Profiting from the volatile cryptocurrency market is all about timing, as well as having access to sound trading strategies and technical analysis. With so many cryptocurrencies to choose from and markets open 24/7, new traders may face a steep learning curve as well as a higher risk of losing money.

Many traders turn to cryptocurrency trading bots and software platforms to address these issues. These bots allow traders to trade automatically at any time and often include features that help traders improve and fine-tune their strategies. In fact, many traders may not realize that they are already competing against bots in the highly volatile crypto market.

This article comprehensively compares the top crypto trading bots available today, highlighting their standout features, pros, and cons.

TL:DR

- Cryptocurrency trading bots can be a powerful resource for traders looking to simplify their trading processes and maximize their profits.

- By choosing the right bot and strategy, traders can take advantage of the around-the-clock nature of the cryptocurrency market and make profitable trades without the emotional risks that come with manual trading.

- Traders should always remember that trading bots are not a magic solution and do not guarantee profits. They are just one tool in a trader’s toolbox and should be used in combination with other strategies and risk management techniques.

- Although bots can help traders make trades and take advantage of price differences between exchanges, traders still need a good trading strategy to be successful.

- As the cryptocurrency market gets more popular, traders will find it easier to use bots to improve their trading strategies.

- Traders should always exercise caution and thoroughly research any bot before using it in real trading.

What Are Crypto Trading Bots?

Cryptocurrency trading bots are automated software programs that can perform all the manual trading tasks, freeing traders to focus on other aspects of their business or even taking some time off while the bot handles their trades.

These bots can analyze market data and trends faster and more accurately than humans, providing traders with valuable insights into potential trading opportunities. They are a powerful resource for traders looking to streamline their trading processes and maximize profits.

One of the key advantages of using a crypto trading bot is its ability to work around the clock. With the cryptocurrency market open 24/7, these bots can help traders make money even while they sleep. This is especially useful for traders who may not have the time or energy to constantly monitor the market and execute trades manually.

The trading bots themselves are designed to take advantage of the volatility of the crypto market by seeking out profitable trades and executing them automatically. This removes the emotional risks that come with manual trading, such as panic selling or greedy buying. The bots do not have feelings and are not subject to the same biases and emotional responses as humans.

How Crypto Trading Bots Work

Each bot has its own hardware and software requirements, and while some are free to use, others require a hefty subscription fee.

To use a bot, a trader typically downloads the code from the developer after finding a bot that they think will be helpful. They then follow the instructions to set up their bot on the exchange of their choice.

Depending on the specific trading bot and strategy used, traders can make money in both rising and falling markets. Some bots are designed to capitalize on short-term fluctuations, while others are geared toward long-term trends. By choosing the right bot and strategy, traders can tailor their approach to match their individual goals and risk tolerance.

However, traders need to remember that a crypto trading bot is not a magic solution for making money quickly. It’s not a guarantee that you’ll win all your trades once you have it. Trading successfully still requires time, effort, and knowledge from the trader. While bots can assist traders, ultimately, it’s up to the trader to decide when to buy and when to sell.

3Commas makes it simple to make money with never-sleeping bots. The bot allows traders to profit from any market condition, whether you use one of their many proven templates or create a fully custom bot.

Furthermore, 3Commas provides powerful portfolio management and trade orchestration options, allowing you to manage all of your crypto activity from a single interface. Their SmartTrade feature allows you to execute trades on any major exchange with far more control and options than the exchanges themselves. With the scalping terminal, traders can seize opportunities for quick profits.

These bots are capable of trading in a variety of ways. The table below shows some ways 3Commas bots can be used.

| Grid Bots They are very helpful in bear markets when the prices of many coins move sideways. | Dollar Cost Averaging Bots They are ideal for making money in volatile markets regardless of market direction (up or down). | Options Bots These bots enable traders to execute more complex trading strategies. However, new users should exercise caution when using these bots. | HODL Bots These enable users to build long positions through regular purchases. |

Pricing

- Free Plan: This has three types of bots (one of each).

- Starter: $15 per month with annual payment

- Advanced: $37 per month with annual payment

- Pro: $74 per month with annual payment

Features

- Automatic trading based on the trader’s presets.

- Access to 3Commas SmartTrade which allows traders to control all exchange activities from a single interface and make trades with advanced features not available in the exchange interface.

- Trading performance analytics to monitor the effectiveness of trades

- Enterprise tools, including APIs, portfolio management, white-glove applications, risk management, priority support, and trade automation

Pros

- All the pro features can be used for free for three days.

- The bots are capable of rebalancing portfolios.

- They can be linked across major exchanges.

- The bots work in all cryptocurrency markets (bull, bear, and sideways)

Cons

- The interface may seem complex initially and take time to adjust to.

- Profitability is difficult to measure as it relies on user configurations.

Pionex

Pionex is a cryptocurrency exchange with built-in trading bots that give users free access to 12 unique training bots. Users can automate their trading strategies with these trading bots, so they don’t have to keep an eye on the market all the time.

This application is ideal for mobile and high-volume traders. The trading bot selection is the tool’s main product, though it also supports manual trading via crypto-to-crypto conversions.

Pionex has a maker-taker fee structure. This means users only pay when their trades “create” liquidity in the market while also “removing” liquidity from the market. A trader pays the taker fee if the order is matched. However, if an outstanding order on the books does not immediately match a trade, the trader will also pay the maker fee.

Pricing

Pionex charges a trading fee of 0.05% per completed transaction.

Features

- Includes 16 built-in free trading bots for automated trading

- Allows users to earn 15-50% APR with the Spot-Futures Arbitrage.

- Buy low and sell high in the price range.

- Access to about 5x leverage.

- Executes DCA buys and one-time sales with the Martingale bot

- Hodl coins with the rebalancing bot

- Perform repeated buys at regular intervals to mitigate volatility with the recurring buy bot.

Pros

- Users can buy low and sell high in a specific price range.

- The Spot-Futures Arbitrage bot helps retail investors to earn passively with little risk.

- Traders can trade in USD by depositing or withdrawing funds from their bank account.

Cons

- Accounts cannot be funded with fiat currency.

- The free and regular plans offer only few features.

- It does not support custom trading strategies.

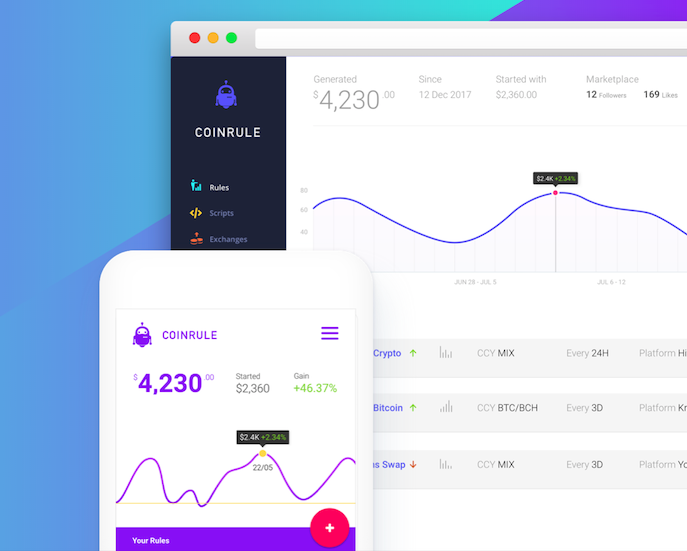

Coinrule

Coinrule is a new, simple automated trading solution for both technical and non-technical traders. Anyone can use the platform to choose from a set of predefined strategies that can be tested in the past before being used.

More experienced traders can create unique strategies, allowing traders of all levels to actively participate in the always-open crypto market and trade 24 hours a day, seven days a week.

Pricing

- Starter Version: It is free but has limited features.

- Hobbyist Version: It costs $30 per month and $359 per year.

- Trader Package: It costs $60 per month and $719 per year.

- Pro Package: It costs $450 per month and $5,399 per year.

Features

- Offers trade Indicators like MACD, RSI (Relative Strength Index), and Bollinger Bands

- Provides Email support, webinars, and live telegram chats

- Offers template trading in the pro version

- Supports native mobile applications for both Android and iOS

Pros

- Users can create automated trading rules based on popular indicators.

- It provides various plans for a higher level of trading.

- It receives support from a professional team of crypto experts.

Cons

- It offers fewer features than its competitors.

- Its highest tier is pricey.

- It doesn’t work with smaller crypto exchanges.

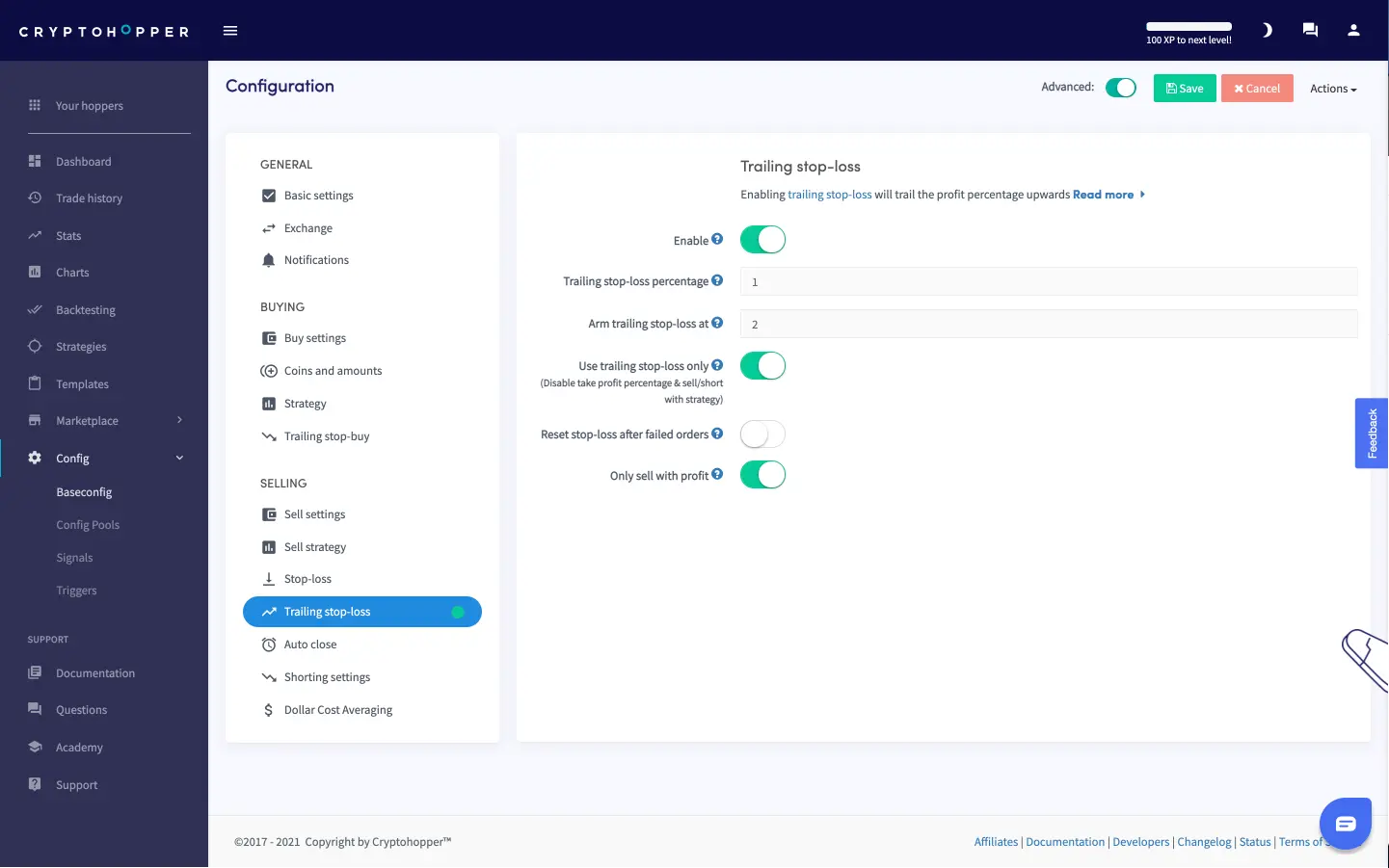

Cryptohopper

Cryptohopper has taken arbitrage to the next level by offering traders sophisticated triangular arbitrage, which allows them to profit from the price difference between multiple pairs on the same exchange. This is one of the many features the service has added since late 2017.

Cryptohopper also allows users to trade an unlimited number of cryptocurrency pairs autonomously. It also has a marketplace where many professional traders sell their trading strategies, which users can copy to make money.

Pricing

- Free trial plan

- Monthly payments of $19, $49, or $99, depending on the plan.

Features

- Renders automatic trading on all popular exchanges

- Supports indicators such as Stochastics, Bollinger Bands, and RSI

- Includes trading tools like backtesting bots, customizable templates, trailing stops, and adjustable technical indicators

Pros

- It’s easy to set up, and a credit card is not required to sign up.

- It hosts all of its services in the cloud.

- It allows users to test their strategies with no financial risk.

- Data can be gathered from the robust backtesting feature.

Cons

- Technical support is limited.

- There is no mention of government regulation. This may be because the platform does not hold users’ crypto assets.

- Users will need to pay extra for signals.

TradeSanta

TradeSanta is another cloud-based platform that provides a fantastic free plan and a 5-day trial of their basic plan. Their free plan allows you to trade with up to two bots, and their basic plan allows you to trade with up to 49 bots.

The TradeSanta website excels at making automated trading appear to be simple. They have excellent tutorials and 24-hour support. You can use their long or short templates to build your strategy or create your own from scratch. Currently, they support nine exchanges, including Kraken and Coinbase Pro.

Price

- Basic Free Plan: It supports a maximum of two bots.

- Basic Paid Plan: It costs $10.5 per month for a maximum of 49 bots.

- Premium Plan: It costs $70 per month for an unlimited number of bots.

Features

- Allows simultaneous deployment of an unlimited number of bots

- Supports indicators, such as MACD, Bollinger Bands, and RSI

- Supports iOS and Android apps in addition to the web platform

Pros

- The crypto trading bot is user-friendly and has an intuitive design.

- It is compatible with most of the major cryptocurrency exchanges.

Cons

- No support for decentralized exchanges (DEXs).

- Popular trading indicators are not compatible with the bot’s settings.

Do Crypto Trading Bots Work?

Although some top-performing cryptocurrency trading bots can yield impressive profits for their users, not all bots are successful. It’s important to note that these bots are not created equal, and some bots may be ineffective or even fraudulent. Therefore, traders must conduct due diligence, carefully research, and test any bot before using it for real trading.

It’s also important to remember that the crypto market is highly volatile, and price trends can change rapidly. Traders should actively monitor and adjust their trading bots according to market conditions instead of relying solely on automated processes if they want to maximize their returns.

Even though many crypto bots claim to have high success rates, it’s crucial to keep in mind that no bot is perfect.

Disclaimer: This article is intended solely for informational purposes and should not be considered trading or investment advice. Nothing herein should be construed as financial, legal, or tax advice. Trading or investing in cryptocurrencies carries a considerable risk of financial loss. Always conduct due diligence.

If you would like to read more articles like this, visit DeFi Planet and follow us on Twitter, LinkedIn, Facebook, and Instagram, and CoinMarketCap Community.

“Take control of your crypto portfolio with MARKETS PRO, DeFi Planet’s suite of analytics tools.”