Flowdesk, a renowned French-based digital asset market maker, has raised $50 million in a Series B funding round to bolster its operations.

The investment round was led by venture capital company Cathay Innovation and comprised contributions from Ripple, Eurazo, Speedinvest, Cathay Ledger Fund, BPI, and ISAI. Flowdesk aims to use the funds to expand its over-the-counter (OTC) provision, hire new staff, and grow its regulatory coverage in the United States and Singapore.

This Series B funding follows Flowdesk’s earlier achievement of raising $30 million in its Series A round on June 6, 2022. The previous round was spearheaded by Eurazeo and Aglaé Ventures, with the involvement of 20 angel investors and 15 venture capitalists.

Flowdesk, along with Jane Street, Flow Traders, and Virtu, recently became liquidity providers for Grayscale’s approved spot Bitcoin ETF. As part of this role, it controls the trading of Bitcoin, contingent on investors establishing or redeeming shares of the exchange-traded fund.

Bitcoin ETF shares, unlike mainstream cryptocurrency trading, don’t settle transactions on the same day; every trade has to be pre-funded by liquidity providers. The pre-funding requirement implies that liquidity providers like Flowdesk must apportion funds to cover the trades. This procedure ensures that the platform has sufficient funds to complete transactions, thus reducing the possibility of default. Furthermore, this requirement aligns with the more structured and regulated approach, which is the standard of mainstream financial markets, compared to the instant and distributed nature of cryptocurrency trading.

Besides being one of Grayscale Bitcoin Trust Shares (GBTC) liquidity providers, Flowdesk is also one of Societe Generale’s (GLE) market makers for its EUR-based stablecoin, EUR CoinVertible (EURCV).

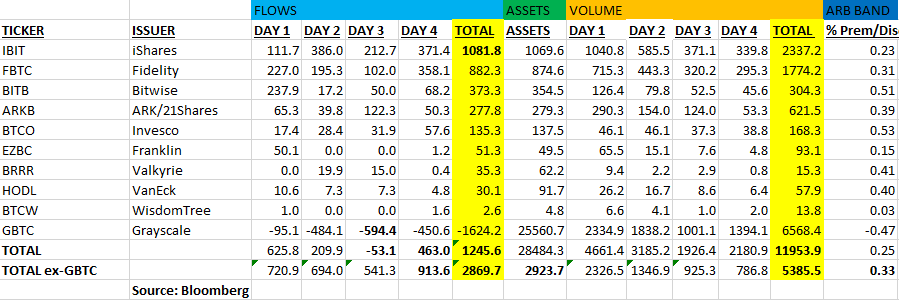

On the other hand, Grayscale’s Bitcoin Trust Shares (GBTC) have been underperforming since its launch last Thursday. According to fourth-day data for trading volumes, it recorded a staggering $450.6 million in outflows, as reported by Bloomberg analyst Eric Balchunas on X, making its total outflow about $1.6 billion for that period.

If you want to read more news articles like this, visit DeFi Planet and follow us on Twitter, LinkedIn, Facebook, Instagram, and CoinMarketCap Community.

“Take control of your crypto portfolio with MARKETS PRO, DeFi Planet’s suite of analytics tools.”