This convergence of traditional finance with decentralized data oracles exemplifies Chainlink’s bridging of blockchain data with real-world asset tokenization, fostering wider acceptance and institutional trust.

Furthermore, Chainlink’s Reserve system, currently holding over 109,000 LINK tokens valued at approximately $2.7 million, plays a pivotal role in enhancing token scarcity and value retention, reflecting prudent network economics intended to bolster tokenomics for investors.

Expert Insights and Trader Strategies

Market commentators emphasize the importance of whale behaviour as a reliable sentiment barometer. The recent sharp dip in wallets holding between 100,000 and 1,000,000 LINK tokens indicates a selective rebalancing by institutional investors amid price consolidation phases. Traders are advised to monitor these onchain dynamics closely, as changes in large holder positions can presage shifts in market direction.

Technical analysts highlight that maintaining key support levels alongside a steady increase in wallet addresses will be essential for sustained bullish momentum. Additionally, traders are encouraged to leverage algorithmic trading bots that analyze on-chain data, social trends, and volume spikes to optimize entry points and manage risk in this volatile environment.

Potential Risks and Market Sentiment

While the network and price indicators position Chainlink for further gains, caution remains warranted. The heavy whale accumulation exposes the market to possible sharp sell-offs, which can trigger transient corrections. Broader market uncertainty, influenced by geopolitical tensions and regulatory developments, continues to inject volatility into the crypto landscape.

Nevertheless, Chainlink’s fundamental strength as a cornerstone provider of secure price oracles and decentralized data feeds for hundreds of DeFi applications helps mitigate downside risks. Its adaptability in expanding into traditional asset data streams, incorporating assets like Apple and Nvidia stocks, illustrates its intent to capture liquidity from diverse financial sectors.

Closing Thoughts: Navigating Chainlink’s Trajectory

Chainlink’s recent price appreciation and network expansion position it at a critical juncture for crypto investors. Whale accumulation and wallet growth underscore renewed bullish interest, while technical patterns set the stage for an ambitious move beyond $30. Strategic partnerships with traditional finance players and the continual enhancement of Oracle technology further secure Chainlink’s status as a vital infrastructure provider in the blockchain ecosystem.

For traders and investors, the key is to watch for a clear breakout above immediate resistance levels and to stay informed about whale movements that could signal shifts in market momentum. As Chainlink evolves with the DeFi sector’s growth, it remains a compelling asset for those seeking exposure to blockchain’s integration with real-world finance.

Disclaimer: This article is intended solely for informational purposes and should not be considered trading or investment advice. Nothing herein should be construed as financial, legal, or tax advice. Trading or investing in cryptocurrencies carries a considerable risk of financial loss. Always conduct due diligence.

If you would like to read more articles like this, visit DeFi Planet and follow us on Twitter, LinkedIn, Facebook, Instagram, and CoinMarketCap Community.

Take control of your crypto portfolio with MARKETS PRO, DeFi Planet’s suite of analytics tools.”